[ad_1]

In less than a year, Activision Blizzard (NASDAQ: ATVI) has released three different games in the Call of Duty franchise and is set to release the fourth installment in the series during the upcoming holiday season. Call of Duty continues to be the highest grossing series for the publisher to date, so it’s no surprise that Activision wants to capitalize on the franchise this year, as home ordering has helped the industry. of the game to reach new records. Thanks to this aggressive strategy, Activision recently had one of the best quarters in its history as it was able to beat the street consensus of revenues of over $ 300 million. While such a performance is impressive, there is every reason to believe that the company will be able to create even more value in the months to come. With a net cash position of $ 3.76 billion, Activision has sufficient resources to continue its expansion, and with its shares trading near its all-time high, the company is not overvalued and has more margin of growth. For this reason, I continue to hold a long position in the company and do not intend to unwind it in the short term.

FY21 is all about Call of Duty

Activision, like any other game publisher, is viewed as a pandemic-resistant company. Its performance in the first months of the lockdown is only improving and its stock is already trading near its all-time high. In recent years, Activision has started releasing titles based on its old franchises extensively, as these have historically generated the most revenue for the publisher.

During the previous holiday season, Activision began building on its Call of Duty franchise and within a year released the following titles: Call of Duty Modern Warfare, Call of Duty Mobile and Call of Duty Warzone. In just two months since launch, Call of Duty Modern Warfare has generated $ 1 billion in revenue, while Call of Duty Mobile has risen to number one in the US App Store’s sales. At the same time, Call of Duty Warzone has reached over 75 million players in less than five months since its release and continues to maintain its momentum to this day. Such a performance from its former titles helped Activision to post an exceptional performance in the second quarter.

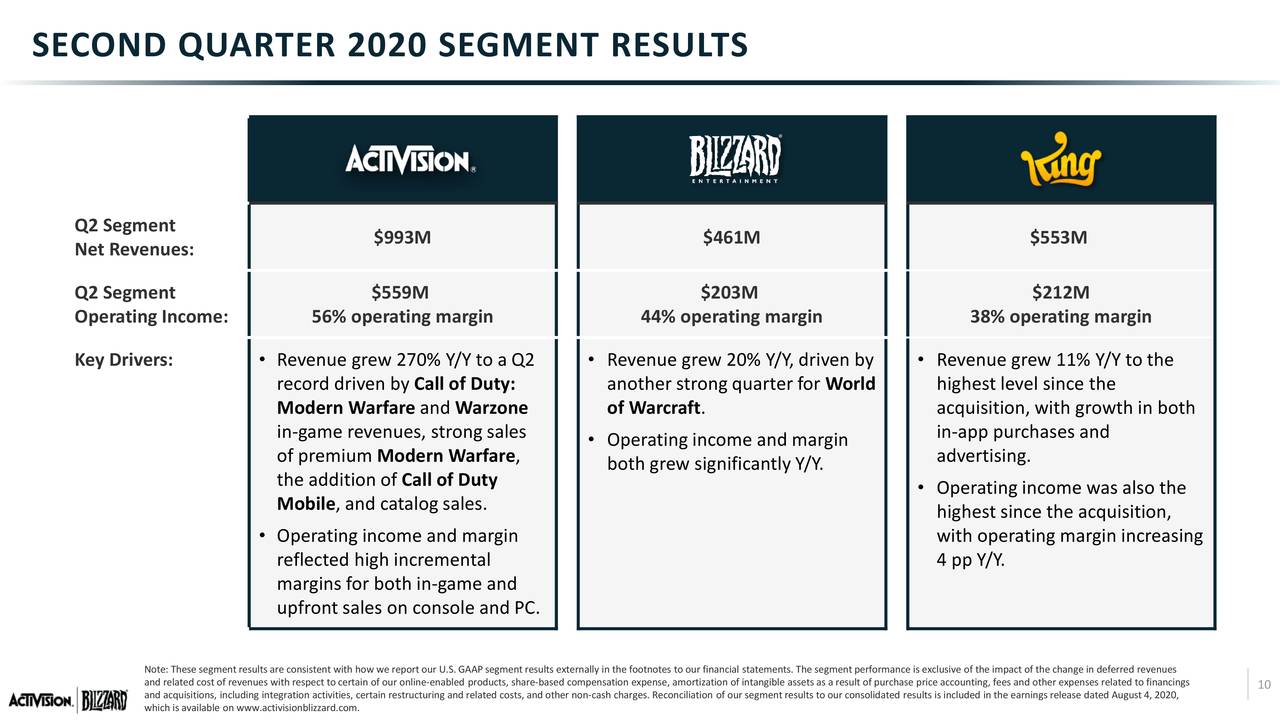

From April to June, Activision’s total revenue was $ 2.08 billion, up 71.9% year-on-year. The company topped revenue estimates by over $ 300 million, and its three subsidiaries have shown growth across the board. On their own, Activision’s revenue (excluding Blizzard and King) grew 270% year-on-year, with the Call of Duty franchise having performed at top notch. Call of Duty Warzone alone accounted for nearly a quarter of overall revenue during the period and helped the company reach an average monthly total of 428 million users.

Source: Activision

Going forward, Activision will continue to drive growth for the foreseeable future. While Newzoo expects the game industry to grow at a compound annual growth rate of 9.3% in the coming years, Activision, as one of the largest game publishers in the world , will benefit greatly from such growth. At the same time, a new round of possible lockdowns will also only benefit the company, as it did in the first quarter. The publisher also plans to release new games and updates to its other legacy franchises such as Diablo, Overwatch, and World of Warcraft. However, there are no release dates for the new titles and currently all eyes are on Call of Duty at this time.

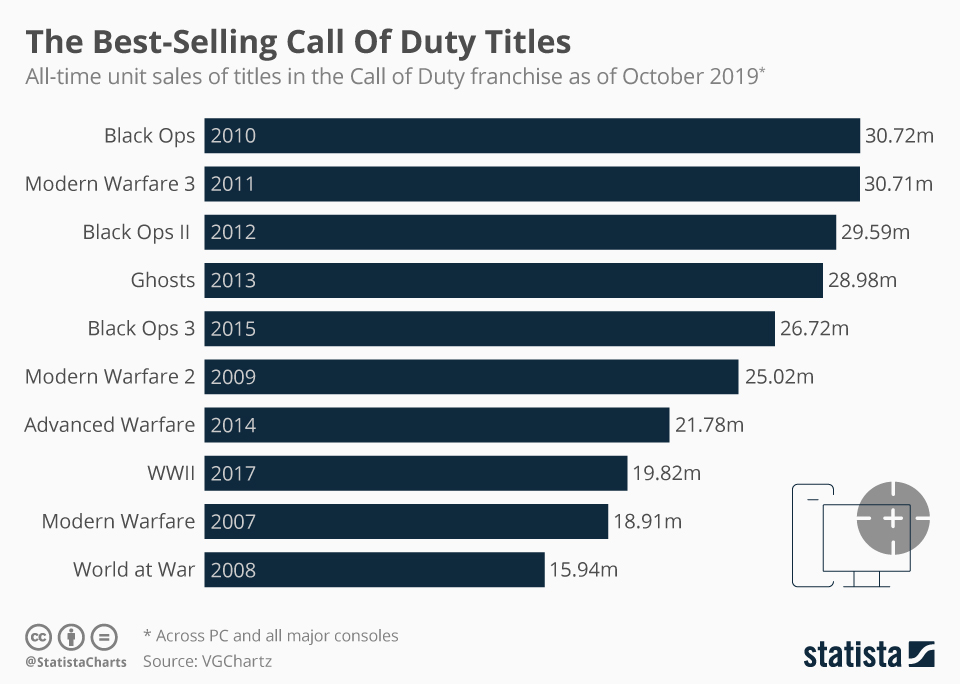

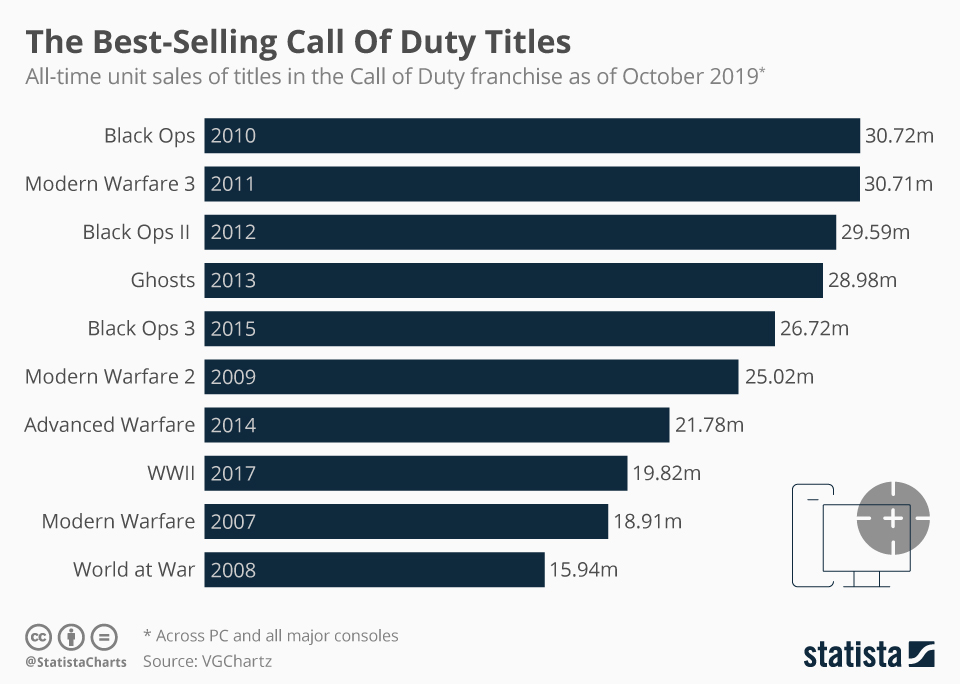

The biggest catalyst for the second half of the year would be another game in the Call of Duty franchise. The upcoming title is called Call of Duty Black Ops Cold War, and it’s slated to release with the launch of the next generation of consoles during the holiday season. Since the Black Ops series is one of the most successful series in the Call of Duty franchise, the game could show similar outstanding performance in Q4 and help the publisher easily meet their exercise goals.

Note: This chart does not include Modern Warfare 2019. Source: Statista

The biggest downside to Activision is that its business is not sufficiently diversified. The company is building on the success of its legacy titles such as Call of Duty, World of Warcraft, and Candy Crush and does not have any new AAA titles in its pipeline. Electronic Arts (EA) has had the same problem in the past, when it relied too much on the success of a title, and when that title underperformed, the company was unable to meet its expectations. goals and his stock fell. This is something Activision investors should be aware of.

However, Activision has enough resources to minimize its downsides, if some titles underperform. At the end of the second quarter, Activision had a net cash position of $ 3.76 billion, an increase from a net cash position of $ 1.98 billion a year ago. At the same time, in early August, the publisher successfully valued $ 2 billion in senior bonds at rates of 1.35% and 2.5% and with maturity in 2030 and 2050. After that, Activision used the proceeds of the deal to hedge its 2021 and 2022 high-interest notes and there is no major debt maturing anytime soon. The fact that Activision was able to secure such a low rate on its newly issued notes shows how fundamentally sound its business is and how it is able to weather any crisis. As Activision continues to thrive during the pandemic, there is every reason to believe the stock will appreciate even more in the coming months.

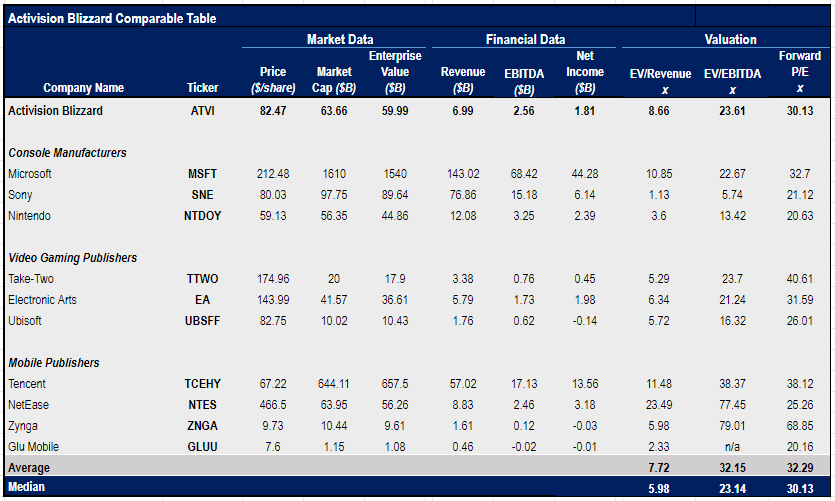

For Q3 and FY21, Activision expects its reservations to be $ 1.65 billion and $ 7.63 billion, respectively. Given the exceptional performance in the first and second quarters, these targets are achievable. Given that Activision’s shares trade at EV / EBITDA and forward-looking P / E ratios, which are in line with the industry median, it is safe to say that the company is not. overvalued, even though the share price is about to hit a new high. .

As all of its Call of Duty titles continue to hold their momentum and with another title in the franchise coming out later this year, there’s no reason not to be optimistic about Activision. I continue to hold a long position in the company and believe its stock has even more room for growth.

Source: Yahoo Finance. The table was created by the author

Disclosure: I am / we have been ATVI, EA, UBSFY, TTWO, SNE, NTDOY, NTES for a long time. I wrote this article myself and it expresses my own opinions. I am not receiving any compensation for this (other than from Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link