[ad_1]

An analyst of a company that invests heavily in Tesla said Friday that recent drastic cuts in target prices on the stock by other investors on Wall Street were missing the reality.

Ark Invest, whose founder on CNBC predicted last year that Tesla could reach $ 4,000 per share, sticks to this call, even though the stock has lost about 40% of its value in 2019. .

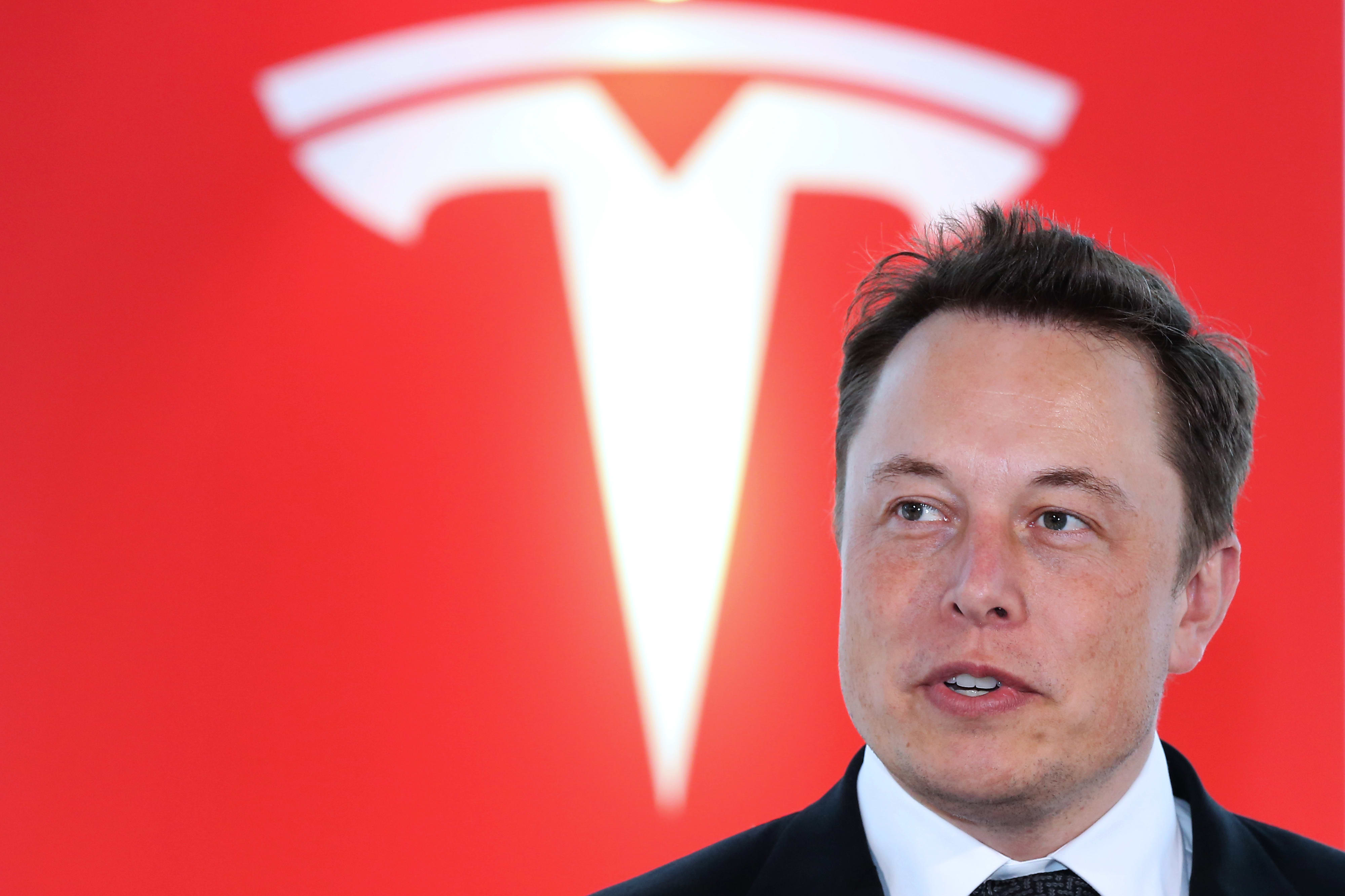

Tasha Keeney, an analyst at Ark, said in an interview with CNBC's "Squawk Box" that Wall Street "misunderstood Tesla's story" and the potential benefits of Elon Musk's vision. Musk's achievements are widely acknowledged, but he himself and Tesla have been in conflict with the government as a result of his comments, following an August tweet about the possibility of taking the company to private title with "secure financing".

Keeney said Ark believed so much in Tesla that his five-year scenario would be $ 560 per share, nearly triple the market value of $ 195.

This week Morgan Stanley charged Tesla the worst case of $ 10 per share. A day later, Citigroup said the stock could fall to $ 36 a share.

Tesla has always been a battleground stock as one of the most beloved and hated. Tesla is also one of the most shorted stocks. Shorting a stock is a bet that it will go down.

The electric vehicle builder started the month by announcing that it would collect more than $ 2 billion in shares and convertible debt. The company's expenses and the need to raise funds on several occasions have been a concern among critics.

Keeney, however, said that Ark was not bothered by additional fundraising. "If we talk about money and concerns, in our valuation model that we expect, Tesla will collect an additional $ 10 billion to $ 20 billion over the next five years, and we do not mind."

"We want them to put as many cars as possible on the road" with the next step of running a "completely autonomous taxi network". Last month, Musk promised next year a million vehicles on the road capable of functioning as "robo – taxis", an assertion generally considered optimistic at best.

In a call for investors earlier this month, two of the guests told CNBC that Musk had predicted that self-driving would turn Tesla into a $ 500 billion stock market company. At Thursday's close, Tesla's market capitalization was just over $ 34 billion.

Keeney admits that Musk sets "extremely aggressive goals" and often fails. "But by doing this, pushing somehow toward that goal, they have been able to achieve the impossible until now."

She also countered the argument that demand for Tesla vehicles is down. "Sixty-nine per cent of the Model 3 trade for the standard range was non-premium, so they are driven by demand from other segments, selling 60% more than their next competitor." . "

"People clearly like these cars for a reason, Tesla has a software advantage that no one else can beat," she added.

CNBC before the news bell

Receive this in your inbox and more information about our products and services.

By subscribing to newsletters, you agree to our Terms of Use and Privacy Policy.

[ad_2]

Source link