[ad_1]

Apple announced this week a new digital credit card service aimed at iPhone users, in which its CEO, Tim Cook, described as "the most significant change to the credit card in 50 years" .

Although this exaggerates a bit, the move is interesting to Apple and highlights its plan to attract users to different services to prevent them from leaving the base of iPhone users.

For now, it's only available to US customers and Apple hopes to attract more iPhone users to Apple Pay and make purchases within its iOS ecosystem, such as its App Store , micropayments in games and payments on par with Apple Cash. a feature only available in the United States.

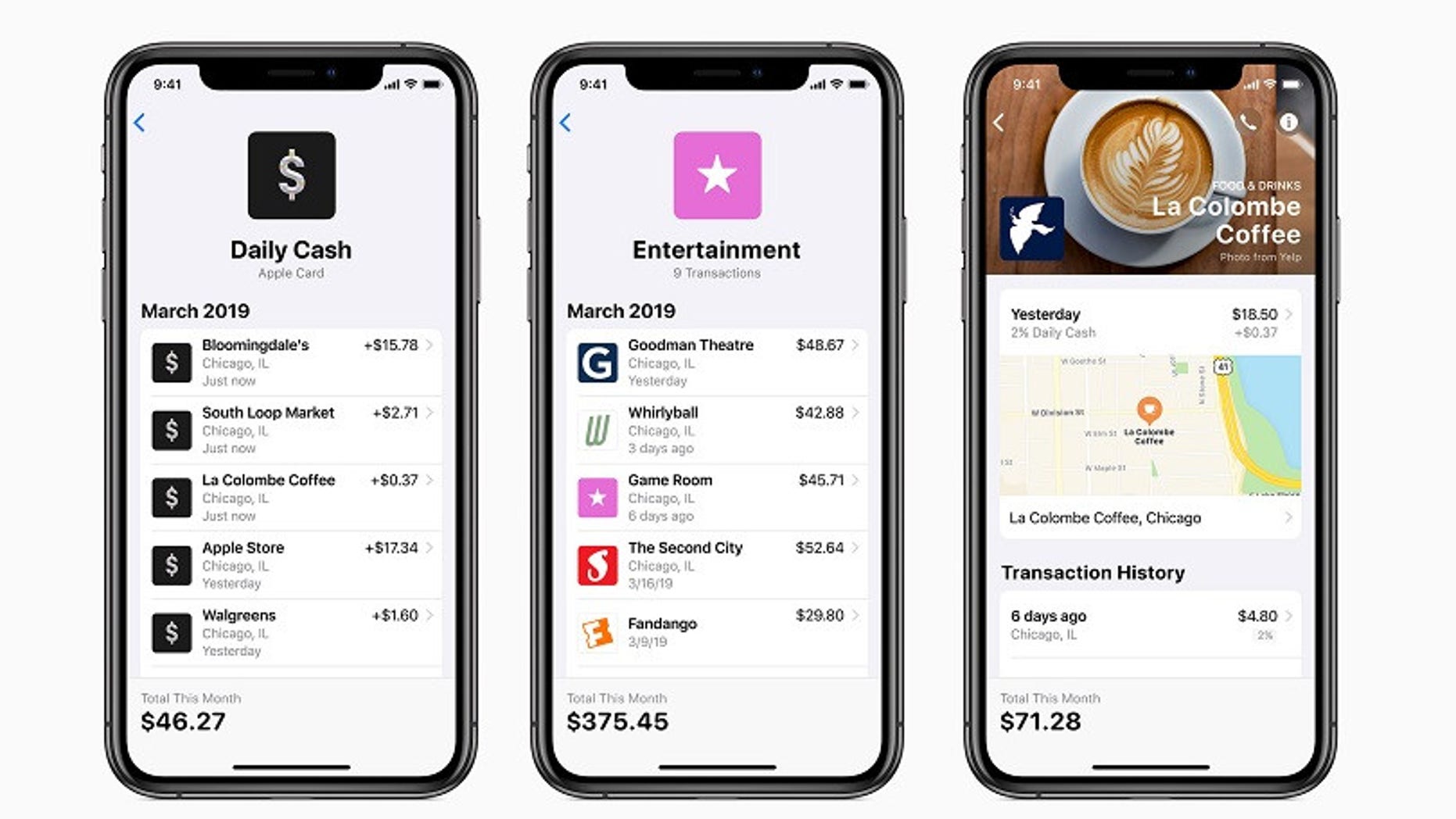

When customers use the card, they recover 2% cash on all purchases and 3% when buying a product or service from Apple.

According to Apple, its digital credit card will have no late fees, no annual fees, no international fees and a rate of interest among the lowest in the industry. However, the fine print on this last point indicate a fairly standard range of interests.

This sounds very good, but many of its features are not new, but rather an evolution of the rewards and fee structures already offered by other cards in the US market, critics quickly pointed out.

"I think the odd thing here is that credit cards do not necessarily constitute a payment innovation, even with better rates and better loyalty," said The Verge Rivka Gewirtz Little, global director. of research within the IDC analysis company.

"So, seeing a big technology company, driven by innovation, adopts such a traditional path. That's what I find a little strange here. I would like to see Apple innovate more in the transformation of our way of paying. "

Apple is partnering with the global investment bank Goldman Sachs and Mastercard to bring its Apple card to life.

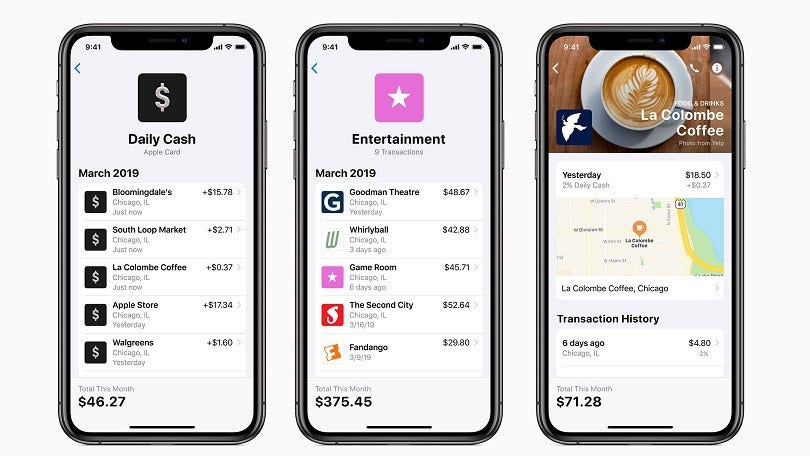

"There are aspects of the credit card experience that could be so much better," Tim Cook said at the announcement. The card will decode readings into something easier to read and understand, automatically consolidate purchases into categories, and help customers track and better understand their spending patterns. And, interestingly, Apple says that no purchase data will be shared or sold to third-party advertisers or data brokers.

While this may not be the revolutionary change announced by Apple, it is an interesting boost for the tech giant's digital portfolio.

As noted by Peter Berg, a former Visa services manager, maintaining payments within the Apple ecosystem could prove worrisome for the card networks if Apple was successful in the long run.

"Apple pushing people to keep their money in the Apple ecosystem should not be underestimated!", He wrote on Twitter.

"They play a long game here. If successful, it is very bad for card networks. "

It is unlikely that Apple Card will arrive in Australia in the near future, but it will be interesting to see if the result desired by the manufacturer of the iPhone is obtained.

In addition to its refurbished television application and original content delivery service, the company also announced a new service for magazines and some major American newspapers this week. In the United States, subscribers can get unlimited access to about 300 major magazines, the Los Angeles Times and the Wall Street Journal for $ 10 per month. He will arrive in Australia in the second half of the year, but the prices remain to be specified.

Apple will share the proceeds with the publishers as part of an undisclosed trade agreement. In a note to investors, Rod Hall, an analyst at Goldman Sachs, said it was unlikely that the new services would increase Apple's profits in the near term, but that they "would be interesting from point of view of platform rotation. "

While iPhone sales (and smartphones in general) are slowing down, Apple wants to plunge you deeper into its ecosystem of services and lose interest in your departure. When you buy a new device, you will need to use an iPhone.

Apple is also expected to eventually bundle them with its other services such as Apple Music, iCloud storage and Apple warranties to offer a great discounted Apple package.

This story originally appeared in news.com.au.

[ad_2]

Source link