[ad_1]

Recent history suggests that the technology giant Apple (AAPL) will unveil its brand new range of iPhone in mid-May. After the actual rise in appliance prices last year, consumers have backed down and when a slowdown in China hit, the company was forced to warn that revenue for the period parties would miss their expectations. With the hope that this year could see a turnaround for the iPhone, current rumors make me wonder if the situation will only get worse.

If you want to read all the details about this year's programming, rumored to be, MacRumors has a good record here. Apple is expected to launch three new phones, essentially the successors of the XR, XS and XS Max, with screen sizes similar to those of these devices. The XR should continue to use an LCD screen, while both XS models will continue to use an OLED display. The image below shows what the two OLED models might look like.

(Source: MacRumors article linked above)

The top left squares represent the biggest change expected this year. This is a three-lens configuration. Current XS models have a dual camera configuration, but Apple should add a third camera, as most major smartphone manufacturers currently do. The XR should also switch to a dual camera setup, while all three phones could get a major upgrade to their front camera.

There are a number of other rumors, the most important of which is that Apple will have larger batteries in these devices. This could allow bidirectional charging, which means that you can charge any Qi-based device from your iPhone, a feature already launched by Samsung (OTC: SSNLF). Beyond the usual processor and other expected upgrades, the XR may also benefit from an increase in RAM from 3GB to 4GB. It is also possible that these phones will benefit from the assistance Apple Pencil, but it is not clear yet.

With the introduction by Apple of new camera configurations in the range of iPhone, as well as the usual upgrades of the next generation, the problem I see currently is that pricing should still increase. Apple is not moving on the margins, which are already under pressure, even before taking into account the impact of tariffs through the trade war between the United States and China. I could easily see a scenario where each phone costs $ 50 more at launch than its previous generation counterpart.

The impact of pricing is an even bigger issue now that Google (GOOG) (GOOGL) recently launched a new Pixel smartphone at an affordable price. Pixel 3A models that have just been launched are equipped with the excellent camera that makes the reputation of the telephone line, although not all technical specifications are at the forefront of technology, allowing the smaller version of the two screens to be sold for $ 399 In addition, Google has added a number of new mobile operators in the United States this year, as opposed to previous models exclusively Verizon (VZ).

(Source: Verge article, seen here)

Those who followed my report on Apple knew that, like many consumers, I am a big fan of small screens and I love my iPhone SE. Apple has not launched a second generation of this phone, and no major rumor suggests that such a phone will come. However, judging by all points of view, it seems that the device has sold fairly well, especially given its size and price. So I wonder if Google's new pixel price will prompt Apple to rethink its strategy.

By removing the Home button, Apple could use a larger screen with the same format as the OS or the same approximate screen size in a smaller device. Those looking for a phone at this price point are not looking for high-end specifications anywhere in the world. Apple could follow Google's strategy and follow halfway in some ways. This would allow the company to maintain decent margins and an increase in total iPhone unit sales would allow it to sell more Apple services, in the perspective of revenue growth for this segment.

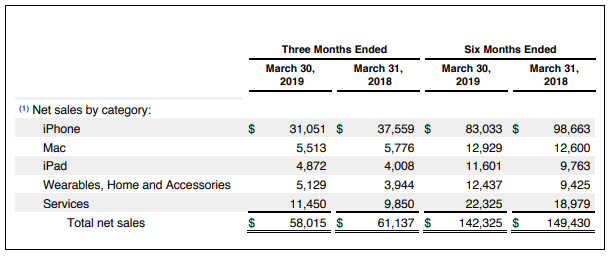

At present, I am not here today to say that Apple is dying, but investors must be aware of it. As you can see in the graph below, iPhone revenues still accounted for 58.3% of Apple's total in the first half of the year despite a drop of more than 15 billions of dollars in revenue. At present, it is simply impossible for the company to increase its total revenue if the iPhone's revenues are in free fall.

(Source: Apple tax supplement for the second quarter (see here)

It's not just about revenue, because the iPhone generates a good share of Apple's profits. Equipment gross margins in the second quarter of the year decreased by 265 basis points from the same period last year, which is worse than the 180 basis points recorded in the first quarter of the year. . This is probably partly because of some reductions while Apple was trying to generate sales, but the loss of high-margin revenue definitely hurts the gross margin. As I mentioned above, the best way to protect margins is to increase prices, but this probably has an impact on unit sales.

The achievement of gross margins also has a significant impact on the income statement. As operating expenses also increased slightly over the previous year, Apple recorded a 12.8% drop in operating income for the six-month period. Net income did not decline as much, but only because the previous semester had another quarter before US tax cuts came into effect. More difficult comparisons are announcing and cash flow from operating activities decreased by $ 5.5 billion for the six-month period.

I think investors should temper a little the expectations for the launch of the iPhone this year. The new camera configurations will certainly be satisfactory, but the pricing strategy of Apple will undoubtedly be one of the keys to the success of this range. It is likely that the focus will be more on the price, because Apple is not expected to launch a new generation 5G compatible phone before the autumn of 2020. This could slow down sales because investors expect this big Leap Forward.

In the end, Apple could be in a repeat of its iPhone problem of last year with regard to high prices. Ignoring the tariff problem, which could itself be a big problem, rumors that the technology giant will this year have a major configuration of the upgraded camera could make the smartphone even more expensive. As Google recently launched an economical Pixel phone, Apple would seem disconnected if it further increases prices. This could have a negative impact on unit sales, not only on net income, but also on reducing the growth potential of additional user services. Apple's shares are currently trading $ 25 below the average benchmark price, but this can not happen if we see another year where the iPhone range disappoints.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

Additional disclosure: Investors are always reminded that before investing, you must do your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

[ad_2]

Source link