[ad_1]

Retail has not been fun this season. We went from disappointment to disaster for many names. We can add Foot Locker (FL) to the latest list of victims with traded shares down 16% early trading Friday afternoon. The company missed the nine-cent net profit when it announced earnings per share of $ 1.53 on revenue of $ 2.08 billion. Although the company has reiterated its guidance for the full year, it now expects high single-digit EPS growth based on share buybacks.

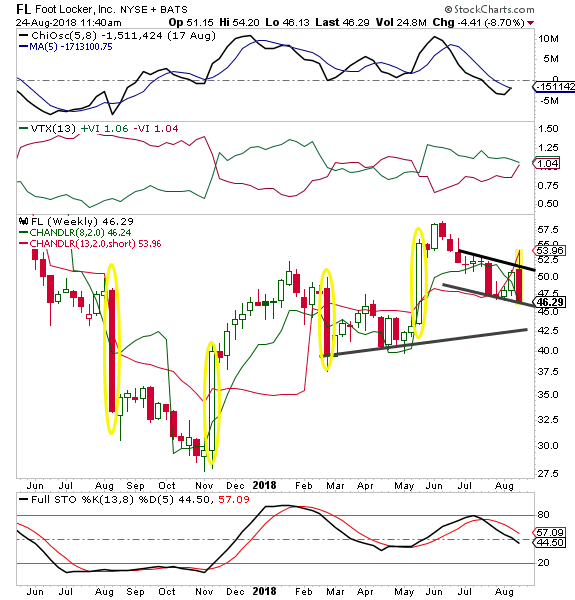

Despite the huge movement that has taken place today, the option market still anticipates another 8% stock move over the next three weeks. And it's not as if Foot Locker was strangers to the big moves on the first day of trading after the profits. The stock closed with a move higher than 9%, out of eight of the last nine declared results. This brings us back to early 2017. The idea of an additional 8% plus the first day's move is a much rarer feat when we look at the next three weeks, which would lead us to June 14th. 2019, expiration. Foot Locker shares have not accomplished this since November 2016. They have moved closer in March 2018, but the bulk of the move is on the first day. I am a bit surprised to see that aggressive prices remain in the options market. If this does not happen before the end of the trading session today, a short game of volatility may be worthy of consideration.

Finding support can be difficult. This could explain the current price of the options. I have to go back to the big move of November 2017 and to further developments to identify support. This leads to another interesting possibility. Note the huge drop of August 17, similar to the current price decline. After a slight rebound, Foot Locker shares struggled for three strong months. It was not until the November results reversed the trend that Foot Locker found buyers. A repetition or even a rhyme of this model would push the actions in a range from 35 to 40 dollars.

In the report or in the technical picture, few things make me want to rush into FL. The company will likely continue to buy back shares, but after spending only $ 1.8 million on the purchase of 32,100 shares at an average price of $ 56.07 (a mediocre performance so far), I do not expect future redemptions to help bring together stocks. It is a company with a market capitalization of $ 6 billion. Also, until we get a "real" amount of money for redemptions, that's not a factor. A dividend approaching 3% will make this issue an intriguing purchase / writing of less than $ 40, but until we see the price to be paid, it would be best to leave somebody else behind. to become the bullish hero of this story.

Receive an email alert whenever I write an article about Real Money. Click the "+ Follow" button next to my signature for this article.

[ad_2]

Source link