[ad_1]

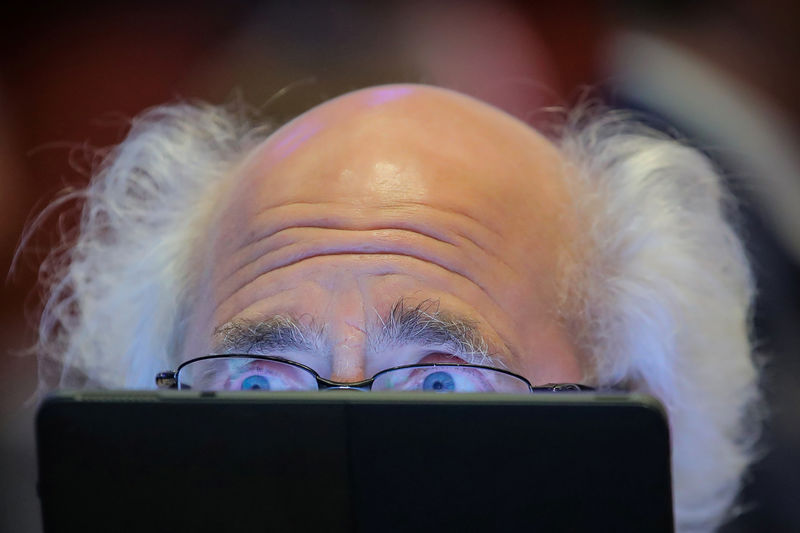

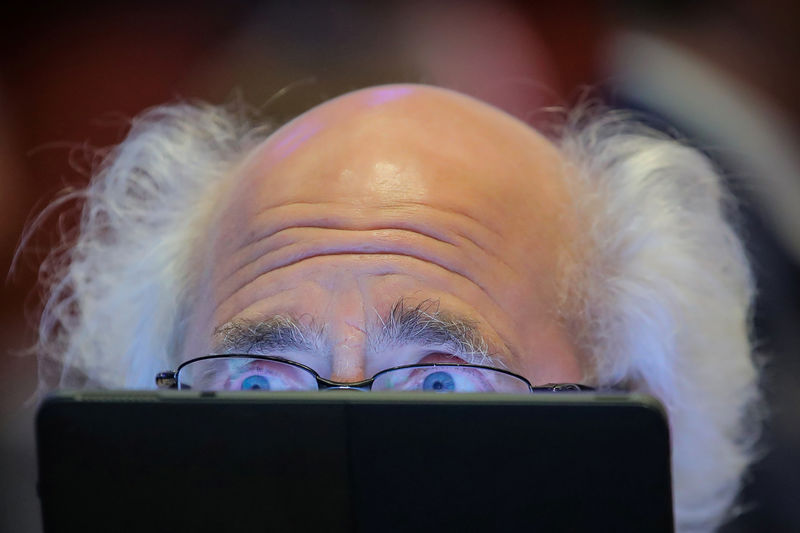

© Reuters. Traders work on the ground at the NYSE in New York

By Shreyashi Sanyal and Sruthi Shankar

(Reuters) – US stocks fell on Monday after a seven-day winning streak on the S & P 500, as Boeing shares were hit and investors prepared for what could be the first drop corporate profits since 2016.

US industrial stocks fell 4.7%, leading to a 1% decline in the S & P industry sector, after the company announced it would reduce production of its 737 MAX devices by nearly 20%. %.

Southwest Airlines (NYSE 🙂 Co dropped 2.7% after the carrier announced that it was withdrawing the 737 MAX from its flight schedules until June 7, thus extending its previous schedule. ;one week.

The sector has also been under pressure from General Electric (The New York Stock Exchange 🙂 loses 8.4% after J.P.Morgan downgraded the conglomerate's shares to "underweight".

The recent wave of gains in US equities proved to be right on 2% of its September closing record, reinforced by the Federal Reserve's decision to delay interest rate hikes in 2019 and in the hope of concluding a trade agreement with China.

However, lower earnings forecasts and fears of an economic slowdown are beginning to dampen investor enthusiasm.

"We have seen some progress in trade, the Fed has shrunk in the face of rising interest rates, we have seen employment growth come back down, but none of this is of little companies do not earn money and this is one of the major concerns of the market. " , "said Brad McMillan, chief investment officer for the Commonwealth Financial Network.

According to Refinitiv data, the big banks are expected to launch the Q1 earnings season later in the week and analysts expect a 2.3% decline in S & P 500 corporate profits in the first quarter.

At 12:43 ET was down 135.20 points, or 0.51%, to 26,289.79, the S & P 500 was down 6.00 points, or 0.21%, to 2,886.74 and was down 11.37 points, or 0.14%, to 7,927.33.

Seven of the top eleven sectors of S & P were lower. Energy stocks, among some positive points, rose 0.40% as oil prices reached their highest level in five months.

Symantec Corp (NASDAQ 🙂 jumped 6% after the announcement that Goldman Sachs (NYSE 🙂 had raised its rating on the cybersecurity firm's title for the "pass" of "neutral".

Procter & Gamble Co climbed 1.2% after Wells Fargo (NYSE 🙂 raised its rating on the company's shares to "outperform" by "market perform".

Falling issues outnumbered defenders for a ratio of 1.18 to 1 on the NYSE and a ratio of 1.41 to 1 on the Nasdaq.

The S & P index recorded 23 new highs over 52 weeks and no new lows, while the Nasdaq recorded 45 new highs and 22 new lows.

Fusion Media or anyone involved in Fusion Media will not accept any liability for loss or damage arising from the use of the information, including data, quotes, graphics and buy / sell signals contained in this site Web. Please be fully aware of the risks and costs associated with financial market transactions. This is one of the most risky forms of investing possible.

[ad_2]

Source link