[ad_1]

While traders have begun to realize that news about the financial situation of Tether Limited (USDT issuer) and Bitfinex are not that bad, Bitcoin (BTC) has recently stabilized. In fact, analysts have said that the lack of response from the cryptography market to seemingly bearish information is a fundamental fundamental strength and could even be a precursor to the rise.

Related reading: Bitcoin price reacts to Tether fiasco May indicate a strong fundamental force

However, a number of chartists recently visited Twitter to note that contrary to popular belief, bitcoin is not yet ready for a rally.

Bitcoin could see one. More. Drop.

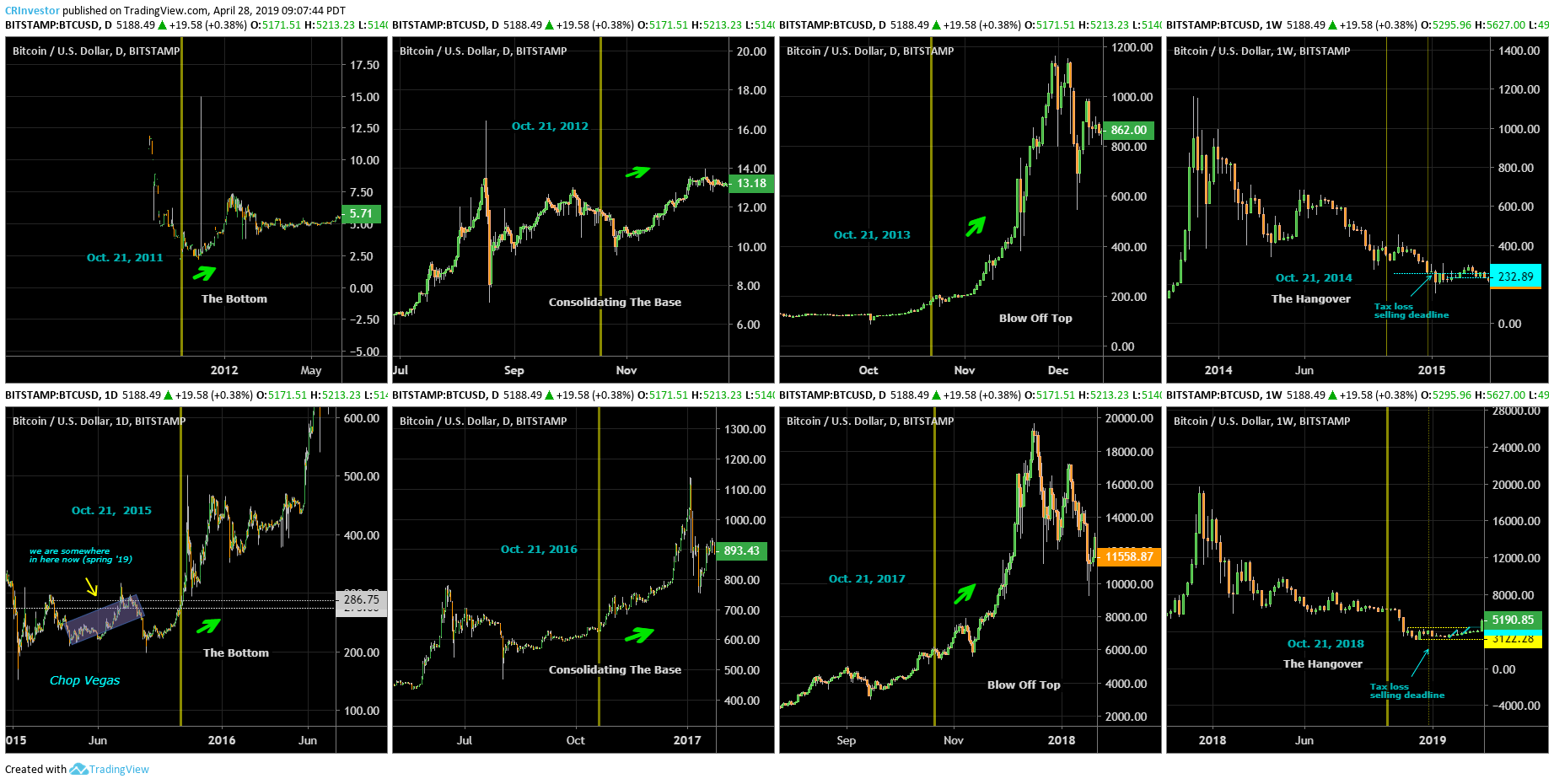

Since BTC became a liquid exchangeable asset, it has tracked short- and long-term trends, most of which can be mapped and extrapolated for price forecasting purposes. A popular technical analyst, Brian "The Rational Investor" Beamish, supports that if Bitcoin again follows its four-year cycle, a lower move might soon be entering.

As shown below (courtesy of Beamish), Bitcoin's price action in 2017 was clearly a "peak" and 2018 a "hangover", two macroeconomic trends observed in the previous bubble. If Bitcoin continues to follow its trend, in 2019, the BTC will recover considerably, but not without another influx of capitulations. Beamish suggests that levels close to those of December 2018 will materialize in the months to come, possibly as early as June.

And he is not alone in boasting this conviction. Magic Poop Cannon, a badly-named analyst who predicted a $ 3,200 Bitcoin drop, pointed out that BTC's current structure in graphics is almost identical to that observed before the "second fund" in 2015. (For those who not aware of the history of the crypto market: in 2015, BTC fell below $ 200 once, then hit $ 200 several months later.)

Magic explains that the current Bitcoin price action, the 50-week exponential moving average, the 50- and 200-day moving averages, the Fibonacci retracement levels and the relative strength index readings (RSI ) seem strangely similar to those observed at mid-term. July 2015. And so he writes that if BTC follows its historical trend, the gold cross will form (check), a trading range of $ 5,000 to $ 5,300 will be maintained until May 7 ( check) and will collapse to $ 4,025 by the end of May. . He explained further:

"On the basis of this comparison, from a technical point of view, I have absolutely no reason to believe that we will not return at least to 0.618 [Fibonacci retracement]which is just above $ 4000. People who think we are just going to skyrocket above this major resistance around $ 6,000 are delusional. It took us months of testing to fall below this level. It will take months of testing for us to succeed above. "

Featured image of Shutterstock

[ad_2]

Source link