[ad_1]

JPMorgan explains why stocks are not at risk

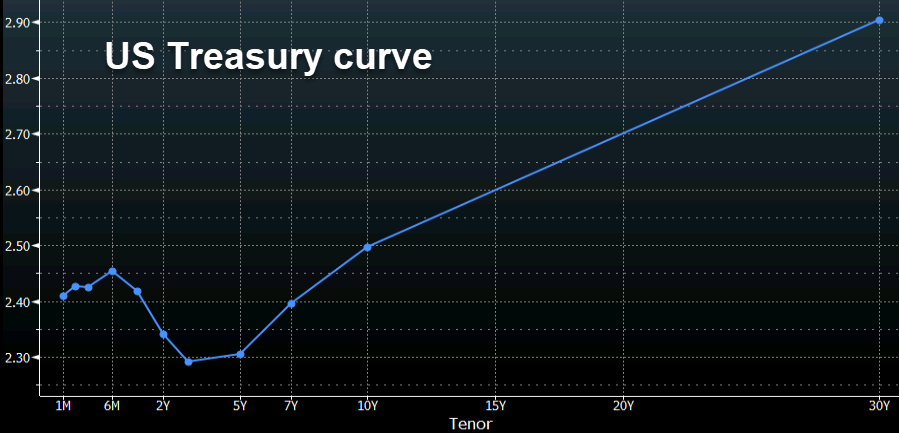

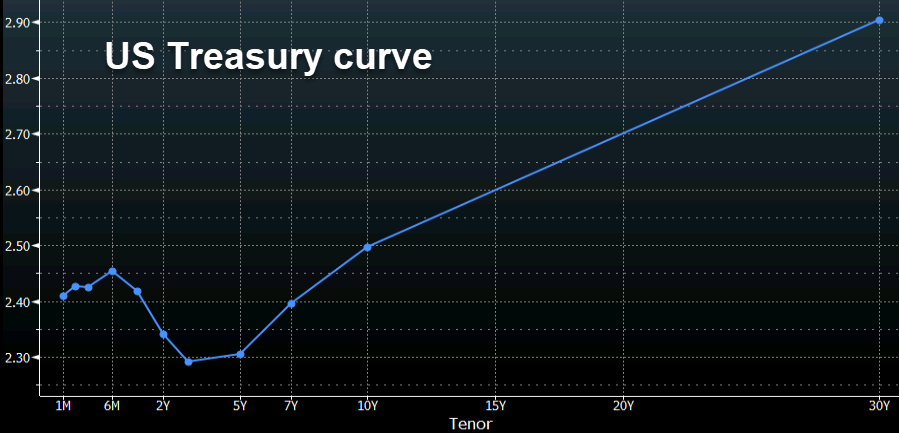

The inversion of the yield curve has preoccupied the markets over the past few weeks, but the stock market has hit five-month highs after a first snag.

Stock market analysts at JPMorgan believe that there are clear reasons why the inverted signal of the yield curve might not say much about the economic outlook.

(1) As a general rule, a reverse yield curve would indicate that

conditions have tightened considerably. Actual rates would be high

and the availability of credit would begin to deteriorate, with an enlargement

credit spreads and the deterioration of bank loan surveys. This time

around key indicators of monetary conditions do not seem tight,

despite the inversion. Current real rates are close to zero, when they

on average 3% at the point of the last 6 inversions. HY credit spreads are

only 80 bp compared to the cycle hollows, whereas they are generally 300 to 400 bp wider

before economic recessions. Banks are very well capitalized

currently in the last 10 years, after getting indebted, and stands ready to

continue to give credit.2) The inversion of the curve could say more

decoupling of global growth and the desynchronized nature of

monetary policy, rather than being a worrying sign of future growth in the United States.

The current gap between US and German 10-year bond yields at 250bp

30-year-olds, which could anchor US long-term rates to some

magnitude.3) Finally, as the term premiums is totally negative, the current inverted curve could say more about

inflation expectations more moderate than growth prospects. C & # 39;

where some repricing could materialize, especially if our repeat of 2016

call wins more traction. We remain constructive on the actions given the

China turns, the dovish Fed, the potential peak in usd, move away from trade

uncertainty and the likely low inflation expectations.

[ad_2]

Source link