[ad_1]

Welcome to this interesting set-up edition of Natural Gas Daily!

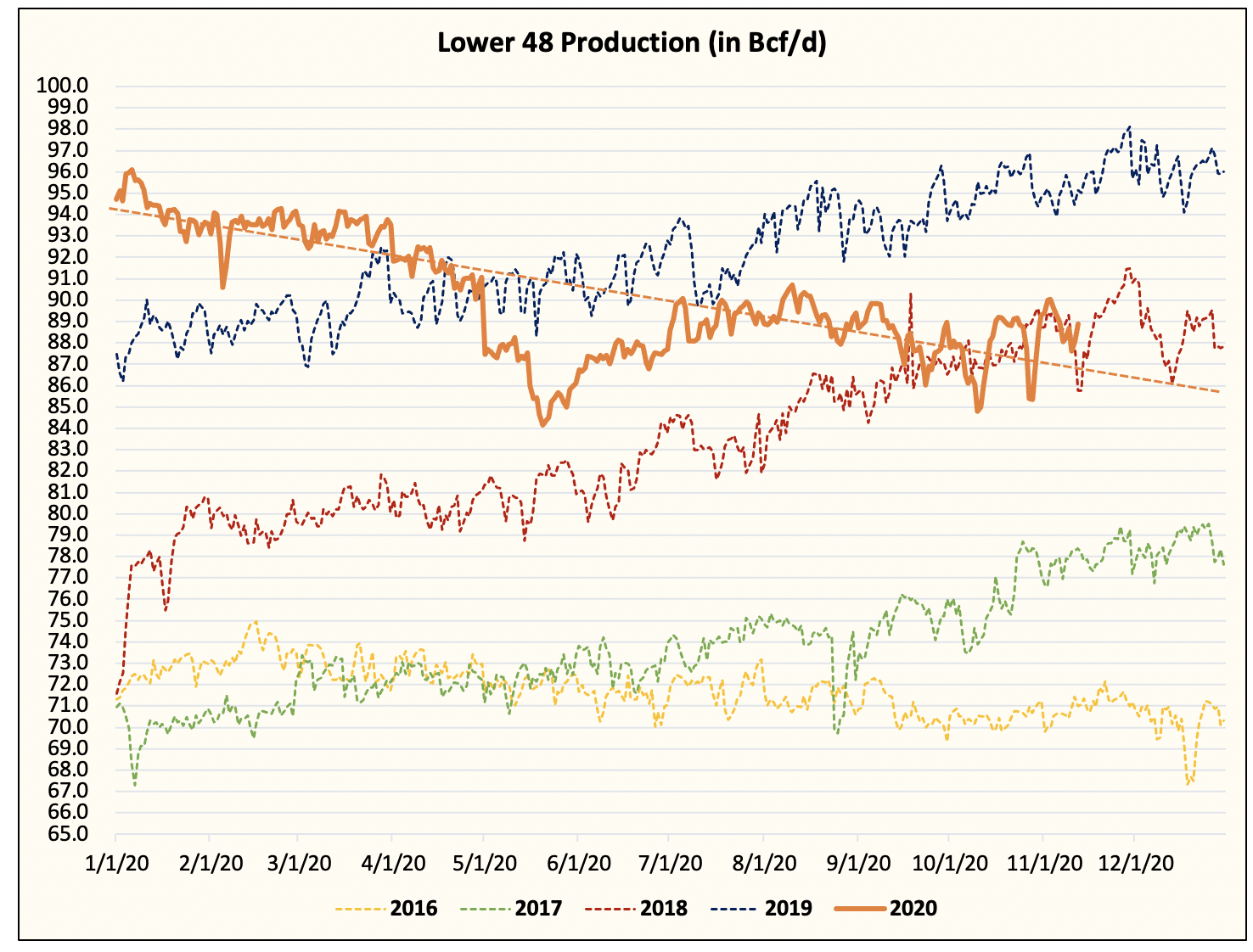

Weather patterns have been more or less neutral to slightly bearish, but December contracts have held steady around $ 3 / MMBtu. Northeastern gas producers have resumed cutting production, bringing total production to ~ 89 Bcf / d.

The combination of a neutral and bearish weather outlook, combined with the rebound in production, should have pushed prices down, so what’s going on?

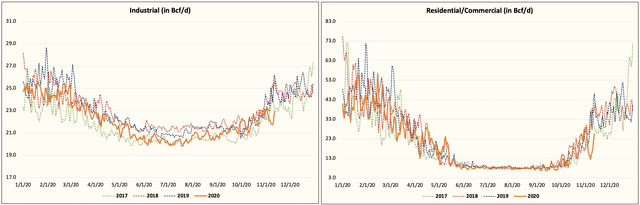

Consider the following charts:

Industrial and residential / commercial demand is well below historical standards.

What this tells traders is that while prices can remain stable given today’s weather forecast, the market will be unusually under-supplied if we reach the other side of the equation. We estimate that if the heat demand is just ~ 5% above the norm, the market deficit increases by 7 to 8 Bcf / d. Yes, this is the importance of the weather during the winter period.

Now consider the following also, the current natural gas market is in surplus by +1 Bcf / d due to the hottest November 3rd since 2000. If the opposite happened and we had the coldest November 3rd since 2000, the market deficit would be 11 Bcf / d.

So while it stinks at a time when the weather outlook is neutral and slightly bearish at best, the size of the market deficit amid a colder-than-normal outlook could be startling.

What does this mean for the trade setup?

The conclusion is simple. In order for us to be long, and we will do it via BOIL, we don’t necessarily need a very optimistic outlook. All we need is for there to be the possibility of a bullish outlook, which means the outlook might be neutral, but with tail risk it might turn bullish.

This will be different from previous winter trades where you would only take a position if the weather outlook is confirmed bullish. Instead, you almost have to anticipate the outlook for a bullish outlook in gas trading this winter.

Additionally, the asymmetry of the risk / reward profile is that if the models remain neutral, you come out with a very limited downside. But if the patterns turn higher, prices will immediately jump to grab the new outlook.

This setup is why we think the next trade setup will be very interesting and we are looking at model updates like a hawk.

We will be watching weather patterns closely, so if you are trading natural gas and need advice on weather, fundamentals and trader positioning, we think you should sign up for HFI Research Natural Gas. We are currently offering a 2 week free trial, so come see for yourself why we are the largest natural gas research service on Seeking Alpha. Sign up here for a 2 week free trial!

Disclosure: I / we have no positions in the mentioned stocks, and I do not plan to initiate any positions within the next 72 hours. I wrote this article myself and it expresses my own opinions. I am not receiving any compensation for this (other than from Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link