[ad_1]

An NCC reader wrote to ask us to explain why he had 13 pending payments in the Bitcoin blockchain. The answer is quite simple: at any time, the main chain of Bitcoins can be congested. The only way to ensure that Bitcoin payments arrive on time is to pay the highest fees Lightning Network, which continues to gain ground.

Lightning network usage reduced by the use of the main chain

The ordinary users of the Bitcoin portfolio are much more numerous than those of Lightning. As a result, miners are saving money on fees. According to a site that tracks data from Lightning Network, the average size of "channels" is only $ 137 and varies at the time of printing. There are nearly 39,000 channels and the total capacity of the network is less than $ 5.5 million.

Meanwhile, between blocks 570 170 and 570 179, just over 26,000 transactions were processed by Bitcoin miners. Approximately 153,400 BTCs ($ 765,400) were traded during this period (less than 2 hours), not counting 125 new BTCs created or more than 15 BTCs in fees collected by miners. According to Chain.so, the current "feerate" is around 1.15 USD, or 0.00022991 BTC per 1000 bytes (just under one kilobyte). Properly formed BTC transactions can be as small as 0.2 KB if they have only one entry.

Transactions like this are minimal, but because of the value of the transactions, the one who sent them decided to pay a much higher fee than the standard to ensure their inclusion. In total, they spent about $ 40 to publish nearly $ 1800. The size of the transaction was 225 bytes. According to Salecalc.com, these fees represent about $ 12 less than sending an identical amount via Paypal.

Merchants will pay the most, no matter the price

Congestion is particularly prevalent during upward price movements, such as we saw this week, where Bitcoins earned nearly $ 1,000 in a matter of hours. Traders are eager to get their stock market deposits and, given the incentive for profit, they are willing to pay higher fees to do so. The higher the average price that users are willing to pay, the more users will have to pay this fee to expect a reasonable delivery time.

As a result, there are currently more than 75,000 unconfirmed transactions. Their chances of being confirmed decrease with each increase in average fees paid by new transactions. Of course, miners have every interest in accepting the highest-paying transactions. thus, the problem worsens as the demand for Bitcoin transactions increases. If no new transactions are sent for the next five hours, all "mempool" transactions can be processed in the order of the fees paid.

The space available on the Bitcoin blockchain is incredibly limited and valuable. A long debate, sometimes referred to as a "war," lasted two years, while people such as Mike Hearn, Roger Ver, and Gavin Andresen argued that increasing block size (also known as "string sizing") was necessary to prevent business congestion.

Replace by Tax was created for moments like these

The other option for unconfirmed transactions is to use "replace with fees", a semi-controversial tool developed by Peter Todd. What RBF does is essentially create a new transaction from the same inputs, but adds higher fees, which allows the transaction to have a higher probability of being accepted by minors. The Bitcoin Core Portfolio and many others, such as Blockstream's green wallet, enable the RBF.

RBF is only useful for people who send transactions, not for those who are waiting to receive them. If you expect to receive a transaction and it is posted, but not confirmed, you can not count it as actually received until you have at least one confirmation. Most online services recommend 3 to 6 security confirmations. Unconfirmed transactions eventually disappear from the memory pool if they are not collected within 72 hours.

Three days is the default timeout for transactions from Bitcoin Core version 0.12. The funds are then returned to the original wallet as if they had never been sent, and the user can try again, either for a higher fee or in a climate. more friendly.

You can use Altcoins …

Another alternative is to use alternative crypto-currencies when the Bitcoin fees are as high as they are. If you only have bitcoins, you will of course have to do at least one transaction on the network before you can convert. But if you are ready to buy with fiat, your options are much wider. Choosing to receive alternatives to Bitcoin is also an option. This option can be useful for those who manage the payroll and do not have waiting days or extrabudgetary funds available to spend funds.

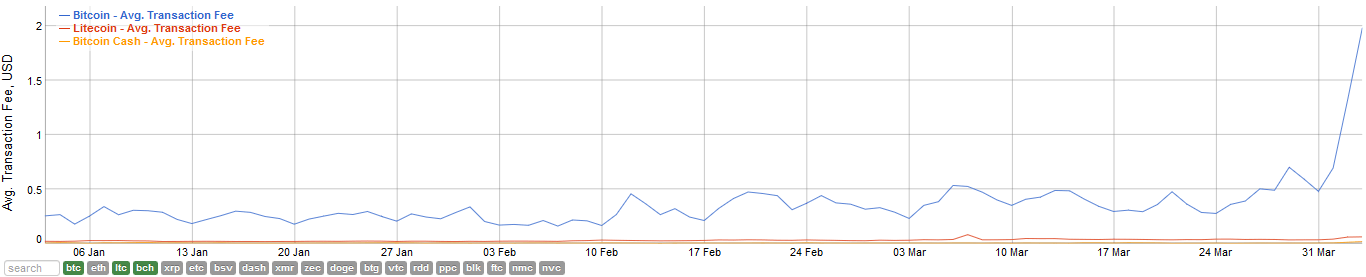

Fees for networks such as Bitcoin Cash and Litecoin are much lower and there is more space available on these channels. See the table below for the last 3 months:

As you can see on this chart, the Bitcoin Core fees have diverged significantly from the Bitcoin Cash and Litecoin fees in the last 3 months. In a few days, they went from less than $ 1 to nearly $ 2 on average. Source: Bitinfocharts.com

If you move between scholarships, BCH and LTC are a viable way to get funds where you want. If you act quickly enough, your risk of loss of value is relatively low. In both cases, recently, if you had used this method, you would have actually released a bit more Bitcoin, depending on the exchange rates and exchanges in question.

Almost all cryptographic exchanges support all three. You will probably spend less on transaction fees than on transaction fees.

[ad_2]

Source link