[ad_1]

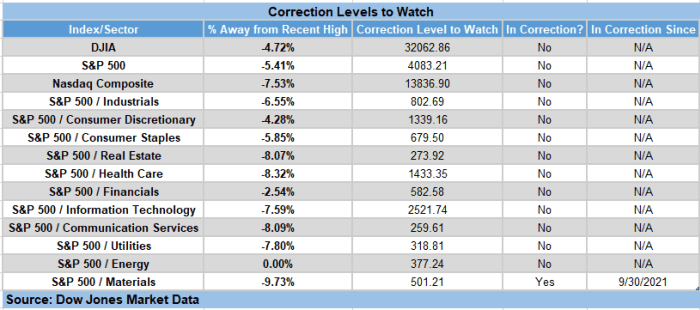

After a dismal September for optimists, the stock market’s bullish patina crumbles further to start October, with at least one major benchmark and a number of sectors dangerously close to correction.

Indeed, the Nasdaq Composite Index COMP,

which was down 2.4% on Monday, as social media company Facebook Inc. FB,

fell nearly 5% on the session, bringing the tech-loaded index to about 7.3% from its record-breaking Sept. 7 close, according to Dow Jones Market Data.

Market technicians typically define a correction as a decrease of at least 10%, but not more than 20%, from a recent peak. An asset is considered in a bear market when it drops at least 20% from its peak.

The Nasdaq Composite must close below 13,836.90 to reach correction territory, according to Dow Jones Market Data. The index last entered the correction on March 8, 2021 and exited the correction on April 9, 2021.

On Monday, it finished at 14,255.48 and has fallen six of the past seven trading sessions.

Amazon.com Inc. AMZN,

part of popular “FAANG” stocks including Facebook, Netflix NFLX,

Apple AAPL,

and Alphabet GOOG, parent of Google,

was down nearly 3% on Monday and 14.5% from its closing peak on July 8. Apple stock is down more than 11% from its recent peak, and Google’s class A shares GOOGL,

were down 8.4% from a recent high reached early last month.

Facebook was also facing widespread blackouts in its WhatsApp and Instagram social media properties, adding to the miserable day for the company.

Facebook came under pressure after data scientist Frances Haugen claimed the social media giant deceived investors about how it handled hate speech and disinformation on its platform. Haugen is due to testify before Congress on Tuesday.

Here are other levels to watch out for if the market continues to lose elevation, which it is known to do in October. The S&P 500 SPX,

and Dow Jones Industrial Average DJIA,

were halfway through the correction: The S&P 500 is down 5.2% from its record close on September 2, while the Dow Jones is down 4.6% from its high on September 16 August.

Dow Jones Market Data

The market has come under increasing pressure, with developments centering on those in Washington, DC, where tense debt ceiling negotiations are taking place and negotiations over infrastructure and social spending have failed. not successful.

Investors also worried about potentially out of control inflation and the Federal Reserve’s likely responses to an overheating economy, with CL.1 crude oil,

and the prices of natural gas NG00,

rising to multi-year highs in recent action.

[ad_2]

Source link