[ad_1]

The 80th Burger King Restaurant in South Africa, located in the Kolonnade Retail Park.

- Disgruntled shareholders want to get rid of the current board of directors of Grand Parade Investments (GPI), which owns the SA franchises of Burger King, Dunkin 'Donuts and Baskin-Robbins.

- A list of their grievances has just been released, and includes dissatisfaction with the large payments made to the directors.

- One of the shareholders believes that Dunkin's Donuts and Baskin-Robbins should be closed.

Next week, a disgruntled group of shareholders will argue for a deal at Grand Parade Investments (GPI), which owns the Burger King, Dunkin 'Donuts and Baskin-Robbins SA franchises, as well as gaming badets like GrandWest Casino and SunSlots.

Shareholders – which include small money managers Denker Capital, Rozendal Partners and Kagiso Asset Management – together hold 12% of GPI, but they are confident that more shareholders will vote with them to vote against long-time directors.

Previously, they had requested a special meeting in October, which had been summarily adjourned following a participant's opposition to the non-understanding of shareholder complaints.

The disgruntled shareholders then wrote a letter containing their grievances, which the JSE asked GPI to release on Wednesday. (An extraordinary meeting is now scheduled for December 5.)

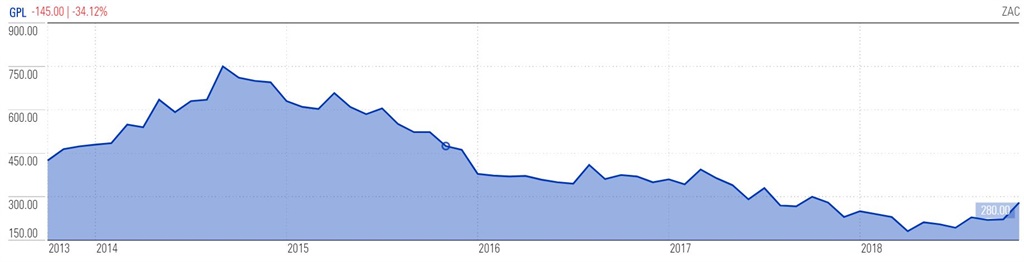

The letter explains why shareholders believe that GPI's share price has lost 70% of its value since 2014.

(Fin24)

In particular, they complain that some of the directors who have been on the board for more than a decade do not have the expertise to oversee the management of a large restaurant company such as Burger King. Disgruntled shareholders have a list of privileged directors who they believe should be elected.

The co-founder and chairman of GPI, Hbadan Adam, and the board of directors have been blamed for contributing to the mbadive exodus of GPI executives, including the loss of two CEOs over the last 18 months, as well as than the Chief Financial Officer and the Chief Executive Officer. Burger King officer in South Africa.

Shareholders also oppose the 26 million rand bonus paid to directors over the last two years, while GPI suffered losses.

"GPI has fantastic badets including Sunwest, Sunslots and Burger King," said Paul Whitburn, portfolio manager at Rozendal. After spending more than a billion rand on Burger King over the last seven years, the channel is finally making a small operating profit.

But GPI does not make sound decisions about capital allocation, buying and managing new businesses, he adds.

Dunkin 'Donuts and Baskin Robbins should be closed in South Africa, he said. Both US franchises suffered a loss of 87.6 million rand in the last two years, before taxes.

The business case for Baskin-Robbins, which has to import twenty flavors of ice cream and sell it at high prices in South Africa, has never made sense, Whitburn said.

And although Dunkin Donuts is popular in the United States as "coffee on the go" for commuters, South Africans are apparently not enamored of its products.

"And anyway, the world is moving away from sweet products as health choices evolve."

While shareholders were opposed to GPI's acquisition of a nearly 20% stake in Spur, Whitburn "does not have the opinion" on whether it should now be sold.

For now, his main concern is that next week's meeting will be reopened for a technical issue – without the shareholders being able to vote to replace the directors.

GPI has not responded to Business Insider's comment request.

Receive a single Whatsapp each morning with all our latest news: click here.

Also in Business Insider South Africa:

Source link