[ad_1]

A report from the Stanford Center on Longevity and the Society of Actuaries suggests that the typical American would benefit from a more advanced retirement age.

After analyzing 292 different retirement income strategies, the research team identified the best way for most people to withdraw their money in retirement: This is called the "Retirement Security Strategy" (SSiRS) and involves postponing Social Security payments until age 70, which could mean working longer.

"Delaying retirement, even for a few years, can dramatically increase retirement income," notes the report.

To show you how powerful it can be, the research team has analyzed the numbers. In one example, a 62-year-old hypothetical middle-income couple earns a combined total of $ 100,000 and has retirement savings of $ 350,000.

Delaying retirement, even for a few years, can dramatically increase retirement income.

Report "Sustainability of spending safely in retirement"

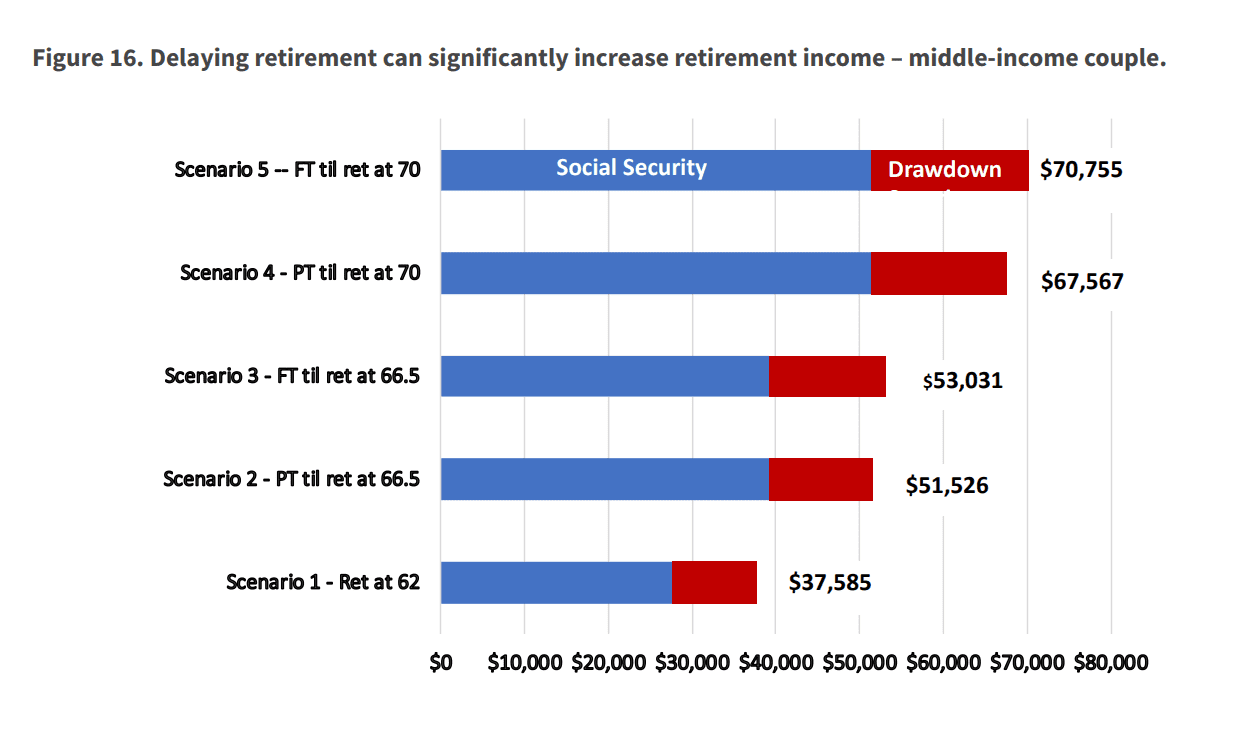

The researchers calculated what the couple's retirement income would look like under five different scenarios: retiring at age 62, working part-time until age 66 (their retirement age at social security), working at home. Full time up to age 66, working part time until the age of 70 and working full time until the age of 70.

The longer the couple waits before starting to receive Social Security benefits and lower their retirement income, the higher their retirement income will be:

The amounts shown are in today 's dollars, not adjusted for inflation. For full-time work scenarios, the report assumes that the couple contributes 10% of their income to retirement savings each year until retirement. For the part-time work scenarios, the report assumes that the couple makes no additional contribution to their retirement savings during this period (they live on their part-time income and delay social security).

As the chart illustrates, if the couple retired at age 62, their annual retirement income (including social security benefits and the amount of their retirement savings) would be $ 37,585. If they worked full time until the age of 70, their annual income would be almost double: $ 70,755.

Researchers assume that they withdraw between 2.8% and 3.6% of their retirement savings each year, a percentage they determined using the same methodology as that used by the IRS for the minimum required allocation. The IRS requires you to make minimum withdrawals of your retirement savings at age 70 and over, called Minimum Required Distribution (RMD).

Even if the couple waited until age 66 to retire – and worked part time or full time – he would have a much larger income than he'd set at age 62.

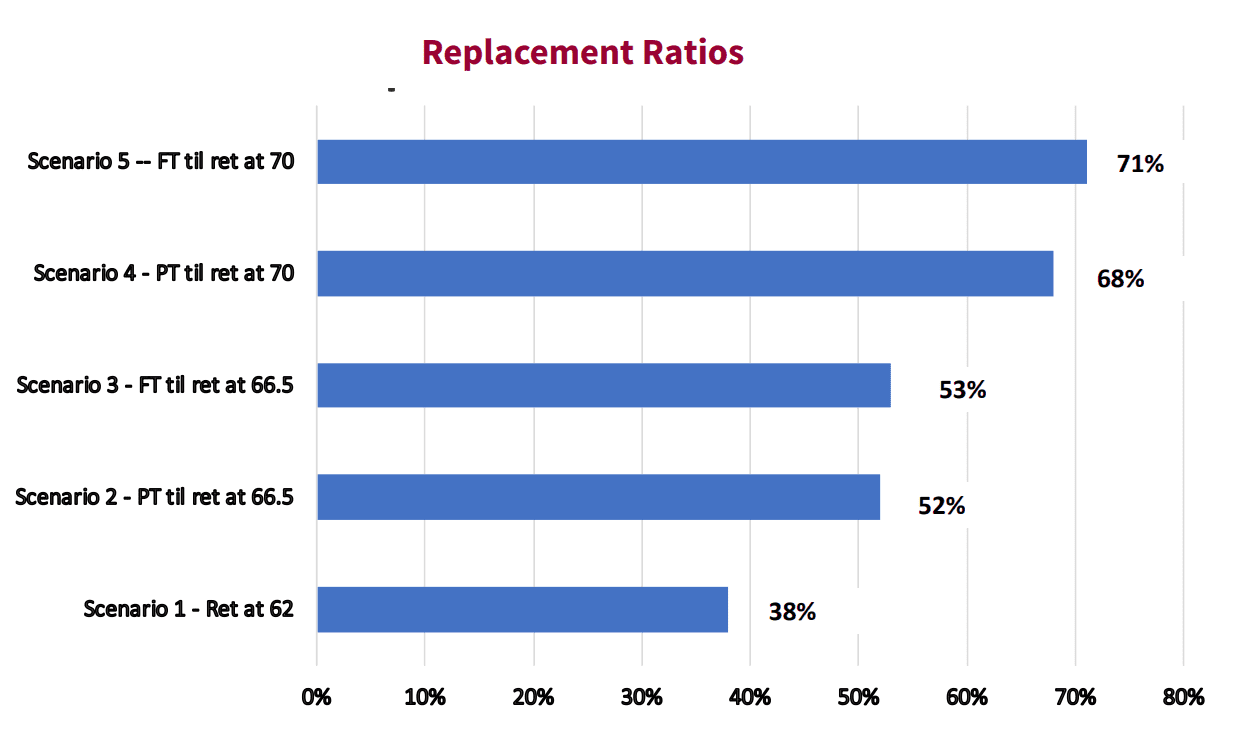

Then the research team looked at the "replacement ratio", which is your income after retirement divided by your income before retirement. "Financial advisors say you need to replace 70% to 80% of your pre-retirement pay to be comfortable," said Steve CNV, co-author of the report, at CNBC Make It. "We therefore converted the dollar amounts of retirement income into a replacement rate."

Unsurprisingly, delaying retirement leads to much more favorable replacement rates:

If the couple retired at age 62, their replacement rate would be 38%, "well below the recommended 70% to 80%," says Vernon. The only scenario in which the couple achieves the recommended rate is one who works full time until age 70.

As the report notes, "most older workers will not meet the generally recommended retirement income targets unless they can work in any way in the late 1960s or 1970s. they may need to learn to live with a reduced disposable income compared to their income, years of work. "

In the end, everyone's scenario is different and people choose to retire at different times in their lives. "There is no perfect retirement income strategy," Vernon said. The report, he adds, attempts to help people make an informed decision about when to retire and how to deploy their retirement savings.

All experts do not agree that 70 years is the "new retirement age".

"Let's make the reality by retiring at age 70," says David Bach, best-selling author of "The Automatic Millionaire" to CNBC Make Bach. "The average person in America retires at age 62, certainly before age 65." There are many reasons for this, he says: health problems, less energy or being forced to quit his job.

"I am not against work before the age of 70," says Bach. "If you like what you do and can stay until the age of 70, it's fantastic, I know people who work in their 80s. can … But do not assume you have an extra decade payday right now to save money because someone else told you that 70 is the new 60. "

Rather than considering working longer to get ready for the golden age, start saving more money now, he says: "The way you get the best return from your business. retirement – I call it ROR – is about saving, saving, saving, saving … And you retire in your early sixties, you have the means, and you will really live the best years of your life. "

Do not miss: Stanford analyzed 292 retirement strategies to determine the best. Here is how it works.

Do you like this story? Subscribe to CNBC Make It on YouTube!

[ad_2]

Source link