[ad_1]

The Ant Group Co. headquarters campus in Hangzhou, China, Jan.20.

Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

Ant Group Co.’s valuation could be further reduced under new measures proposed by China to curb market concentration in its online payments market, according to new estimates from Bloomberg Intelligence.

According to senior analyst Francis Chan, Jack Ma’s fintech giant could be worth less than 700 billion yuan ($ 108 billion) according to the draft proposals, which could halve the value of Ant’s Alipay service. Earlier this month, Chan lowered his ant value to less than 1 trillion yuan, from around 1.44 trillion yuan.

“Ant Group’s valuation could plunge further if its payment unit is forced to break due to a potential antitrust Chinese central bank probes, ”Chan wrote in a research note.

The revised estimate for Ant is far from valuations that reached $ 320 billion before the company was forced to abandon its record IPO in November. China’s crackdown forced Ma’s company to withdraw its $ 35 billion IPO just days before its scheduled listing in Hong Kong and Shanghai.

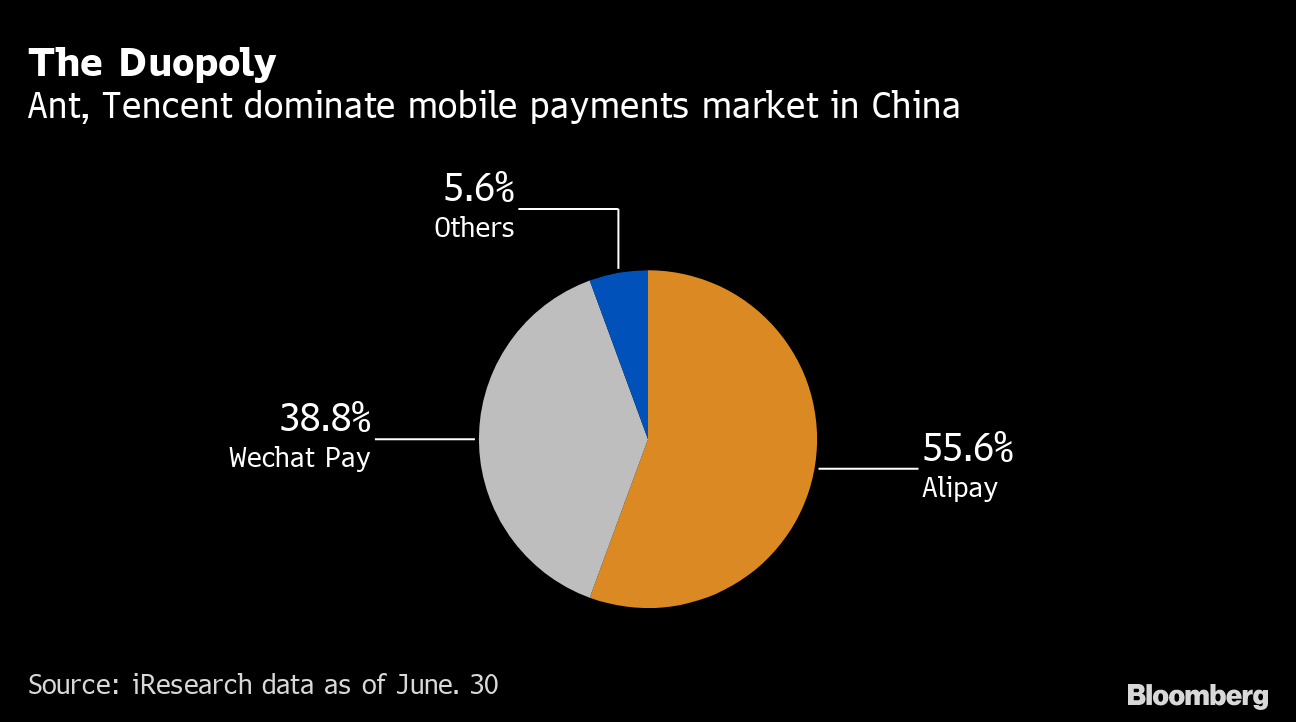

China’s central bank said on Wednesday that any non-bank payments company with half the market share in online transactions, or two entities with a combined two-thirds share, could be subject to antitrust investigations.

If a monopoly is confirmed, the central bank may suggest that the cabinet impose restrictive measures, including dividing the entity according to its type of business. Companies that already hold payment licenses would have a one-year grace period to comply with the new rules, the central bank said.

Alipay, with around 1 billion users, controls 55% of the mobile payments market. A break could halve its 600 billion yuan valuation, Chan said, adding that it was doubtful Ant could relaunch its IPO this year.

The duopoly

Ant and Tencent dominate China’s mobile payments market

Source: iResearch data in June. 30

Alibaba Group Holding Ltd., which owns a stake in Ant, fell for a second day in Hong Kong, losing 2.9% at 9:57 a.m. Shares jumped 8.5% on Wednesday after Ma appeared in public for the first time since China began to squeeze. on its businesses, ending several months of speculation on its whereabouts.

Read more: Why China Changed the Rules on Jack Ma’s Ant Group: QuickTake

– With the help of David Scanlan, Lulu Yilun Chen and Jun Luo

[ad_2]

Source link