[ad_1]

(Fin24)

- The British group of shopping centers Intu Properties, listed on the JSE, lost a third of its value during the first hour of trading.

- At a second public tender this year, Intu was again overthrown.

- This time, potential buyers blamed Brexit.

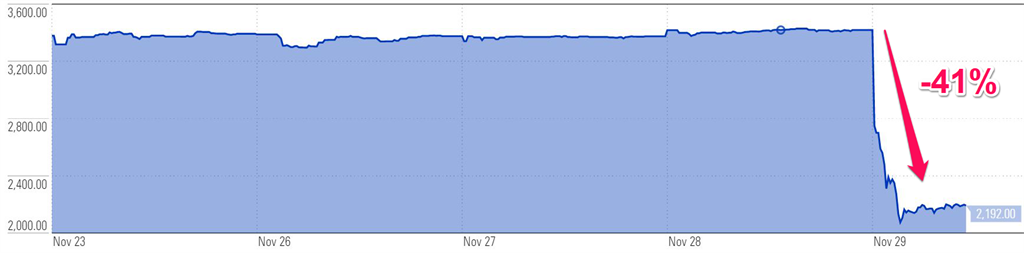

Intu Properties, a UK-listed JSE-listed shopping center that is highly regarded by South African investors looking for an international exposure, fell to record lows on Thursday after the bankruptcy of a takeover.

Intu Properties closed Wednesday at R34.21, but lost more than 40% of its value, a charge of $ 24 billion, to trade around 22 rounds on Thursday at lunchtime.

A consortium offered Intu £ 2.9 billion (51 billion rand), which owns the Manchester Trafford Center and 13 other shopping centers, but then withdrew because of its 'volatility'.

David Fischel, CEO of Intu, told Reuters that the Brexit uncertainty was at the root of the uncertainty.

"The current escalation around Brexit and all its potential ramifications have obviously come a long way in recent weeks and have made the climate very difficult to make a big investment decision," Fischel said. Reuters.

Earlier this year, his rival Hammerson – also listed on the JSE – also abandoned the Intu buyout.

Casparus Treurnicht of Gryphon Asset Management is scary to investors that the latest offer of the consortium was not retained after that of Hammerson at the beginning of the year.

But there are even bigger concerns about society.

"The UK real estate sector is not doing well." The UK chain of stores House of Fraser has also confirmed its intention to leave its stores in Intu shopping centers.

"Intu then informed investors that they were considering using the land available for redevelopment (mainly residential and commercial). And in order to pay for it, they will reduce the dividend.

"The simple dynamics of supply and demand do not guarantee it. They may have a longer view of British property, but faced with so many uncertainties related to Brexit, it is no wonder that the action is being pounded. "

Treurnicht believes that investors who bought the stock have done so recently for the dividend yield.

Intu is valuable, but Brexit is imminent, according to Simon Brown, founder and director of the JustOneLap.com investment site. Brexit should be negative for the British economy

"In addition, it is the company's second failed recovery proposal and I would be very careful to keep the stock."

Property – the kiss of death of the JSE. Performance ytd – Fortress B -66%, Rebosis -65%, Resilient -55%, NEPI -51%, Intu -48%, Arrowhead -34%, MAS -33%, Acceleration -23%, Attack -26% , Hammerson -24%, Hyprop -21%, Delta -20%, SA Corp -18%, Growth Point -13%, L2D -13% and CapCo -12%.

– David Shapiro (@ davidshapiro61) November 29, 2018

Although his company holds no Intu shares on behalf of clients, Vestact's portfolio, Michael Treherne, believes that Intu's misfortunes are a warning to South Africa.

"Investment only occurs when there is certainty, especially when it comes to long-term property." This underscores the need for South Africa to provide certainty on land issues. All the market wants to know is what is at risk for investors to plan accordingly. At the present time, because the ANC has not clarified things, all lands are in danger, depending on your interlocutor.

"Political certainty leads to investment and investment leads to growth."

Receive every morning a single WhatsApp with all our latest news: click here.

Also in Business Insider South Africa:

[ad_2]

Source link