[ad_1]

CBS NEWS

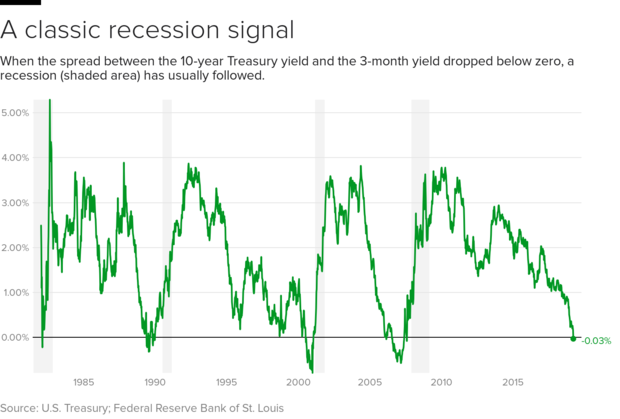

One of the most watched recession predictors has just sent an alarm signal, causing a stock market crash. An indicator that investment professionals call the "yield curve" reversed Friday for the first time since 2007 during the Great Recession.

Inventories dropped in response. The wave of sales made the Dow Jones Industrial Average lose 460 points, a loss of nearly 1.8% for the day, and the benchmark S & P 500 saw its biggest drop in a day, 1, 9% since January 3rd.

Here's why bond yields are important. Investors show how confident they are in the economy by the degree of interest they demand from US government bonds. In general, short-term debt produces less interest than long-term debt.

But on Friday, a treasury bill maturing in three months yielded 2.45%, or 0.03% more than a treasury bond maturing in 10 years. This means that investors think the short-term market is riskier than the long-term market – which is not a good message for other investors. Generally, an inverted curve can signal a recession in about a year. Such a signal has preceded every recession of the last 60 years with a single false alarm, according to the San Francisco Fed.

Economists have warned against an excessive reading of the signal on Friday, pointing out that the time between the moment when the curve is reversed and the moment a recession occurs can be significant. As Gregory Daco, chief economist at Oxford Economics explains, in a note:[T]The yield curve remains one of the main leading indicators of recessions, but turnaround times have always been long – almost two years on average since the 1980s – and variable, ranging from 10 months to three years. In addition, short-term inversions are more likely [in a low interest rate environment like today’s]. "

The US Federal Reserve is forecasting moderate growth in the US economy of 2% this year.

Associated Press contributed to the reports.

[ad_2]

Source link