[ad_1]

Nvidia (NVDA) purchased Mellanox Technologies (MLNX) to increase opportunities in the growing space of data centers. The valuation paid on Mellanox's growth forecasts puts our investment thesis in sharp decline on Advanced micro systems (AMD).

Source of the image: AMD website

Big Premium

Nvidia agreed to pay $ 125 per share in cash to acquire Mellanox. The agreement deals with semiconductor at an enterprise value of $ 6.9 billion.

The deal is expected to generate gains for Nvidia on the basis of earnings per share and free cash flow, but the company is paying almost double the $ 65 minimum in October to buy Mellanox. In addition, Mellanox is expected to significantly reduce its growth rates after reaching more than 33% in the first quarter of 2018, while revenues are expected to increase by only 10% in 2020.

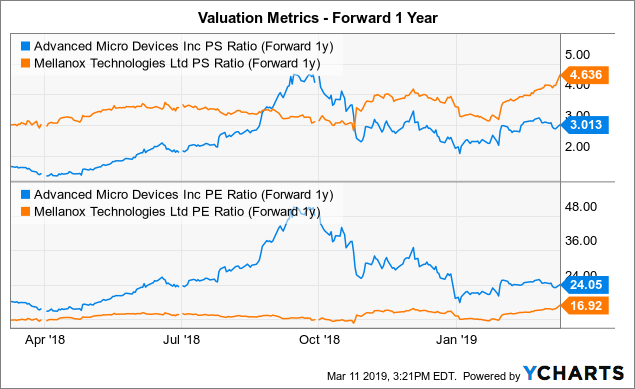

For this reason, AMD becomes a more interesting datacenter stock as the CPU chip maker expects growth of up to 20% next year. At this rate, AMD will grow faster than Mellanox, although equities are trading at a lower P / S multiple. Last year, AMD traded at a multiple of its forward price / earnings ratio and at a level similar to that of Mellanox, now more than 4.5 times its sales.

Data by YCharts

In addition, the valuation of transactions makes it possible to bridge the P / E gap. While AMD expects EPS to reach nearly $ 1 next year, the stock is already falling back to a price / earnings ratio. more reasonable profit of 24 times. The figure corrects the gap with this value paid for Mellanox, using in addition more reasonable goals, ranging from $ 1.25 to $ 1.50 per share.

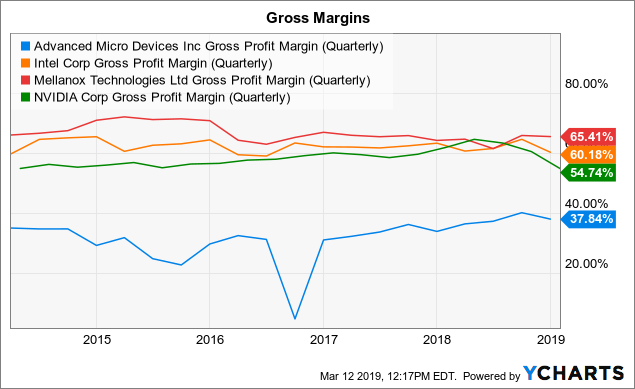

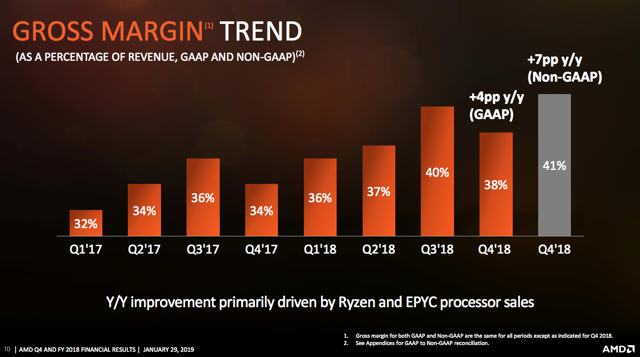

Note that Mellanox has gross margins of 69% and AMD is on track to increase significantly after recently reaching 40%. The chart below highlights the large difference between GAAP gross margins for these actions, including Intel (INTC). Non-GAAP gross margins in the group are much higher.

Data by YCharts

AMD remains the only company that can not achieve margins of 50%, and even less than 60% with this group. The company has made significant progress over the past year, reaching 39% gross margins for the year, up from 34% last year. The last two quarters have finally reached 40% and we expect new gross margin gains in 2019, with a forecast of at least 41% for the year.

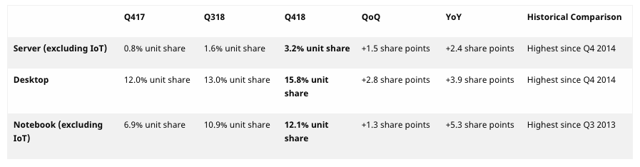

Source: presentation of AMD Q4 – 18

Data center Potential

Nvidia buys Mellanox Tech to expand its current collaboration in building fast supercomputers. Jensen Huang, CEO of Nvidia:

The emergence of artificial intelligence and data science, as well as billions of simultaneous users, is fueling a growing demand for data centers around the world. To meet this demand will require global architectures that connect a large number of fast computing nodes on intelligent network arrays to form a giant compute engine at the data center scale.

Depending on whether you use AMD's internal market or Mercury Research's internal market estimates, AMD holds 3.2% or 5% of the server chip market share. The actual percentage is simply not very significant, as investors are already experiencing revenue and growth rates, with either estimate taking into account substantial market share gains.

According to Mercury Research, the company has more than quadrupled its share of the server market over the last year, from 0.8% to 3.2%. The plan with the 7nm Epyc 2 chip wants AMD to end the year with a 10% market share and my predictions are that the company will end up capturing a similar 20% market share at the same time. record reached in 2006. The Mercury Research figures will be lower due to the use of a different calculation for server unit estimates.

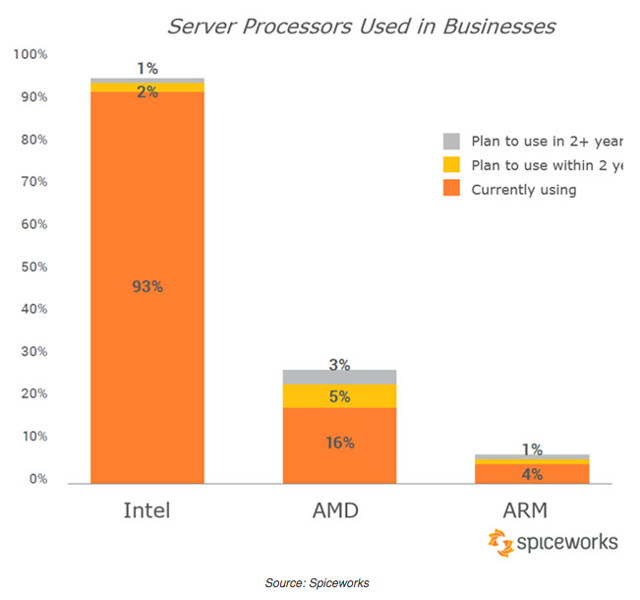

Anyway, AMD is clearly in a position to conquer more market share in the sector data center server space. According to a study by Spiceworks, AMD is well positioned to work with 8% of companies considering starting to use their chips over the next two years. Although this report does not address the market share of these companies, the company is expected to grow from just 16% penetration to 24%, the equivalent of a 50% growth in the number of companies. companies planning to use AMD for server processors.

To take away

The main benefit for investors is that AMD remains best positioned to capture market share in the data center. In addition to substantially higher gross margins of approximately 46% and revenues of $ 10 billion, the company achieves EPS of $ 1.50 per share. Even higher gross margins allow AMD to play even cheaper data center growth.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: Disclaimer: The information in this document is for informational purposes only. Nothing in this article should be considered as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes the risks, including the loss of capital.

[ad_2]

Source link