[ad_1]

According to one analyst, the US-China business niche could save some chip makers.

While major chip companies such as Broadcom are under pressure from restrictions imposed on Chinese telecommunications giant Huawei – a major buyer of US semiconductor chips until its recent blacklisting – some more players Concentrates are likely to avoid the shock, said James Wang of Ark Invest on Thursday on CNBC's Fast Money.

"We have never been very fond of … Broadcom," said Wang, head of semiconductors, the new generation of Internet and artificial intelligence at Ark. "It's always been a company of operators. It's about boosting businesses and optimizing efficiency. In our funds, we are more interested in investing in growing companies and creating opportunities, such as AMD and Xilinx, that control their own destinies much more. "

AMD and Xilinx, headquartered in California, are still relatively large and have a market value of approximately $ 33 and $ 27 billion, respectively. But, compared to a $ 104 billion giant such as Broadcom, which draws nearly half of its revenue from mainland China, according to Factset, they are well positioned to grow despite geopolitical concerns, Wang said.

"You do not see companies like AMD, for example, print because they're still relatively small," Wang said, while Broadcom's shares have fallen as a result of disappointing results from the company. 39; company. "In our tough macroeconomic environment, when you opt for smaller players, they can grow despite a macroeconomic wind."

And while investors might assume that macroeconomic winds are a general concern for all companies, Wang proposed a counterpoint.

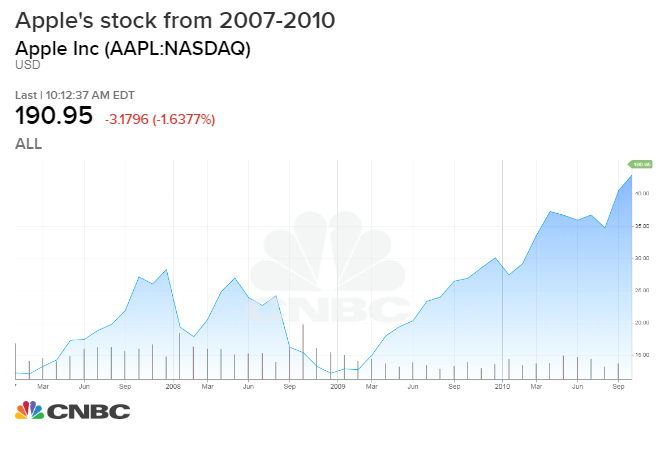

"The more mature a company is, the more it hits you because you are more correlated with GDP growth and more trade," he said. "If you look at some of the youngest social media companies in 2008-2009, they have made good progress – Apple – you could not even say that they had problems."

Apple's shares fell by nearly 42% between October 2007 and March 2009, at the height of the financial crisis. The S & P 500 fell by nearly 52% over the same period.

Fast forward to 2019, and "we are looking for companies that [are] more macro-agnostic construction products, not generating an income share of 3 to 5% or hit hard by Huawei's situation, "said Wang.

Wang is currently focusing on global semiconductor companies looking to build advanced chips for artificial intelligence applications, where the United States and China are neck and neck.

"I've looked at all the venture capital invested in the field of artificial intelligence chips: 40% went to Chinese companies, 35% to US companies," he said on Thursday. .

China "has long aspired to the United States for the independence of silicon and semiconductors," he said. "Artificial intelligence is actually a great reset point, because the conventional players who usually control this industry – Intel, with the x86 instruction set – are no longer in control.LIA is built on frameworks that are instructions and agnostic chips, so China has a chance to be the engine of this industry. "

This could potentially bifurcate the global trade relations of the United States and China, said Wang, while saying that we are not yet "up to the task".

"We are certainly looking at the possibility of two scenarios: Japanese companies serving the domestic market, located in China, and US companies and some European companies serving the rest of the world," he said. "It remains to be seen whether, at the global level, other customers will be willing to take Chinese AI chips, they have yet to prove themselves, they are very early in the software process."

Semiconductor stocks continued to decline during Friday's trading session, although Wall Street analysts urged investors not to panic about the decline. The VanEck Vectors Semicondcutor ETF, which tracks space, lost nearly 3% by noon.

Warning

[ad_2]

Source link