[ad_1]

Positive management tone on the last call

As part of our coverage on Alibaba Group Holding (BABA), we have joined its call for results for 4QFY19 (fiscal year ending March) held last week. First, we would say that the tone of the direction on the call for results is positive, despite all the concerns such as the trade war between the United States and China and the slowing of macroeconomic consumption of the China. Management specifically cited 4QFY19 as an excellent quarter with earnings and earnings above expectations.

In addition, at the beginning of the call for results, the management dealt directly with the elephant in the room, which is the impact of the trade issue between the United States and China on BABA. In short, management believes that the problem is positive (in the long run) as the trade problem would lead China to be a more market-oriented economy or accelerate the transition of the Chinese economy to consumption. domestic export-oriented. – given one. The middle class (estimated at about 300 million people today) would continue to double over the next 10 years, with the new middle class coming from tier 3 and 4 cities. Management is therefore convinced that Baba is doing very well. placed to take advantage of the long-term recovery of this consumption.

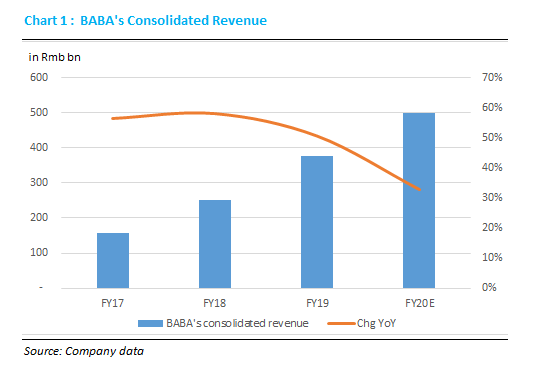

In addition, with regard to the short-term outlook (Fiscal 2010), the turnover management guides of 500 billion rand (33% growth in turnover year-on-year), Gross Merchandise Volume (GGW) reaching $ 1 billion. According to management, business growth forecasts of 33% reflect bullish prospects, which would allow BABA to outperform its competitors. In comparison, the BABA exercise achieved a turnover of 377 billion rand (51% over one year and 39% on an organic basis / excluding the effects of new acquisitions). Unfortunately, no breakdown by growth segment is given. And management was vague in indicating which sector would generate the greatest growth, except that it was said that direct selling activities (direct imports and new retailers) would represent a larger proportion of sales. As usual, the management gives no indication of profit.

What management does not tell us candidly

After the results were called, we conducted an in-depth analysis (in particular a detailed sectoral analysis, including its three-year trend analysis) to assess the fundamentals of BABA. In our in-depth analysis, we found some information that we believe is not sincerely revealed by management (to be fair, to give a positive view of the perspective / fundamentals of the company is normal for the management of public companies) . More precisely, we found three disturbing measures that indicate a much slower growth story in terms of sales and revenues.

Measure # 1: eCommerce turnover growth decelerates

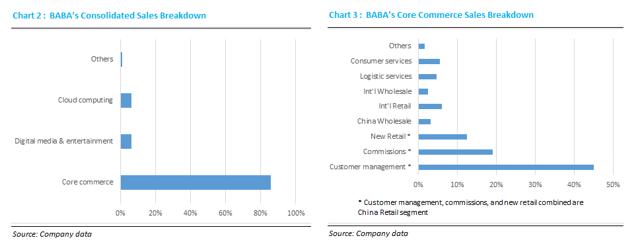

The basic trade sector accounts for 86% of BABA's turnover. The core business segment comprises seven sub-segments: Chinese Retail, China Wholesale Trade, International Retail Trade, International Wholesale Trade, Logistics Services, Consumer Services (ele.me, a retail distribution platform). online products like GrubHub (GRUB)), etc. China Retail (77% of core business) is the main e-commerce platform of BABA (Taobao and Tmall). China's retail sub-segment includes customer management, commissions and new retail trade (mainly Hema direct imports and physical stores whose sales are recorded on a gross basis). 1 p, compared to a net basis / 3 p for customer management and commission sales).

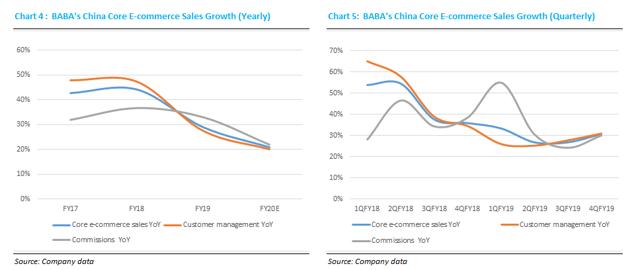

However, since BABA has expanded its operations to new strategic initiatives (including New Retail and an online food distribution platform), eCommerce revenue (ranked in customer management and commissions in China's retail sub-segment) slowed. in terms of growth, from 43% to 44% year-on-year in Fiscal 2017/18, to 29% year-on-year in Fiscal Year 19. On a quarterly trend basis, core sales growth in Fiscal Year E-commerce reached 54% to 55% year-over-year during the first two quarters of fiscal year 2017 (quarter of June 2017 to September 2017). In the second quarter of 1999 (September 2018 to September 2019), growth in core e-commerce sales was only 28% on average. Thus, much stronger growth in China's retail sub-segment was recorded in new retail sales (155% year-over-year during FY19, versus only 29% yoy annual report for basic electronic commerce). As a percentage of retail sales in China, core e-commerce accounted for only 84% of fiscal year 19, up from 98% in fiscal year 17.

Based on management's 2010 revenue growth forecast of 33%, we conclude that growth in core e-commerce revenues would slow further to between 20% and 23% year-over-year. . Therefore, practically speaking, The growth of BABA's basic e-commerce revenues would be halved in fiscal 2014 from 43 to 44 percent year-over-year in the 17 to 18 period.. The slowdown in GMV, driven by the slowdown in macroeconomic consumption, is the cause. GMV growth in FY19 slowed to 19% year-over-year, the first growth of less than 20% in BABA's history.

Furthermore, we also note that the meteoric rise of the e-commerce start-up Pinduoduo (PDD), created in September 2015 and made public in July 2018, has helped to increase competition, especially in level 3 groups. and 4.) cities (strong DP markets). The PDT GMV (on a TTM basis) in 1Q19 reached Rmb 557 billion, compared to RBM 141 billion in 2017, or virtually non-existent in 2015. Thus, the PDT GMV TTM in 1Q19 accounted for 10% of the MGV. from Baba during the same period. In December 2018, DDP is the second largest e-commerce platform in China in terms of annual active buyers, with 418 million buyers, exceeding 305 million JD.com (JD).

Measure # 2: Losses from the surge in new strategic initiatives

As previously stated, Baba has developed into new strategic initiatives within its core business segment. For example, in April 2018, BABA fully acquired ele.me (its previous participation was 43%) and began consolidating ele.me in May 2018. As a backdrop, ele.me is the second largest Online food distribution platform in China. with 36% of the United States, behind Meituan Dianping (55% on the Hong Kong Stock Exchange with the symbol 3690 HK). Management believes that online food delivery is the next frontier in terms of growth potential, with market size (in terms of gross transaction value) exceeding Rmb 600 billion.

Another new strategic initiative to note is New Retail, which essentially involves an omni-channel strategy. To provide a seamless online and offline customer experience, Hema's state-of-the-art grocery (brick and mortar) stores have been deployed since 2017. Since March 2019, BABA has operated 135 Hema stores operated, mainly located in first and second tier cities. In addition, as a new retail initiative, BABA operates Ling Shou Tong's retail supply platform (LST). The LST platform allows merchants (mostly family stores) to stock up on a wide selection of brands and products that can be delivered to their stores, allowing them to increase their merchandise. revenues and reduce their operational costs.

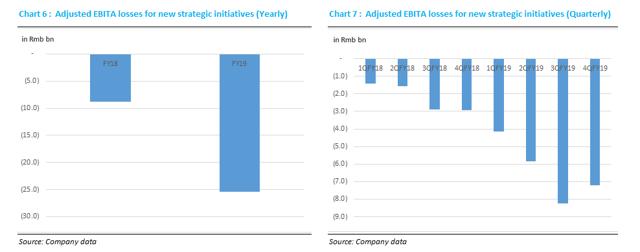

Thus, with all new strategic initiatives added, in the core business segment, the proportion of core e-commerce sales has increased from 83% in Fiscal 2017 to 64% in FY19. the basis of new information on adjusted operating profit adjusted for the core business segment, losses for all new strategic initiatives (ele.me, New Retail, etc.) amounted to Rmb 25.4 billion during fiscal year 19, almost triple that of 8.8 billion RB for the year 18. It is true that the consolidation of ele.me (from May 2018) largely contributed to the balloon losses.

Nevertheless, on an apple apple basis (since the ele.me consolidation), 4QFY19 (quarter of March 2019) losses of new expanded strategic initiatives to 7.2 billion rand against 5.84 billion rand in 2QFY19 (quarter of September 2018). This indicates that competition in the online food distribution market has remained intense, which is confirmed by our channel which verifies that the (consumer) subsidy war between ele.me and Meituan is continuing. Acting on this battle of market share, the management of Baba said that Ele.me would continue its aggressive expansion, particularly in lower-tier cities, during the EX20, in the Middle East. the extent that only 20% of total orders came from these cities. In addition, we do not compare the losses of 4QFY19 resulting from new strategic initiatives with 3QFY19, as the December quarter is a seasonal quarter (when the promotion / grant is also the highest).

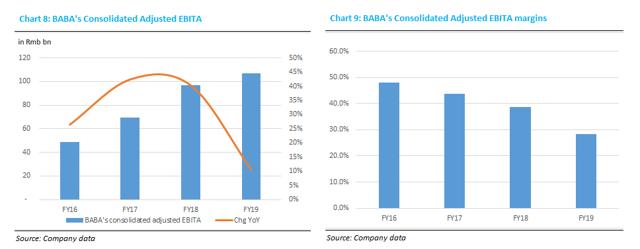

Measure # 3: Margin compression to a record low

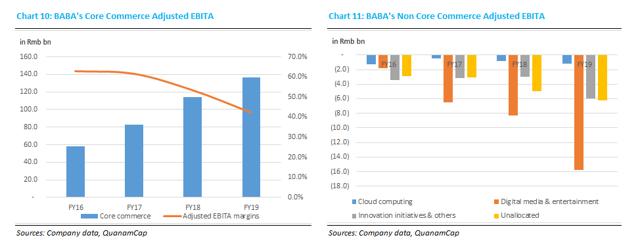

Hidden behind the positive tone of management when announcing the results of 4QFY19 is that BABA's consolidated margins have been reduced to historic lows. Adjusted EBITA margin for FY19 was 28.4%, down 1,040 basis points from the prior year (yes, it exceeds 1,000 basis points – it is not a typo). Compared to the 2015-2016 fiscal year (the beginnings of BABA as a public company), Adjusted EBITA margins of 28.4% are only more than half of those recorded by BABA (Adjusted EBITA margins between 48 and 50%). As a result, adjusted EBITA for fiscal year 19 increased only 10% year on year, compared with 40 to 42% on the 17-18 year.

With respect to the distribution of Adjusted EBITA, Adjusted EBITA margins in the Central Trade Segment decreased significantly from 61.6% in Fiscal 2017 and 53.3% in Fiscal Year 18 to 42.1% for Fiscal Year 19. As noted above, losses related to new strategic initiatives are an important factor for compressed EBITA margins for the core business, as management has stated that margins for EBITA adjusted for e-commerce remained stable.

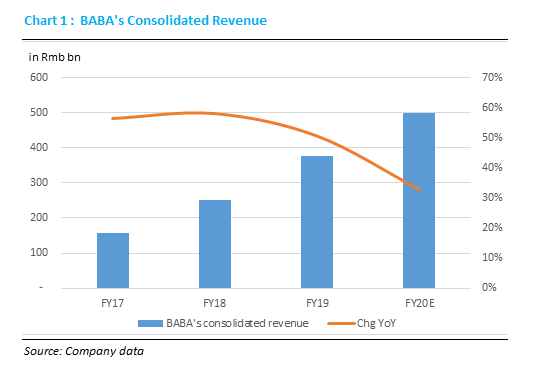

Some investors argue that outside of the core business segment, BABA operates in the cloud computing business at Amazon Web Services (AWS). However, it should be noted that unlike AWS (very profitable business at 30-40% OM), BABA's cloud computing activities actually have negative adjusted EBITA margins (-4.7% during the year 19). In fact, the improvement in margins had been slow enough for BABA's cloud computing. At the time of Exercises 17 and 18, cloud computing had adjusted EBITA margins of -7.1% and -6%, respectively. As a result, with such a marginally slower improvement, BABA's cloud-based adjusted operating income loss increased from R48 to R.0.8 billion during the year. 17-18 to an amount of $ 1.16 billion during the fiscal year19. Our channel audit reveals that the company's cloud computing negative margins are more of China's, where high subsidies are needed to encourage customers to make digital transformations through the public cloud.

Another segment, that of digital media and entertainment (mainly the Youku online video streaming platform), even recorded a staggering 15.8 billion RBI adjusted EBITA loss over the course of the year. FY19, deepening considerably after losses of RMB 6.5 / 8.3 billion in fiscal years 17-18. Management said that it was currently focusing on developing original content production capabilities in order to stimulate growth in the number of subscribers. In simple terms, this means that management focuses on market share rather than profitability. The analysis of the financial data of the competitors of iQiyi (IQ) in streaming video shows that the profitability, or even reduction of losses, of an online video streaming service remains difficult to achieve in the future close. In 1Q19, the net losses of IQ amounted to 1.8 billion gross operating income, compared with 685 million RBM in 1Q18. In addition, for the full year of 2019, IQ only provides revenue forecasts (no earnings forecasts), which implies that the focus remains on market share rather than on the profitability.

Conclusion and evaluation

Management maintains its bullish outlook in the latest earnings call despite all the concerns (trade war between the US and China, slowing macroeconomic consumption in China). However, our in-depth analysis reveals that growth (whether adjusted operating income or adjusted operating income) recorded in FY19 does not provide a similar upward trend. In fact, we found that the growth of e-commerce has slowed down to the front-line level, and that new strategic initiatives, while providing some protection against slowing e-commerce revenue, are causing huge losses without no sign of improvement in the foreseeable future. A similar narrative (balloon losses without improved vision) is also used in the segments of cloud computing and media and digital entertainment. As a result, growth in BABA's adjusted operating income (an indirect indicator of earnings growth) slowed significantly to 10% year-on-year in FY19 from 42% to 43%. year-over-year during fiscal year 17-18.

In reviewing the Bloomberg consensus, EBITA reveals that analysts expect BABA to grow 25 percent year-over-year and 33 percent year-over-year for fiscal 2015 and 21, respectively. Our in-depth analysis, particularly with a substantial growth in EBITA for FY19 (10% year-on-year only), does not match Bloomberg's consensus EBITA growth expectations. Our mini-profit model suggests adjusted EBITA growth of 10 to 12% during the EX20 as a more realistic expectation. Therefore, faced with a risk as high as BABA is not at the rendezvous of consensus for FY20, trading at 19 x 2019E EV / EBITDA suggests (a lot) more risk of lowering the course price. the action only upside risk, in our opinion.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link