[ad_1]

Those who follow my personal account on Twitter will be familiar with my weekly S & P 500 #ChartStorm in which I select 10 graphics on the S & P 500 to tweet. In general, I choose a few themes to explore with the graphics, but sometimes it's only a selection of graphics that will add to your perspective and help illuminate your own vision – what's it? be bearish, bullish or whatever!

The purpose of this note is to add context and additional colors. It should be noted that the purpose of #ChartStorm is not necessarily to arrive at a certain point of view, but to highlight graphics and themes worthy of attention.

So here's another article about the S & P 500 #ChartStorm!

1. S & P500 Buy & Hold and the highest of January 2018: First of all, I thought it would be very interesting to point out how the S & P500 has recovered the highest of January 2018 this week. You may be wondering, "Why would he choose the highest in January 2018. The market has peaked much later in the year" and that is true. But there are several things that go through my mind about it.

In January 2018, global momentum in the economy and benefits peaked, and for many global markets, for example. emerging and developed outside the United States, it was the peak. Basically, the market was now functioning from vapors. The other thing is that it's around January that long-term sentiment measures have peaked, for example. the Euphoriameter – so this is a point of optimism and hype, and it is a likely turning point for which new investors have started to enter the market.

So in this context, the recovery of heights now seems a little more interesting, and indeed, it is not far from making a new record. So, those who bought back in January 2018 and held (how much would have gone through volatility ??) would be back in black now. This shows that sometimes bear markets are as much a question of time as distance.

Bottom line: Those who bought at the top of January 2018 are now only back above the water.

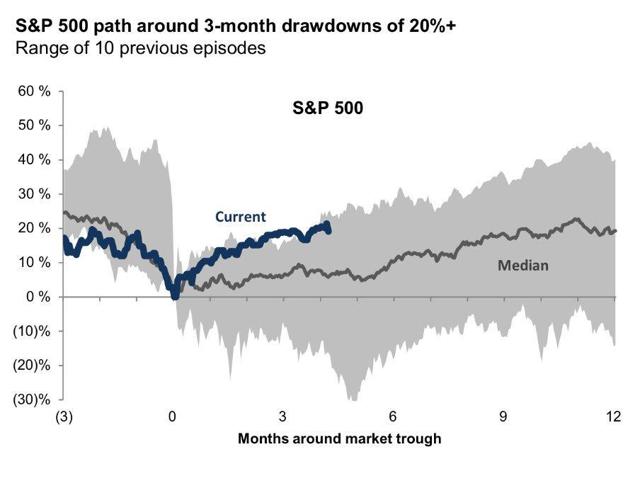

2. The 20% reduction roadmap: The next map of Volatility Quant indicates where the S & P500 is relative to the average of the 10 most recent draws of 20% and more. This is a useful table because it provides somehow a game book for the rebound. Of course, past performance does not prejudge future performance, and past ranges are not an obstacle to totally different models. That said, it is at the top of the range, so some might say it's gone too far (and others might say it's actually a good thing because Is a sign of strength).

Bottom line: the rebound roughly follows the gamebook to more than 20%.

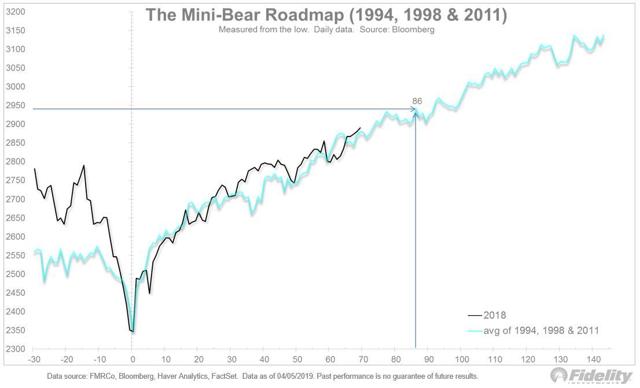

3. The mini-bear roadmap: An excellent follow-up of the previous table, this one by Jurrien Timmer Fidelity Investments has more than one conditional / filtered view of the rebound analog. He calls it the mini-bearish roadmap (good title!) And is basically a composite of the last 3 non-recession bear markets. And it's going to fundamentally plan well …

Bottom Line: The market follows the roadmap for mini-bear recovery.

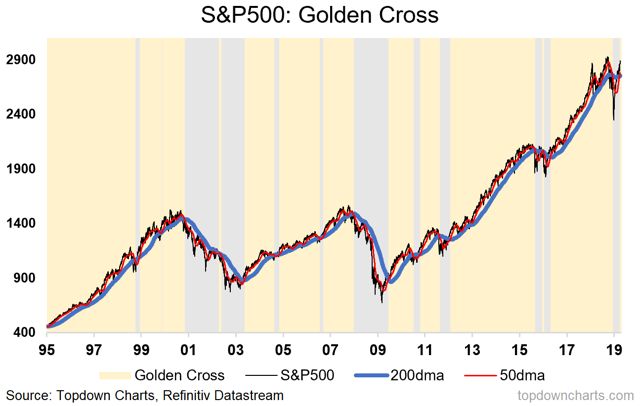

4. Signal S & P500 Golden Cross: The next shows how the S & P500 managed to get the golden cross signal. I wrote a note about it on the blog last week, but to sum up, a gold cross is when the 50-day moving average moves above the 200-day moving average. This signal is designed to identify the major trend (ie if the market is in an uptrend / uptrend).

As you can see on the graph, there are some false signals, which is by no means infallible. In addition to the benefits, there are a number of limitations (for example, it will give a false signal in a booming market and for a prolonged period – a false bear market rebound). But there are also many important periods when the signal worked well.

The question that interests me is whether it will be a catalyst to stem the tide of negative feelings, outflows and slight positioning. I will monitor my monitors closely for confirmation.

Conclusion: The S & P500 is now in Golden Cross mode.

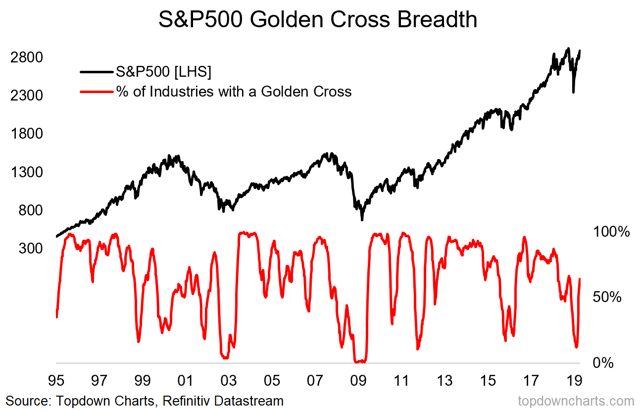

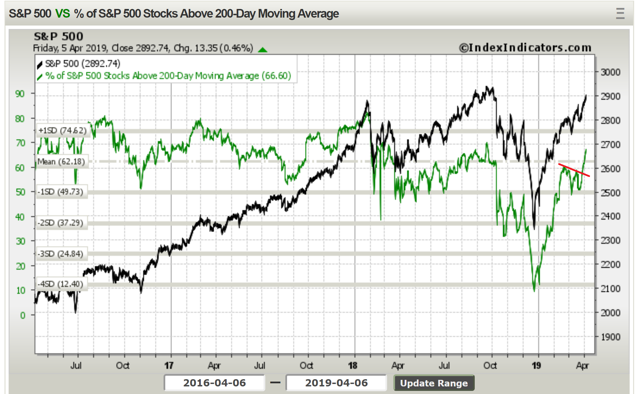

5. Width of the S & P500 Gold Cross: The following graph takes an entirely different angle from the gold cross analysis and uses an extended approach. I'm a big proponent of applying in-depth market analysis techniques to indicators other than price, and that's a good example.

As you can see, this indicator has experienced a significant slowdown in which the proportion of S & P500 industries marked with a gold cross has fallen to its lowest level in 10 years. The trend of total collapse and strong recovery is a very bullish signal and looks more like a correction than a bear market.

Bottom Line: The width of the golden crosses showed a bullish pattern.

6. width escape: This chart complements both bullish technical evidence and provides a snapshot of what was a common chart in recent editions of weekly charts. I had already noted that there was a bearish divergence signal with a moving average width over 200 days (a series of highs in the short term) and an index (a series of highs in the near term). ).

I've noticed that, even though it's usually a bearish signal, it can resolve itself upward, as it does now. The width indicator has reached a new peak and is basically a sign of improvement in the underlying strength (as in the previous width chart).

Bottom line: the divergence in bearish width is solved upwards with a break in width.

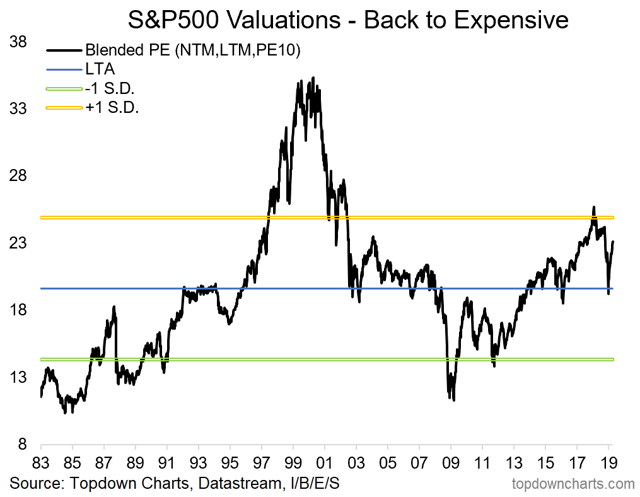

7. S & P500 Ratings: The following graph should be familiar to regular readers – it's my own graph and it shows the mixed PE (which is essentially a compromise between the forces / limitations of 3 different PE ratios: the PE10, the PE before and the PE outgoing).

During the storm on Twitter, I joked that I wondered how long it would take before we could go back to the high ratings anxiety! As you may remember, throughout the 2017 bull market, many participants corrected the valuation chart. In the short term, they were right. To be honest towards the end of 2017 / early 2018, I had also started to take a more cautious approach to assessments in the United States and around the world. But 2018 has provided a great reset to the assessment situation.

We are not yet back to extremes, so it is quite possible to make a new assessment from here. Again, this is the investment challenge at the end of the cycle: you can not buy because it's cheap, and yet you can not really sell because it's very expensive, and to this is added all sorts of mixed signals on the macro pulse. Anyway, it's one of my favorite paintings to watch.

Net income: valuations rebounded, but it is likely possible to revalue.

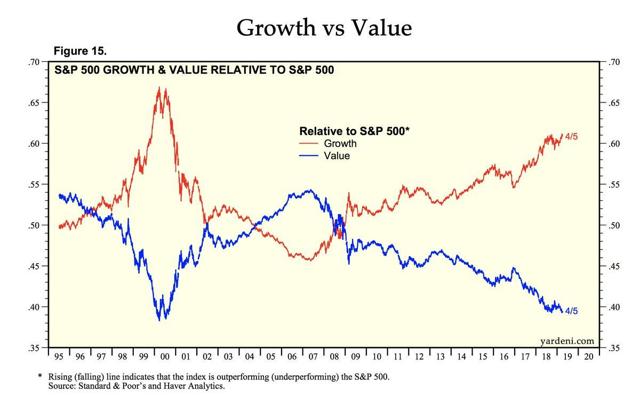

8. Value vs. growth S & P500: This graph shows something I've written a lot about and been following for a while: the poor performance of value vs. growth. Basically, "value" as a style has almost consistently underperformed the S & P500 index (it has also underperformed relative to growth).

I would like to highlight a few points regarding this persistent trend. First, in my analysis, value relative to growth is more of a reversal of trend than a mean reversal. Therefore, although the value may well spend the day in the sun, I would bet on a reversal of trend and not on a medium inversion. And the other thing is that if you think about what these terms actually represent – "value" = the cheapest shares. Sometimes cheap is cheap for a reason or not really "cheap" when you factor in growth.

Growth / momentum stocks are often (not always) the next big thing in terms of structural change. For example, think about typewriters as opposed to personal computers – typewriters can get a rebound when hipsters start buying for the sake of irony, but basically, it's a declining industry ( the appearance growth) which should therefore be cheap … and it may be that no price is too cheap (unless it falls below the value of hard assets achievable).

Be that as it may, we must be careful about the value, but at the same time we must remain vigilant in the face of extreme overruns, because even if the reversal of the average is excluded, this does not mean that a certain degree of trend reversal can come into play.

Conclusion: Value has almost consistently underperformed the market (and growth).

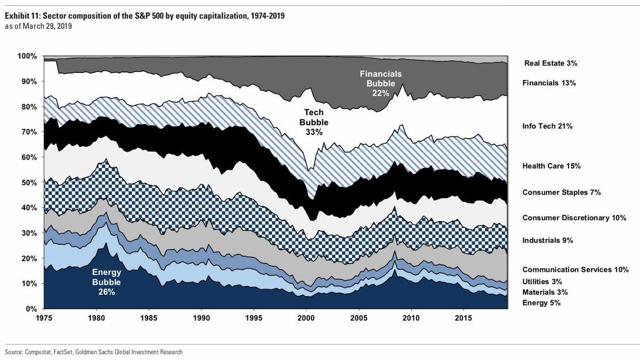

9. Composition of the market capitalization of the S & P500: This interesting, somewhat geologically inspired map shared by David Schawel shows the evolution of the market capitalization representation of different sectors of the S & P500 index. It should be noted that last year, the GICS review divided much of the technology into a new sector called "communication services" (formerly known as telecommunications).

An interesting aspect of this chart is the way you can see the clear bubble development induced by the sectors, for example. the energy bubble in the early 1980s and the technology bubble in 2000, and later in the financial sector (probably also commodities around 2010). There are not really super-obvious candidates for the same kind of situation as these examples at the moment, but it gives a good overview of the field.

Conclusion: It is important to keep an eye on the evolution of the sectoral composition of the S & P500.

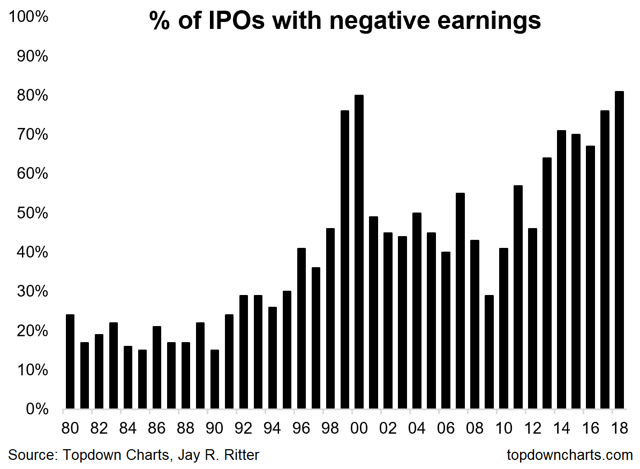

10. Proportion of IPOs with negative benefits: The final graph is an old but a goodie, which shows the proportion of IPOs in 2018 that have had a negative profit. What makes him so interesting is that he simply pushed aside 2000 to reach an all-time record. This would certainly make many people make comparisons between now and the frenzy of comedians, but there are some statistics to note … because they are different (but similar) this time around.

First, there were 134 IPOs in 2018 (477 in 1999, 381 in 2000), secondly, the median age in 2018 was 10 years (5 years in 1999 and 6 in 2000), the third introductions Tech's stock market accounted for 28% of all IPOs in 2018. (78% in 1999 and 69% in 2000), the fourth IPOs in the biotechnology sector reached 43% in 2018 (2% in 1999 and 15% in 2000) and 100% of all IPOs in the biotechnology sector generated negative results.

So, although there are a lot of similarities, there are also a lot of differences and it's not really a repetition, certainly nothing to do with the * frenzy * of the internet bubble. This is nevertheless remarkable and is probably still a sign of the maturity of the cycle.

In summary: in 2018, a record proportion of IPOs carried out by companies posting negative profits.

summary

This week, apart from generally interesting graphics, presented a rather optimistic set of technical charts (depth distribution, gold cross, road map for the rebound of a mini-bear, recovery of the highest of January 2018). possibility of reassessment of evaluations). Although the macroeconomic / earnings signals are still mixed, and we are in one of the most difficult parts of the business / market cycle, for the moment, the short-term outlook has a bullish tone.

See also: Weekly S & P500 #ChartStorm – March 31, 2019

If you like my free articles, you'll probably enjoy our Marketplace service, which takes a closer look at some ideas, provides you with a comprehensive weekly overview of the weekly global market, and a monthly checklist of global market outlooks. A must in the market for active investors.

Click on right here for a free trial.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not get compensation for that. I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link