[ad_1]

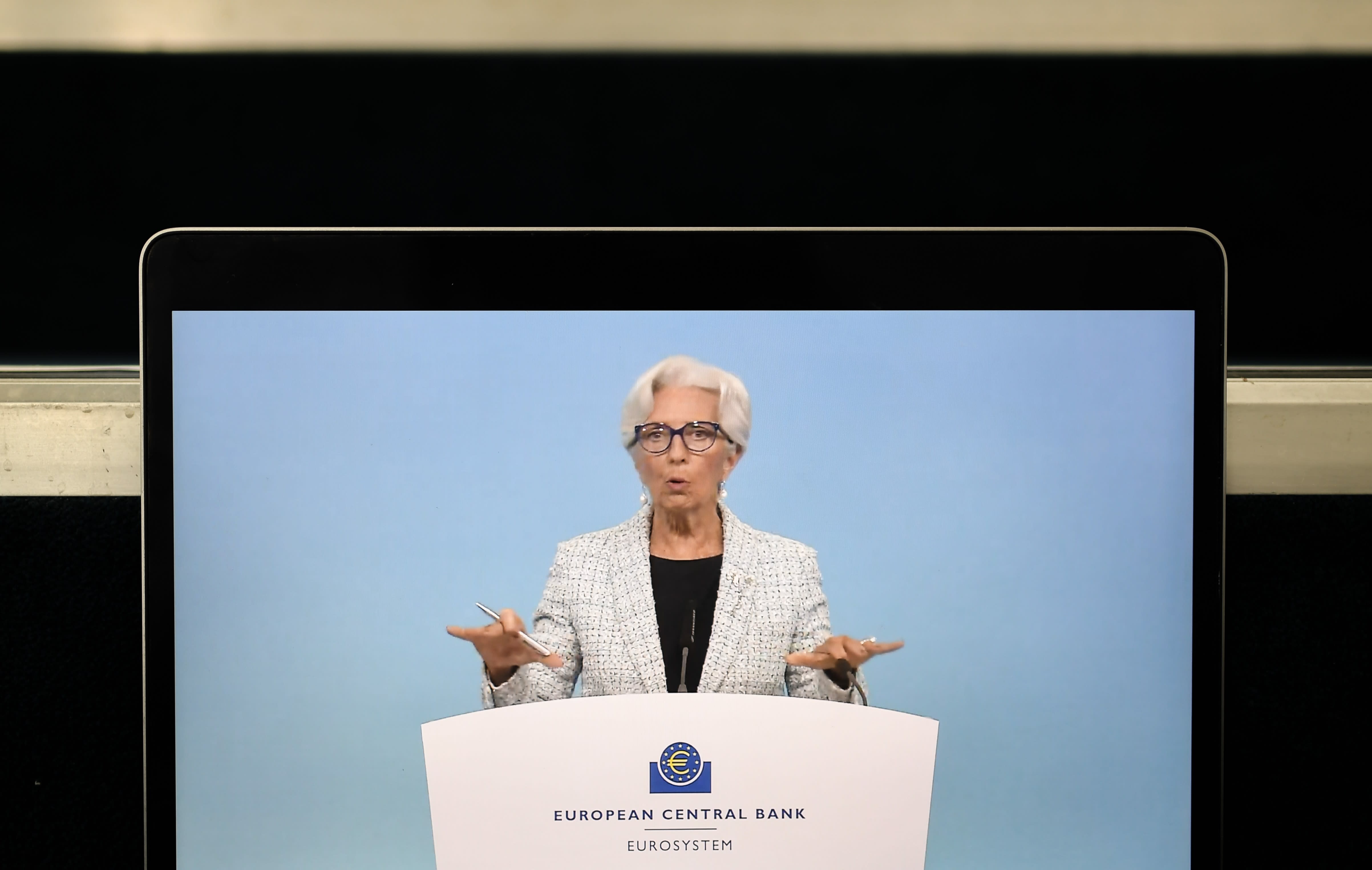

European Central Bank President Christine Lagarde during a live broadcast of a press conference following the ECB Governing Council meeting.

Xinhua News Agency | Xinhua News Agency | Getty Images

LONDON – The European Central Bank will announce the reduction of its Covid-related stimulus measures in December, four analysts told CNBC amid an economic improvement in the eurozone.

In the United States, the Federal Reserve has already signaled that it will likely start to slow down before the end of the year. President Jerome Powell said last week that the U.S. economy is at a point where it does not need as much political support as it did in the wake of the pandemic, although the pace at which asset purchases will be reduced has not yet been decided. .

And in the eurozone, a similar announcement could be imminent.

“I guess they probably will in December,” Gilles Moëc, group chief economist at AXA Investment Managers, told CNBC on Wednesday.

The ECB is meeting on September 9, but analysts believe the central bank will wait a few more months before announcing what it will do with its Covid-related measures.

“I think they want to give themselves time and have new forecasts,” Moëc said, before the ECB’s governing council took a decision.

In addition to having new forecasts on the table, Chiara Zangarelli, European economist at Nomura, said the ECB will also want to see what happens with the pandemic in the months to come.

But as it stands, she said, “it would be difficult even for conciliatory members” of the ECB to postpone a tapering announcement beyond December.

ECB Chief Economist Philip Lane also said in an interview last week that “September is a long way off” from the current conclusion date of its Covid-related asset purchase program, thus suggesting that ‘an announcement on tapering could take a few more months.

Market participants are monitoring key data releases to understand how the ECB might react.

No matter when the PEPP might end, that is not the end of the ECB’s role in terms of QE.

Preliminary data released on Tuesday suggests the eurozone experienced its highest inflation rate in a decade in August, at 3% due to high vaccination rates and an easing of Covid restrictions in the region.

The ECB had said it expected consumer prices to spike this year, albeit due to temporary factors. The central bank’s objective is to achieve a headline inflation rate of 2% over the medium term. If higher inflation rates were to persist, it would increase the pressure on the ECB to cancel its stimulus faster.

What it might look like

The institution headed by Christine Lagarde developed a new asset purchase program in the wake of the coronavirus in March 2020 to support the euro zone. The pandemic emergency procurement program – known as PEPP – is due to end in March 2022 with a potential total envelope of 1.85 trillion euros ($ 2.19 trillion).

The program gave the ECB more flexibility, notably by allowing it to buy Greek bonds, which did not meet the investment criteria to be bought under other programs.

“If PEPP purchases can go down significantly I think it’s a bit premature, I think we will have an indication that PEPP purchases still remain very high throughout the fourth quarter before decreasing in the first quarter. “, said Guillaume Menuet, European economist at Citi. CNBC’s “Street Signs Europe” Wednesday.

Moëc, from AXA Investment Managers, expects the PEPP to be concluded in March “but then the big conversation will be what to do with the APP”.

When the pandemic hit the euro area in March 2020, the ECB also maintained its asset purchase program, known as the APP, which has a current monthly pace of € 20 billion. The central bank used this program in combination with PEPP to support the economy of 19 members.

Salomon Fiedler, an economist at Berenberg, told CNBC on Wednesday that the APP would likely last until 2023, then a potential first-rate increase could take place in the fourth quarter of this year.

But, in the meantime, Zangarelli, of Nomura, said the APP would be subject to expansion once the PEPP ends. She expects those details to be released at the December meeting as well.

Lane of the ECB also said last week that “the conditions to end the JPA are not in place”.

“No matter when the PEPP might come to an end, that’s not the end of the ECB’s role in terms of QE. That’s why we don’t need a huge delay to think about it. Of course, we can’t leave it too late either. But six months is a long time. In the fall we will have to sort out a lot of issues related to what 2022 should look like, “he told Reuters. .

What could derail a December ad

“Covid, Covid, Covid,” said Moëc, from AXA Investment Managers.

He said the economic situation in the eurozone benefits from high vaccination rates and overall caution to avoid lifting all Covid restrictions. But even if the pandemic were to worsen in the coming months, he said “the bar for keeping the PEPP as it is today is very high”.

Across the European Union, 70% of the adult population has been fully vaccinated against the coronavirus.

[ad_2]

Source link