[ad_1]

In the United States, the health of giant retailers is attracting considerable interest, a mass of store closures. This article has included the effect this could have on US stock markets.

At the Dow Jones, Nike is leading the retail sales, registering a rise of 17% this year while concerns are also growing for stores such as Walmart, which are likely to be assaulted by Amazon. The closing epidemic even affected Elon Musk and the Nasdaq-listed pioneer company Telsa, who were forced to close their stores.

US retailers are closing their stores at a record pace, including Tesla.

There are two sides to this coin. Do not assume immediately that the Tesla lock shops are identical to JC Penney's, which puts a red line between 18 properties. Traffic to shopping centers in the United States has been declining for some time and, as a result, the profits of the companies that depend on it have naturally decreased. Amazon's online revolution is probably an important cause. Dive a little deeper into Tesla's decision-making and you'll realize that his presence in the retail business will always be temporary.

TSLA stores little more than "awareness centers".

Following an awareness approach, many Tesla stores were concentrated in popular malls to spark interest in the brand. Due to regulatory restrictions, they have not even been able to sell in many places, as local authorities have adopted a protectionist approach to their car dealerships. In the end, at this stage of Tesla's development and media attention close to all-time highs, a purely online sales model makes perfect sense.

Dow Jones strengthened by Walmart's resilience

This half-full glass-of-Tesla reductions approach also applies to Walmart, listed on the Dow Jones. Investors are in the habit of saying that the market is always right. What the market tells us is that, yes, Amazon could come for the grocery store, but Walmart can still adapt and counter this assault. The title would not be up 5% this year if it was not perception. It is interesting to note that the media could talk about Amazon taking the grocery market at a low price, but only one store is final and five more are planned. Walmart has 11,695 stores worldwide!

Elon Musk makes marketing and strategy a beast

For companies like JC Penny or Macy's, stop looking in the short term and start looking at the board. What are they doing right now to adapt to the online revolution? Change must not kill a business; as an investor, you want profitability and sustainability. Success begins and ends with the board, but it's remarkable how many people invested in DJIA companies can not even tell you what is the first part of the long-term strategy. Advertising is what Elon Musk does in Tesla. He makes marketing and business approach a coherent entity. This transparency is both refreshing and sometimes nervous, as demonstrated by its contacts with the SEC.

The Dow Jones Index has been particularly vulnerable to Jeff Bezos' grand vision for Amazon. Naturally, Walmart, Home Depot and Nike found that their activities were impacted, but others could also be scrutinized. Bezos has often expressed interest in pharmaceuticals and healthcare. Walgreens is affected, but the biggest market capitalization of the DJIA is United Healthcare, which makes the Dow particularly vulnerable to any ambitious social protection or Amazon disruption project. Nobody can see the future, but we can understand the present. Amazon is not going to invade Walmart or offer health care with Warren Buffett anytime soon.

Dow Jones, FANG and Tesla may be overvalued, but where would you put your money?

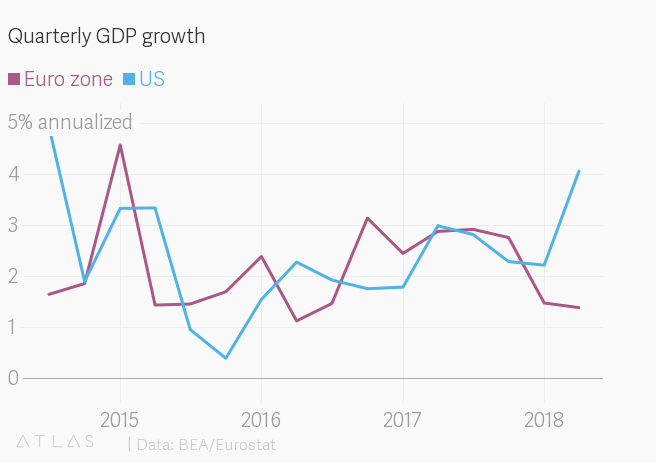

The expectation of better growth and innovation from the EU has turned out to be an unsuccessful business. For this reason, US equities have maintained their lead over the rest of the world. Sluggish global growth makes it difficult to cancel the Dow Jones base stock, or the excessive purchase of Nasdaq's Tesla or Amazon. They may be overvalued, but it's the natural result of being the only sport in town.

Data: BEA / Eurostat

[ad_2]

Source link