[ad_1]

Altria Group, Inc. (MO) is the leading manufacturer of American cigarettes, which for decades has also been the darling of dividend investors. In recent years, the company has been under intense pressure due to the continuing decline in cigarette volume and FDA attacks on electronic cigarettes for which MO has taken a stake.

In the last two years, MO shares have declined by 35%, placing investors in a difficult position due to the uncertainties surrounding the company. A possible merger with Philip Morris International (PM) was discussed, which could have a significant impact on the assessment. Has this darling dividend died in the water or is it trading at an extreme discount rate, which would be a great entry point for long-term investors? ? We will take a look!

Is the price of falling stocks guaranteed on the basis of recent results?

As I mentioned earlier, Altria shareholders are on a long downtrend, with the stock having lost 35% of its value over the past 48 months. A little further back, stocks are trading at levels not seen since May 2014. Investors are now wondering if the decline is warranted.

Let's first look at the latest results of the company.

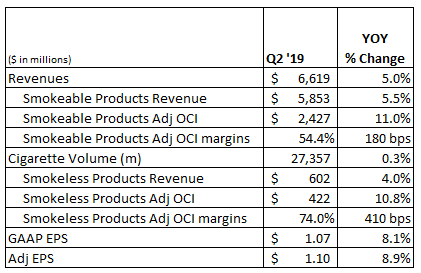

(Graphic created by the author)

As you can see in Altria's 2019 second quarter results, revenues increased by 5%, mainly due to the strong quarter of the company's core segment: smoking products. This sector alone posted a 5.5% increase in sales, due to a slight increase in volume sales combined with higher prices than in the previous year. However, in the first six months, volumes decreased by 7%.

The company continues to have the leading brand of cigarettes, which gives it the pricing power it continues to use to offset declining volumes. Over the years, Altria has always explained that new generations are more "health conscious" than in the past, which has become evident in the volume declines observed in cigarettes, at least in the United States.

According to Morningstar, they predict that the rate of decline in the volume of cigarette consumption in the United States will be about 4% per year, a rate of decline that is faster than most world markets. However, because of its pricing power based on the choice of leading products, the company has always been able to set its prices above the rate of decline in volumes.

The company's volume projections are a little more cautious, as the rate of decline is estimated at between 5% and 6%, but the reasoning is based more on the fact that adult smokers switch from cigarettes to electronic steam. However, the FDA president recently looked closely at the electronic vapor products. This will be a point to watch too, especially since Altria holds a stake in the market leader, JUUL.

The Smoke-Free Products segment continued to perform well, with sales up 4% and margins adjusted for other comprehensive income, which gained 410 basis points to 74%. Growth is again mainly due to higher prices compared to the previous year.

As mentioned earlier, MO holds a stake in JUUL, the leader of the e-cigarette, which has recently been the subject of bad news. Altria has already received negative reactions from investors based on the valuation attributed to JUUL when acquiring a 35% stake in the company at the end of last year for $ 12.8 billion. JUUL has been criticized by regulators of the FDA as well as by Washington, including the president, for increasing the number of incidents and deaths related to vaping. The regulators have questioned the company's marketing tactics towards teenagers, as well as the safety of its products. In recent weeks, eight deaths related to e-cigarettes have occurred, in addition to at least 530 people with a known disease related to vaping, according to the CDC. More than half of the 530 patients treated for this disease are under 25 years old.

Companies and countries around the world have become aware of it and have either banned electronic cigarettes or stopped selling them in their stores. Walmart (WMT), the largest retailer in the United States, announced last week only its intention to stop selling e-cigarettes in all its stores as a result of vaping-related deaths. India has also announced the ban on the production, import and distribution of electronic cigarettes.

As a result of these events and the expected impending crackdown by regulators, it is expected that the company will cancel the investment in the near future. However, what investors are forgetting is that JUUL is just a tiny piece of the cake for Altria as a whole.

The other recent acquisition by the company was to take a stake in the global cannabis group, Cronos Group (OTC: CRON). Altria invested $ 1.8 billion in a 45% stake in the company, with warrants to increase ownership to 55% over the next four years. CRON's shares have been about equal since the announcement of the company's acquisition in December 2018, but rose to 125% in March 2019.

(Photo credit)

The acquisition of Cronos further diversifies the company and moves closer to a Marlboro green. If cannabis became legal in the United States, at the federal level, Altria would be better placed with this acquisition. With this acquisition, the company will have enough time to put in place an appropriate supply chain. Once the federal government has legalized cannabis in the United States, Altria will be ready to launch quickly, generating quality returns for shareholders.

A possible fusion on the horizon

After weeks of rumors, Altria and Philip Morris confirmed that the two companies had indeed discussed the possibility of a possible meeting. Altria shares jumped 8% in the pre-market session before dropping by around 4% by the end of the day.

Altria's shareholders are dissecting whether the merger would be favorable or not. From a balance sheet point of view, the merger with PM would significantly improve this area and in turn provide the company with access to low-cost capital to drive growth.

For comparison purposes, Altria currently maintains an effective interest rate of 4.3% with a credit rating of S & P of BBB, while PM has an effective interest rate of 2.0%. A credit note from A. Altria has used a lot of acquisitions, so it would be an immediate benefit to the new company.

Considering that the two companies are extremely similar, the synergies in a merger would occur quickly from the point of view of the operation. Both companies are both generating strong free cash flow that would make the combined company a giant of free cash flow.

The merger would also help the global expansion that JUUL is currently going through. In addition, the number of cigarettes exported abroad was below average compared to the United States.

However, the main benefit of a (re) Altria / PM merger is that 20% of PM's revenues are now in the form of reduced risk products, or PRS (thermal sticks, vapers and replacement oral sachets). nicotine). PM iQOS products have been a great success for the company and represent approximately 14% of its total sales.

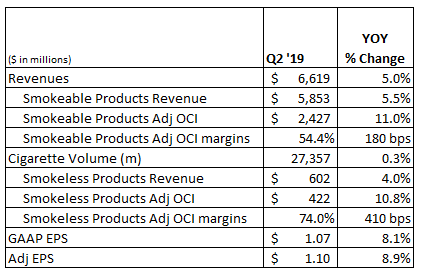

The global nicotine market outside the US is $ 465 billion and growing more than 3% per year. In the overall market, PPRs represent only 4% of this figure, which speaks volumes about the potential of the products.

(Source: PM Investor Relations)

Philip Morris expects to increase its smokeless product volumes by nearly 400% between 2018 and 2025, which he believes will enable RRP revenues to reach approximately 40% of the company's total sales.

Overall, the merger would create a very solid company that would certainly benefit Altria's shareholders. PM's management has slowed dividend growth as it attempts to limit the payout ratio within a reasonable range, which would be a change for MO shareholders.

PM's management is also not subject to share repurchases, as was the case for Altria, which will be another change for the shareholders of MO. As PM's management tends to favor investments in growth over dividend growth, and on the basis of the supposed (early) merger transaction, Altria's shareholders may see a dividends, which would not make us too happy. In the end, I think we're still far from any fusion, but it's fun to play "What if?"

Can the dividend continue to grow at a reasonable pace?

Regarding the dividend, it is one of the main reasons why Altria investors have invested in the company over the decades. At present, shareholders receive an annual dividend of $ 3.36, which corresponds to a return of 8.4%. Last month, Altria increased its dividend by 5%. Over the past five years, the board has increased the dividend by an average of 10.3% per annum. The most recent dividend increase marked the 54th increase in the last 50 years for the company, which was mentioned in its press release:

Over the past 50 years, Altria has demonstrated its unwavering commitment to rewarding its shareholders despite the many changes in the tobacco landscape. Today, we remain focused on our shareholders as we lead the industry during a period of change.

Source: Altria Investor Relations

During the first six months of the year, Altria's management purchased 3.7 million shares of the company at an average price of $ 52.93 at a cost of $ 195 million. Until now, management has lost about 23% on these shares. The second quarter repurchases completed the company's $ 2 billion share repurchase program. The Board has therefore authorized a new $ 1 billion share buyback program starting in the third quarter, which is expected to be completed by the end of 2020.

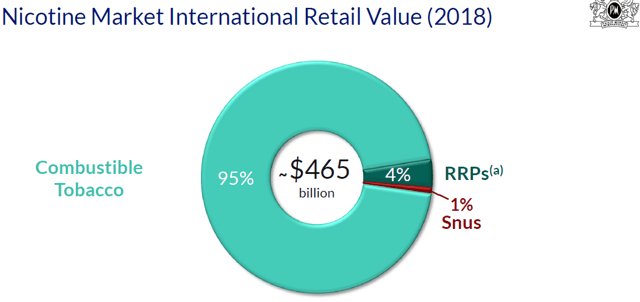

Altria aims for a payout ratio of 80% and an EPS growth rate of less than 5%, propelling future dividend growth. Here is an overview of the company's recent distribution ratio.

Despite all the negative news between the decline in cigarette volume and e-cigarette-related illnesses, Altria continues to generate healthy levels of FCF, which has kept the payout ratio within the expected management levels. Its latest dividend increase, with a quarterly increase per share of $ 0.04, represents the 54th dividend increase in 50 years, a milestone for the company:

Over the past 50 years, Altria has demonstrated its unwavering commitment to rewarding its shareholders despite the many changes in the tobacco landscape. Today, we remain focused on our shareholders as we lead the industry during a period of change.

Given the company's ability to generate strong free cash flow consistently, I think the dividend is still well covered and investors should not expect a slowdown in dividend growth. in the near future. Current yield of more than 8% is an excellent entry point for investors seeking to add a stable income to their portfolio over the long term.

Investor to take away

At the moment, Altria is facing an uncertainty that has created a buying opportunity for those looking to get into the name: the uncertainty surrounding a possible merger with Philip Morris, as well as the Investment company in JUUL. However, one thing remains constant, namely the company's ability to maintain growing cash flows leading to a growing dividend.

For some investors, the idea of investing in a tobacco company goes against their morality and beliefs, although it is still something that, in my opinion, must be disassociated when it comes to investing – but it is only me and every man for himself. If you manage to go beyond this fact, tobacco companies have long been the best performing industry and offer investment models that resist the recession.

The sale of the merger when the news of the talks was announced has created an opportunity for those looking to add shares of a blue-chip company with a strong dividend history. The stock is currently trading at a C / B level of 9.9, well below its five-year average of 19.3. Whether the Altria and Philip Morris merger takes place or not, both companies are well managed and, on the basis of their proven track record, I think both will generate shareholder growth for years to come.

As always, I recommend buying in installments because the uncertainties surrounding the merger and the headlines about JUUL (which, let's remember, is a small piece of the Altria pie) persist.

Note: I hope you all enjoyed the article and that you found it informative. As always, I look forward to reading and responding to your comments below and invite you to leave your comments. Happy investment!

Warning of the author: This article is intended to provide information to interested parties. I do not know your individual goals as an investor and I ask you to exercise due diligence before buying the actions mentioned or recommended.

With better information, you get better results …

AT High Yield OwnerWe spend thousands of hours and well over $ 50,000 a year looking for the most profitable investment opportunities for the REIT, the MLP and other real estate markets. We share the results with you at a much lower cost.

- We are the # 1 rated service on Seeking Alpha with a perfect score of 5/5.

- We are the Ranked # 1 a service for real estate investors with nearly 1000 members.

Take advantage of the free 2-week trial period and join our community of ~ 1000 "owners" before driving up the price!

Disclosure: I am / we are long MO. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link