[ad_1]

Apple (AAPL) is trying to convince more customers to upgrade, as new models have generated less enthusiasm from users. Bloomberg said the company had "asked retail employees to promote the new iPhones using novel methods."

We have already seen significant discounts on the iPhone during the holiday quarter, where customers could exchange their old phones for newer models.

Apple will also delay the 5G smartphone to the 2020 cycle. This can further lengthen the upgrade cycle, as customers delay their purchases during the iPhone 2019 cycle. Finally, Apple would be forced to promote sales through larger discounts, which could hurt margins and EPS. Investors are expected to face difficulties in the coming quarters, while Apple's attack on the problem of upgrading. It can also be a better entry point for investors looking for a long-term investment.

How long will the upgrade cycle take

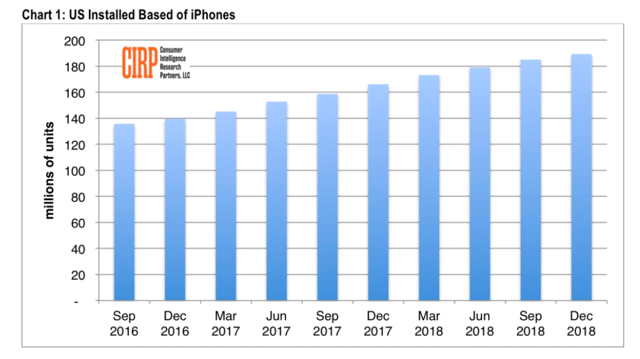

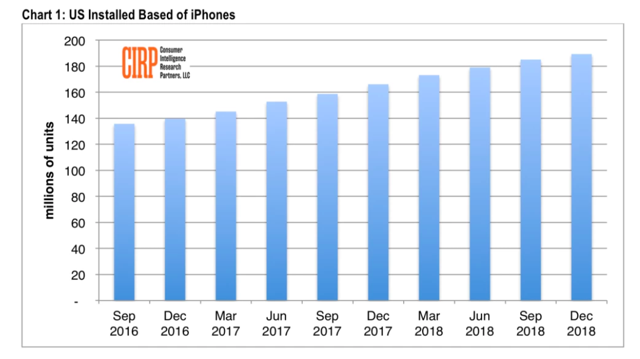

It is well known that customers have been keeping their Apple devices for longer. Although the company recorded growth in the total installed base, unit shipments of new aircraft are down. Toni Sacogachi, of Bernstein, said in his recent report that the total installed base had increased by 9%, while unit deliveries during FY19 could fall by 19%. This statement is corroborated by a recent IBPAR report, which also shows a growth in the installed base in the United States.

Source: CIRP, 9to5mac

The question is how long will the upgrade cycle last? Many customers have been put off by the rapid price increases over the last two cycles. Apple also faces a problem that causes customers to delay upgrading because their old phones are performing well. We know that Apple will not come out with an iPhone 5G in the next cycle. On the other hand, most other smartphone manufacturers plan to aggressively launch and commercialize their 5G flagship devices in the second half of 2019. A non-5G iPhone will face additional obstacles by requiring customers to put upgrade their old devices.

Other discounts on the upgrade

Apple is offering the new iPhone XR for $ 549 with an exchange of the iPhone 6S and $ 499 with an exchange of the iPhone 7. We should see a more aggressive reduction over the next quarters, by the time the company will try to attract more upgrades. However, the absence of a shock factor that forces customers to consider upgrading is at the heart of the problem. We could see more upgrades as the iPhone 5G is launched in the 2020 cycle with a host of new services built around this technology. But in the short term, Apple should face the dilemma of the upgrade that will affect unit deliveries and revenue in the coming quarters.

Impact on margins

Offering a bigger discount in exchange is a quick fix, but it also hurts the overall margin of the business. Apple recorded a decline in its operating margin over 12 quarters out of 13. In the last quarter, the operating margin rose from 29.76% to 27.69% in the same quarter of the year. The previous year, a decrease of 207 basis points.

During the recent dismantling, IHS Markit estimated that the hardware bill for the iPhone XS Max was 390 USD. This equates to 35.48% of the full retail price. However, with an exchange of iPhone 6s, a new iPhone XS Max can be purchased for $ 899. At this price, the nomenclature corresponds to 43% of the retail price. This obviously has an impact on the overall margin of the company. In the recent earnings call, Apple said gross margin was 34.3 percent, while services margin was 62.8 percent. The total gross margin was 38%. Product margins are very important for the company. As a result, more aggressive takeover options will leave the company with less room for maneuver and a lower FCF.

Popularity of older models

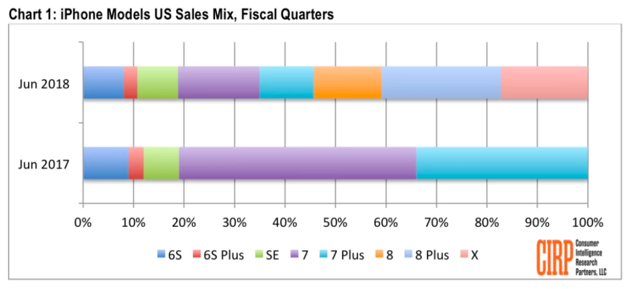

In addition to the headwinds of upgrades, Apple will also need to move more customers to flagship iPhones.

Fig: Older models like 6S and 7 accounted for a good percentage (over 40%) of total shipments. Source: CIRP, 9to5mac

During the last cycle, we can see that older phones generated nearly 40% of total unit shipments. This could be the case this year as well, especially as the price gap with flagship devices has widened. An older iPhone 7 has a much smaller margin than flagship iPhones. Two years ago, IHS Markit estimated the nomenclature of the iPhone 7 at 224.80 dollars. It is currently sold for $ 449. Even if we do not add to inflationary pressures, the nomenclature of the iPhone 7 is currently 50% of the retail price. This is much higher than 35.48% for iPhone XS Max.

As a result, investors should look at the future direction of margins as the company expands the buyout option and attempts to promote flagship models over older iPhone models.

Investor to take away

Apple is facing a challenge due to the lengthening of the upgrade cycle. This reduces unit shipments for new devices and also forces the company to aggressively promote the takeover option. It is unlikely that we are witnessing a change in the iPhone cycle in 2019 because the company is delaying the launch of 5G devices. This will have a negative impact on margins and overall profits. We should see a further decline in the estimate of EPS in the coming quarters as margins tighten.

A bearish reversal of the stock should be expected in the short term. Investors looking for a good point of entry should analyze these headwinds and expect a better price.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link