[ad_1]

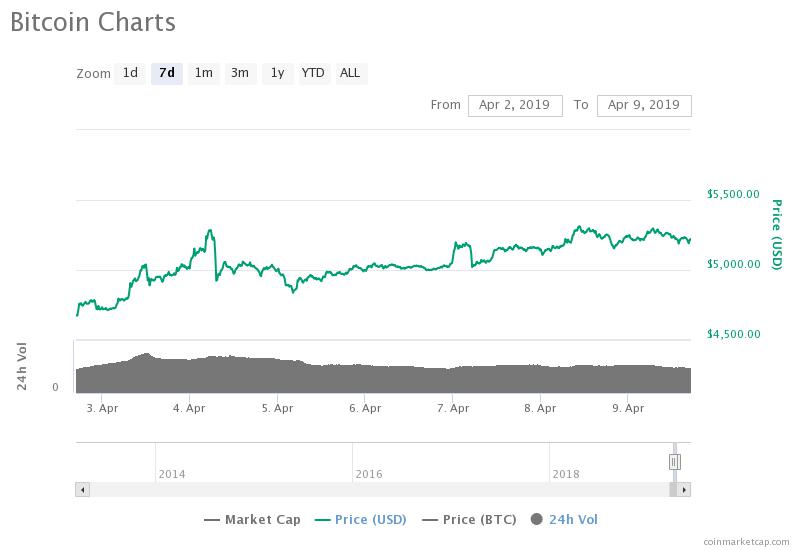

In the last seven days, after an initial increase of $ 4,200 on April 1, the price of bitcoin rose from $ 4,673 to $ 5,218, an increase of more than 11%.

The rest of the cryptocurrency market, including major cryptographic assets such as Litecoin and Ethereum, has made significant gains against the US dollar with momentum from Bitcoin.

Bitcoin needs fuel to get out of the range of $ 5,000 to $ 6,000, will CME be that fuel?

On April 1, various technical factors supported the upward movement of Bitcoin and allowed the dominant cryptocurrency to jump 20% as soon as it exceeded a significant resistance level of $ 4,200.

Bitcoin has managed to quickly jump from $ 4,200 to $ 4,800 in just a few minutes thanks to three main factors:

- Liquidation of $ 500 million short-term contracts in major markets

- One buyer buying 20,000 BTC or 100 million dollars

- Lack of resistance above $ 4,200

Some traders were cautious about bitcoin 's ability to break the $ 5,000 to $ 6,000 range, as strong stimulus would be needed to push assets above this range, as an order of magnitude. $ 100 million purchase and a $ 500 million short-term liquidation prompted BTC earlier. the week.

In the short term, if the CME bitcoin futures market volume can be maintained, it is very likely that the bitcoin futures market will serve as a catalyst for the next bitcoin move.

On Tuesday, CME reportedly told Bloomberg that 22,542 bitcoin contracts had been traded for approximately $ 546 million.

Interestingly, most of the volume came during Asian times, more than half the daily volume.

"CME Bitcoin's futures contracts reached a record 22,542 contracts negotiated on April 4, which equates to 112,710 Bitcoins with a face value of $ 546 million, according to a statement from the Prime Minister. derivatives trader. Most of the trading volume that day came in Asia with 12,634 contracts traded, said CME, "reads Bloomberg report.

Transactions processed during business hours in Asia do not necessarily translate into purchases of bitcoin futures by Asian buyers, but they greatly increase the likelihood that these buyers will be based in the main Asian cryptocurrency markets, such as Japan and South Korea.

Why is future volume important now

Previously, the volume of the bitcoin futures market was neglected by many people because of the inflated volume of the cryptocurrency foreign exchange market.

According to Bitwise, more than 95% of reported bitcoin volume is inflated or falsified, leaving the futures market responsible for about 35% of the global bitcoin volume.

17 / And when you remove the false volume, the volume of the CME and CBOE futures contracts is significant ($ 91M), especially compared to the actual cash volume (35% for February 2019).

This is good news because it means that the CMF – a regulated and supervised market – has a material size that is important for an ETF. pic.twitter.com/pVqMqPSZkt

– Bitwise (@ BitwiseInvest) March 22, 2019

From March 4 to 8, CME and CBOE reported a volume of more than $ 91 million.

The CME volume of $ 546 million as of April 4 is lower than the 4-day volume recorded in early March and reflects a dramatic increase in BTC demand over a short period of time.

CME volume on April 4 exceeded total daily spot volume in March

Bitwise also reported that, from March 4 to 8, BTC's total cash volume for all exchanges was $ 273 million. That's exactly half the volume recorded by CME in a single day.

4 / The total daily spot volume is approximately $ 270 million, 95% less than reported. pic.twitter.com/kILQcqOlQR

– Bitwise (@ BitwiseInvest) March 22, 2019

The uncertainty is whether the volume of the CMC Bitcoin futures market will be maintained in the medium term or whether it will decline after its initial peak on 4 April.

But this could be a catalyst for BTC's next move, as the liquidation of $ 500 million in short-term contracts allowed Bitcoin to make further progress on April 1.

[ad_2]

Source link