[ad_1]

Tom Williams | Call CQ | Getty Images

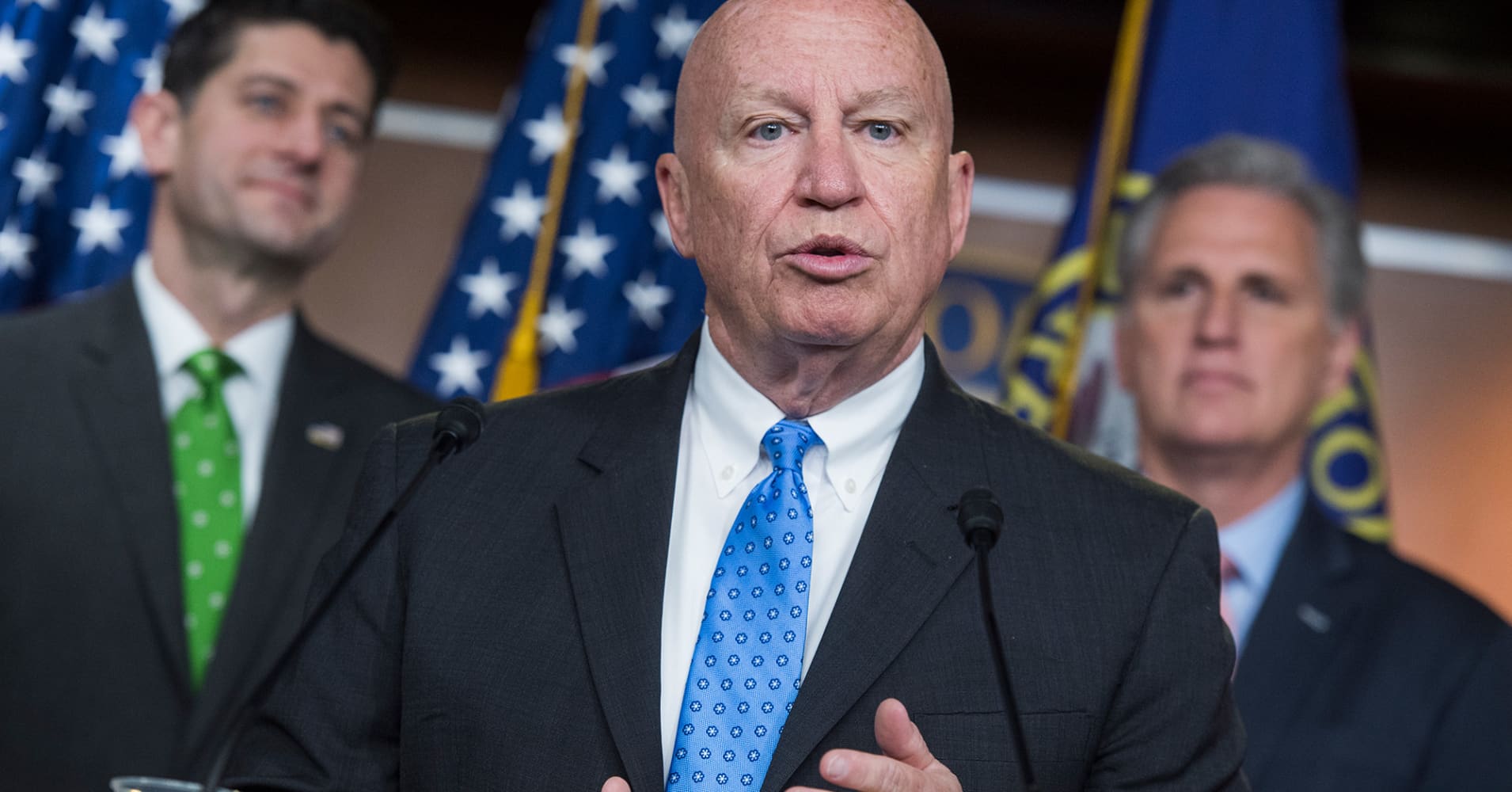

Ways and Means President Kevin Brady, R-Texas, holds a press conference on issues such as the GOP tax reform bill in the home studio after a meeting of the conference GOP 17 April 2018.

A Republican who will soon be stepping down as chairman of the US House of Commons Tax Committee released Monday a massive 300-page tax bill that would affect retirement savings, the many tax breaks and the recasting of the Internal Revenue Service. .

Representative Kevin Brady, Chair of the House Ways and Means Committee until early January, guided through the House and on the office of President Donald Trump in 2017 a major tax bill that reduced the rate of 39, corporate taxation in the United States.

In his statement, Brady said in a statement: "The policy proposals contained in this package have the support of Republicans and Democrats in both Houses, and I hope I can move quickly in the House to send these measures to the Senate. . "

US voters ended the Republican control of the House in the November 6 elections and handed over power to the Democrats. Brady should be replaced in January by Democratic representative Richard Neal as chair of the committee.

In the meantime, Congress is organizing a "lame duck" session during which Republicans such as Brady will still be in charge of the House's agenda. No summary of Brady's bill was immediately available, said a legislator spokesman.

The outlook for the bill was unclear, with Congress likely being busy at the "lame duck" session with a measure of imperative spending and Trump's renewed demand for money to build a wall project along the US-Mexico border.

The 297-page text of the bill covers tax breaks for fuel cell cars, energy-efficient homes, racehorses, mine safety equipment, motor racing tracks and many other items, as well as for retirement savings plans such as 401 (k) and individuals. retirement accounts (IRA).

The bill "also includes urgent technical corrections" to the 2017 bill that Trump enacted in the law, said Brady in his statement.

[ad_2]

Source link