[ad_1]

Last month, the management team of Chesapeake Energy Corp. (CHK) announced a relatively expensive public takeover offer, giving some short-term bondholders the opportunity to return their notes to the company in exchange for new interest-bearing notes at a higher rate and for a premium. The advantage for Chesapeake was that he would be able to repay or otherwise refinance his debts in a few years, but the premium and interest rate changes had to be painful. On April 2, the company officially unveiled the results of its call for tenders. On one hand, the pain for shareholders will always exist, but on the other hand, we have seen what can only be described as a market inefficiency to save shareholders from the total weight of this pain.

Look at the bidder's results

Chesapeake's public takeover bid, published on March 5, had been taken by management to try to push the debt limits. You see, despite sales of assets worth billions of dollars last year and the merger with the WildHorse Resource Development Corporation, the cash and debts of the oil and gas exploration and production company are anything but great. In an attempt to dispel fears of a bad end for shareholders, management has taken a multidimensional approach of combining assets with WildHorse, selling non-core properties and refinancing well before the time the company has to pay. the debts in question.

With respect to refinancing, the Company has decided to offer bondholders of four different groups, the 6.625% and the 6.875% senior notes due in 2020, as well as its 6.125% senior notes. and 5.375% maturity of 2021, new premium notes would delay the company's repayments to 2026.

Overall, since management has stated that there will be no minimum or maximum threshold for this transaction, a debt of up to $ 1.48 billion could have been exchanged. In return, because of the premiums offered, a new debt of $ 1.52 billion in principal was issued. That's an increase of $ 37.79 million. In addition to this change in principal, the interest rate of 8% on the new notes would have generated, in the worst case scenario, $ 28.87 million per year in additional interest. For a company that is already struggling to generate positive free cash flow, it is a heavy price.

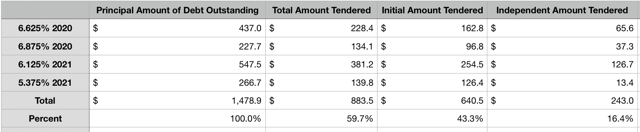

Now that the results are known, we can look back and see what the final balance sheet will be for the company. As you can see in the table below, Chesapeake had committed approximately $ 640.5 million in notes even before the offer was made public. This represented approximately 43.3% of all applicable notes in circulation. Today, however, this amount has reached $ 883.5 million, mainly due to the $ 381.2 million attributable to the 6.125% senior notes maturing in 2021.

Created by the author

As a result of the premium paid for each set of notes, the actual amount of the new debt incurred by the business will be $ 35 million, with the principal of the new notes representing $ 918.5 million. The interest expense on the notes returned to Chesapeake by the holders would have been $ 55.21 million per annum, while the new notes would result in debt of $ 73.48 million per annum. This represents an increase of $ 18.27 million on an annual basis. This is certainly better than what the maximum case would have been, but it remains painful.

This transaction does not make sense

Based on my assessment of the data provided by management, I can only conclude that something does not make sense. I totally understand why Chesapeake made this offer. In their minds, they saw it as a prudent choice that would eliminate the refinancing risks of the equation for the next few years if it were fully implemented. This, in turn, would significantly reduce any kind of bankruptcy situation (unless energy prices are liquidated again for an extended period). What does not make sense, however, is the fact that so few bondholders have offered their tickets as part of this exchange offer.

As you can see, as shown in the table above, only $ 243 million of bondholders surrendered their notes for this exchange, if you exclude those who agreed to do so prior to the offer. That leaves $ 595.4 million of notes still available to the general public and, given the terms of the agreement, I have asserted that it was likely that all the bondholders would accept this offer. Not only is the high interest rate interesting, but the au pair premium should also have attracted investors.

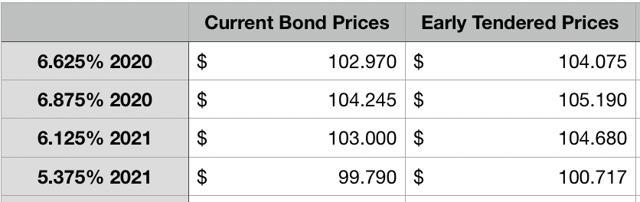

Created by the author

This situation is even more disconcerting when one considers the current prices of the bonds in question and the implicit exchange rates. In the table above, you can see these illustrations side by side. In any case, it would have been preferable for the bondholders to make the transition, even excluding interest expense. Why did this happen? Honestly, I'm clueless, but it creates both a good and a bad scenario for management and shareholders.

On the positive side, we have the fact that the negative impacts associated with the transaction (higher interest, higher premiums) are mitigated to a certain extent. On the negative side, this $ 595.4 million debt will expire between next year and the following year; management must repay cash now or through another form of offer. Comparatively, this amount is not insurmountable for a company the size of Chesapeake, particularly over the period considered, but presents refinancing risks or forces the company to reduce its capital or future expenditures. with money through the sale of assets.

To take away

For the moment, the picture facing Chesapeake is interesting to say the least. Given the terms of its offer to bondholders, I was surprised to find that only a small portion (apart from those previously incurred) had accepted the transaction. In all respects, the exchange of bonds made sense for the bondholders. For shareholders, the rejection of some bondholders will be positive, especially in terms of cash flow, but it creates short-term issues that management must address.

Crude Value Insights offers an investment service and community focused on oil and natural gas. We focus on cash flows and the companies that generate them, generating value and growth prospects with real potential.

Subscribers can use a standard account of more than 50 years, in-depth analyzes of E & P's cash flow and a live discussion of the industry.

Sign up today for your free two week trial and get a new lease on oil and gas!

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link