[ad_1]

Among the television shows, magazines and gaming services unveiled at Apple's "Show time" event, was a surprise entry into a category that could not be further from the wheelhouse of Apple: a map credit. Nicknamed Apple Card, it's not a traditional plastic credit card that gives you points on what you buy. It's a whole new way to shop online and offline. Here's all you need to know about this:

What is the Apple Card?

The Apple Card is an Apple MasterCard credit card. Unlike the current Barclaycard Visa with Apple Rewards, which is a partner card, the Apple Card is owned and operated by Apple.

When will it be available?

Apple says the Apple card will be available this summer.

How can I apply for the Apple Card?

With your iPhone, of course. Applications go through Apple Pay in the Wallet app, which means you'll probably need to periodically ask if you do not already have one. Just remember that this is a credit card. The application will probably always ask you for your work history, social security number, etc.

So I have to have an iPhone?

That's true. The card information is stored in the Wallet app and you need an iPhone to get them.

Will my old iPhone work?

Probably. All iPhone that supports Apple Pay and the Wallet app will work. So, unless you have an iPhone 5s, you're good.

Apple

AppleThe Apple card can be used anywhere, but the best advantage is the purchase made with Apple Pay.

What about the iPad?

You can not download the Wallet app on the iPad, so there is no way to apply, it does not have NFC and you can not use it in stores. However, you can use it for the Apple Store App and Apple Pay Online if you register on your iPhone.

Can I get a physical card or is it only virtual?

Apple also offers a laser engraved titanium card for times when Apple Pay is not available. In real Apple mode, the card is minimal and beautiful, no numbers, expiration date or CVV code to ruin everything.

And if I need my card number or its expiration date?

You can find this information in the Wallet app.

What if I lose my Apple card?

Apple will provide a button in the Wallet app so you can freeze your card and order a new one.

Which bank issues the card?

Apple is associated with Goldman Sachs. Note that this is the first consumer credit card of the bank.

How long will I be approved?

According to Apple, approval takes only a few minutes. The whole process therefore probably takes as long as when he asks for a store card.

Apple

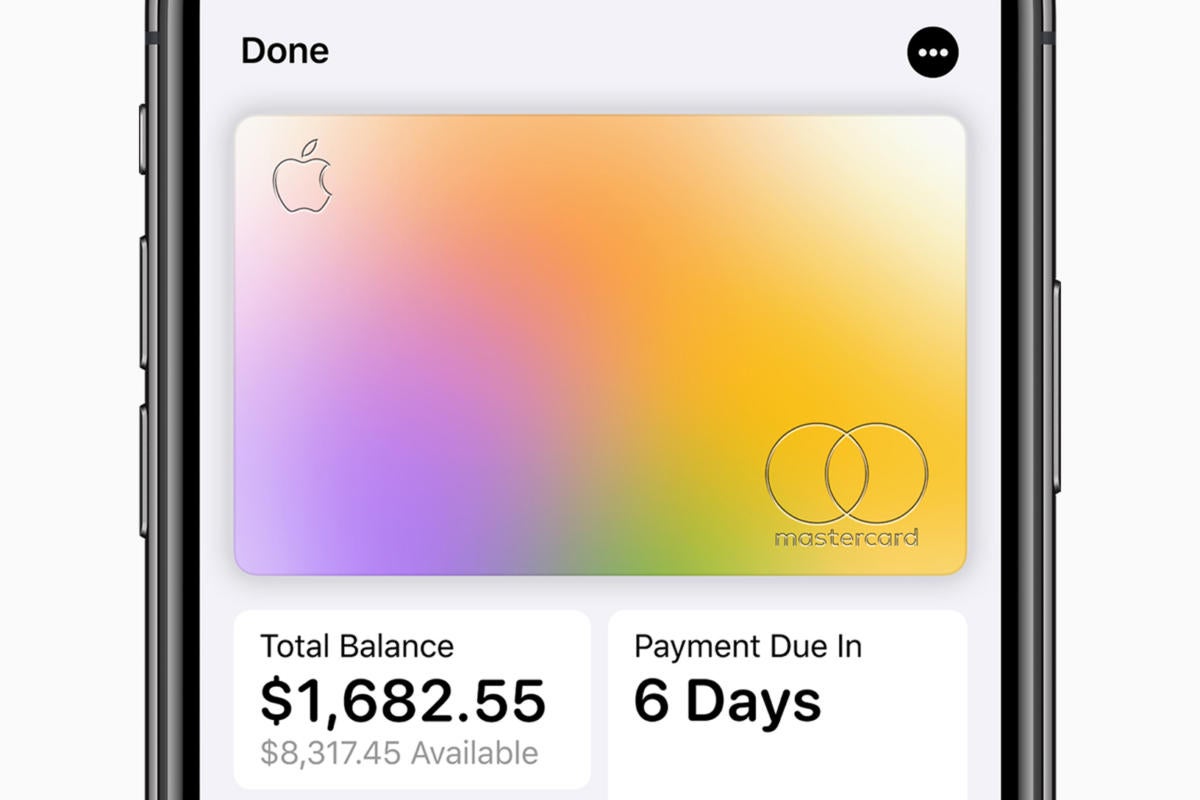

AppleYour balance and your due date are in the foreground when you launch the Apple Card tab in the Wallet application.

When can I start using my Apple card?

With all your card information stored on your phone, you'll be able to start using your new card as soon as you're approved.

How can I buy?

Just as you would with any other card. When you buy at a store that accepts Apple Pay, you can hold your phone near the contactless reader or double-click the Home or Power button (depending on your iPhone model) to quickly view the payment screen and authenticate you. using Touch ID or Face ID.

Can I use the Apple card with my Apple Watch?

Of course. Since this is a classic credit card, it will work the same way as any other card.

Can I schedule payments for tasks such as recurring bills and utilities?

Since you have a standard number, an expiry date, and a CVV in the Wallet application, you only need to enter this information in the payment page for the invoice you want to add.

Are there any sign up bonuses?

Apple did not mention registration bonuses when it announced the Apple card, but that does not mean there will be no sporadic offers to attract new users.

Is there a rewards program?

Yep! Apple's rewards program is called Daily Cash. Rather than a complicated points system, it simply pays you a cash back for every purchase you make.

Apple

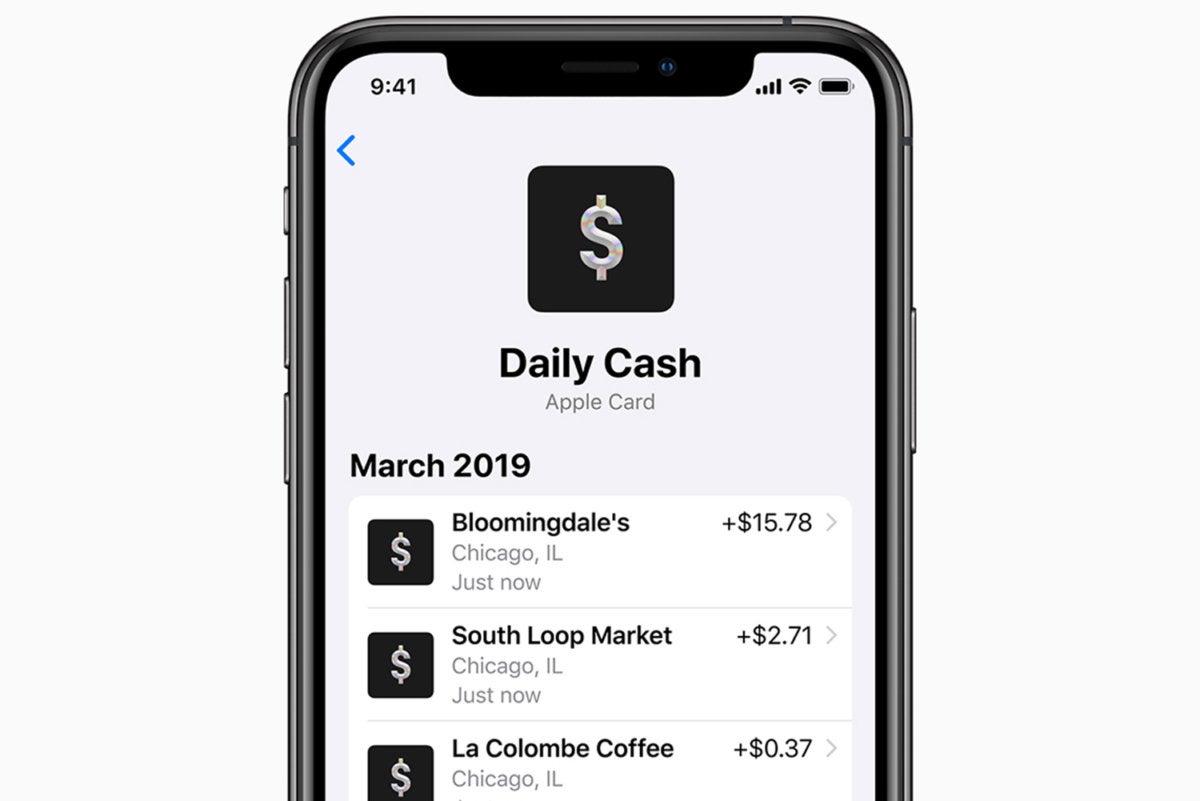

AppleThe rewards of the Apple card are counted daily and distributed via a payment card.

What is the daily cash reward rate?

The Apple Card will reimburse you 3% on Apple Store purchases and iTunes downloads, and 2% on all other purchases made with Apple Pay. However, when you use the physical Apple card, you only recover one percent.

Is there a limit to the amount of daily cash I can get?

No, Apple does not set a ceiling on the amount of your daily earnings, but the amount you earn is based on your expenses. There is a limit.

Can I spend my daily money immediately?

That's why it's called Daily Cash. Instead of waiting a month or a year to get a rewards check, all you have won will automatically be deposited into your wallet in the form of an Apple Pay Cash Card. From there, you can transfer it to your bank account, send money to a friend or simply use it to buy something in any store that accepts Apple Pay.

What if I have to return something for which I have already received a reward?

This is not yet entirely clear, but it can be assumed that Apple will charge your card the amount to be reversed or deduct it from your daily cash balance.

Where can I see a record of my transactions?

All you will need to see will be in the Wallet app, including the payment due date, transaction and payment history, as well as the expense analytics. Apple will also code the expense categories in color so it's "easy to spot trends in your spending. … you see a lot of orange? These are things like lunch and coffee. Green? These must be these tickets for Miami.

Is there an annual fee?

Nope.

Are there late fees?

Also Nope.

What about transaction fees abroad?

Once again, Nope. Apple claims that the Apple card has no fees, even if you exceed your spending limit inadvertently.

Apple

AppleApple's Smart Spend Analyzer will tell you what interest rate you will pay based on your payment.

What are the interest rates?

Apple boasts that their interest rates are among the lowest in the industry, but they are not really friendly. On the Apple card website, Apple says variable APRs range from 13.24% to 24.24% as of March 2019, which could change before the card is launched.

What about cash advances?

We do not know what Apple's terms will be for cash advances, but they generally carry extremely high interest rates.

How can I see my interest rate and my penalties?

Before submitting your payment, Apple will present you with a smart payment suggestion wheel that lets you know how much interest you will earn based on the amount you pay.

Will the Barclaycard Visa with Apple Rewards disappear?

It is unclear whether Apple will continue to offer or support Barclaycard Visa for Apple Store purchases after the launch of the Apple Card.

Will Apple see all my transactions?

According to Apple, the history of your transactions and expense summaries are all generated on your iPhone. Apple will not be able to consult any of the data on your card.

What about Goldman Sachs?

In the case of those who lend you money and secure each transaction, Goldman Sachs will keep a record of every purchase and payment made with your Apple Card.

Will Goldman Sachs sell my data?

Apple claims that Goldman Sachs has agreed to "never share or sell your data to third parties for marketing or advertising purposes."

Apple

AppleApple makes it easy to view your transactions and expenses in the Wallet app.

And if I need to contact the support?

Apple has integrated Apple Card support directly into Messages via Business Chat. Instead of calling an automated service, you simply send an SMS and a person answers 24 hours a day, seven days a week.

When will my bill be due?

Instead of a flexible due date, Apple makes all card payments on the last day of the month, regardless of the time of your request.

How can I make a payment?

You will make payments in the Wallet app with the help of a Pay button.

Can I make more than one payment per month?

Yes, in addition to standard monthly payments, Apple will also let you set up "weekly or biweekly payments to match when you get paid."

[ad_2]

Source link