[ad_1]

The thinking of investors and analysts Advanced micro-systems (AMD) is a sale of over $ 80 due to valuation issues that do not fully understand the huge opportunity available to the chipmaker. The opinion is that AMD took part in Intel (INTC), but the action just isn’t worth $ 100 billion for a company that is only aiming north of $ 10 billion in annual sales next year. My bullish investment thesis has always held that the stock went higher on signs the company was gaining significant market share from the chip giant, not a meager sales target of $ 10 billion for 2021.

Image source: AMD website

Image source: AMD website

Actual market share targets

An investor making a bullish case on AMD saw the company’s double-digit server chip market share targets as a first step. Bears at best viewed these goals as maximum market share.

Now, after Intel delayed the 7nm chips to 2023/2024, several analysts have set overall AMD market share targets of between 30% and 50%. AMD had already achieved CPU market share approaching 20%, but the company failed to generate the substantial market share expected from data centers despite strong revenue gains.

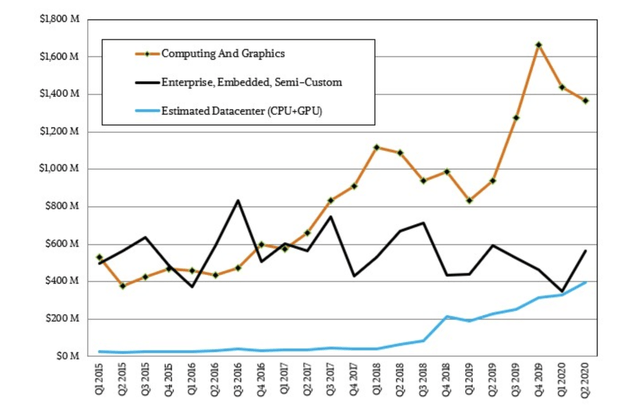

EESC sales reached $ 565 million in the second quarter, with server revenues reaching nearly $ 400 million and other revenues, including semi-custom products for new consoles, nearly $ 200 million. A big part of the upcoming revenue increase is that the CESE category has hit record highs recently, with data center and console revenue reaching a full cycle after years of trending downward.

Source: NextPlatform

The real question with AMD pumping 7+nm chips and Intel working on 10+nm is why the smaller company can’t gain much more market share. Jefferies has AMD reaching $ 4.75 per share on 30% market share and $ 6.50 per share on 50% market share, while Hans Mosesmann of Rosenblatt helped the company reach 40% share market on a TAM of 80 billion dollars.

The key here is not the exact prediction, but the massive size of the market and the potential of BPA. Many investors scoffed at my previous goal of $ 3 + EPS, and now a mainstream company in Wall St. has listed a potential EPS target of $ 6.50. Suddenly an $ 80 + course doesn’t seem overly expensive.

Analyst Hans Mosesmann predicts that AMD will surpass the 25% share of x86 servers / desktops / laptops in 2021, eventually reaching 40% in a few years:

With Intel in a multi-year transition of organization and business model (trying to recover from its 7nm delays), we see no technical or structural hurdles for AMD to capture more than 40% of the x86 processor in years. to come up.

Updated financial targets

My previous analysis had already described what their finances will look like with a combined 25% market share on their 2023 TAM. This new analysis looks at 40% market share gains with a total TAM of $ 80 billion:

- Revenue = $ 32.0 billion

- Gross margins at 55% = $ 19.25 billion

- OpEx @ 26% = $ 8.32 billion

- Operating profit = $ 10.93 billion

- Taxes at 15% = $ 1.64 billion

- EPS = $ 9.29 billion / 1.2 billion shares = $ 7.74

Yes, those financial goals seem exaggerated, but AMD has a lot of market share to grab hold of. The key here is whether the semiconductor company actually has a maintainable chip lead over Intel, and whether gross margins can reach 55% over time.

For 2019, Intel spent around 27% on operating costs. The possibility here is that a much more efficient AMD will spend much less on the R&D and SG&A categories in order to generate lower operating costs as a percentage of revenue. The chip company could clearly decide to spend a lot more to gain market share and spent more than 30% in the last quarter, so 26% could find itself aggressive in a competitive industry.

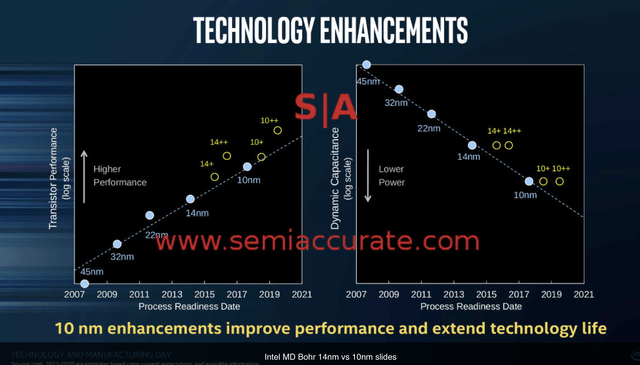

Intel is certainly not going to continue to give market share to AMD, but the recent delay of the 7nm chip leaves them with limited choice. Tiger Lake’s recent launch on 10nm SuperFin transistor technology has received positive reviews. Semi-precise looks positive on the new Tiger Lake chips, but even Intel points out that the 10 ++ technology is only a slight improvement over the pre-2017 14 ++ technology.

Source: SemiAccurate

Source: SemiAccurate

While the PC World Tiger Lake review is bullish on chip performance in single-core performance, AMD’s Ryzen 4000 is still the leader in multi-core performance. Where Tiger Lake has an advantage is potentially in small 13-inch laptops that don’t need multi-cores.

What the review doesn’t really discuss is price versus performance, and that’s where AMD typically leads even when Intel might have a slightly better chip. Ars Technica says Intel was very careful about the volumes and timing of the chips, suggesting that even a better chip won’t fully hit the market in a while.

In general, all of the reviews seem to be debating the new leader in CPU chips while questioning whether Tiger Lake’s actual performance matches manufacturing design claims. Investors should remember that this is not the type of scenario where Intel should claim an 80% market share in laptops and leave AMD satisfied with just 20%. A roughly equal debate on the chip leader on performance with a limited discussion on price performance allows AMD to continue to gain more and more market share, thus achieving the goal of 25% and possibly 40% market share.

To take away

The main takeaway for investors is that it’s far too early to offload AMD despite the stock’s massive gains. Some investors find the stock expensive, but the company still has significant market share to gain as well as substantial improvement in financial targets. Whether AMD actually achieves 30% market share or 50% market share or even more is still debatable, but what is not debatable is that the market share will continue to grow and boost. BPA.

My previous target of $ 3 + EPS seems cautious, and investors should own the AMD-based stock eventually hitting Jefferies’ EPS target of at least $ 4.75.

If you’re interested in learning more about how best to position yourself for a rally in battered stocks due to COVID-19, consider joining Out Fox The Street.

The service offers a portfolio of models, daily updates, trade alerts, and real-time chat. Register now to access old rates available for the first 25 subscribers.

Disclosure: I / we have no positions in the mentioned stocks, and I do not intend to initiate any positions within the next 72 hours. I wrote this article myself and it expresses my own opinions. I am not receiving any compensation for this (other than from Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional Disclosure: The information contained in this document is for informational purposes only. Nothing in this article should be construed as a solicitation to buy or sell securities. Before buying or selling stocks, you should do your own research and come to your own conclusions or consult a financial advisor. Investing understands risk, including loss of capital.

[ad_2]

Source link