[ad_1]

Gary Dickerson, CEO of In Applied Materials' (AMAT) FYQ1, said:

"Yes, I think if you look at the overall market share, the third party data will come out in a little over a month.We will see all the numbers, including our share."

Growth in equipment revenues

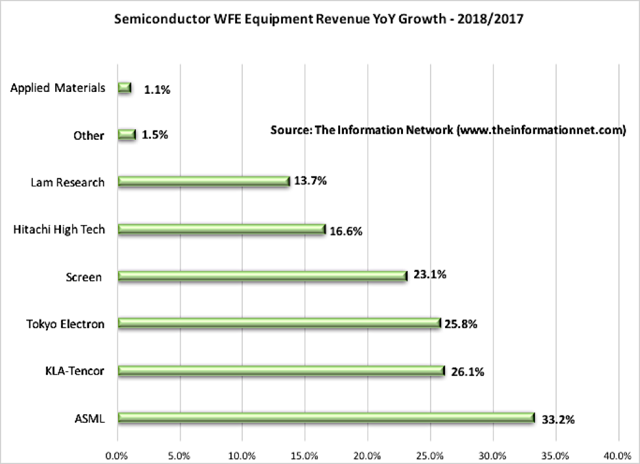

Well, I'm here, Mr. Dickerson, providing third-party data, and I do not think you'd like what you read. Chart 1 shows AMAT's revenue growth in 2018 compared to 2017. Revenue growth for the other 6 major equipment suppliers is also shown. Wafer Front End (WFE) equipment reached $ 54,848 million in 2018, up 14.0% from 2017, according to The Information Network's report, "Global semiconductor equipment: markets, market shares, market forecasts ".

Keep in mind that although the data relates to the 2018 fiscal year, AMAT, as we just saw when calling the results, has an exercise that ends a month later than before. A typical quarter. In other words, all of the data in this analysis is for a period ending December 31, 2018, while AMAT is for a period ending January 31, 2019. This difference is not significant.

For example, in 2017, AMAT revenues calculated in this manner (end of January) amounted to $ 10,216 million, while the refined data at December 31, 2017 amounted to $ 10,607 million, a difference of $ 391 million or 0.7% of the total WFE market of $ 54,848. million.

Another caveat: all data pertains only to WFE equipment and does not include spare parts or service. With these caveats as a base, there are several important points to remember:

- Applied Materials sales increased only 1.1% year-on-year.

- Other Top 6 revenues increased by 17.6%.

- The rest of the semiconductor equipment companies in the world has only grown by 1.5%

Thus, the main companies (excluding the AMAT) – ASML (ASML), KLA-Tencor (KLAC), Tokyo Electron (OTCPK: TOELY), Screen Holdings, Hitachi High Technologies (OTC: HICTY ) and Lam Research (LRCX) – recorded significant market share gains on their smaller competitors.

AMAT has performed worse than the average of the companies that, in many cases, are small-cap companies representing a fraction of the size of AMAT.

Market share

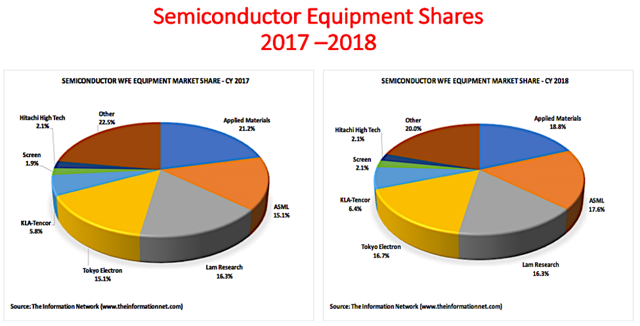

Chart 2 shows the global market share of the entire WFE equipment market in 2017 and 2018.

As in Chart 1, there are several important points to remember:

- AMAT's market share decreased by 2.4 percentage points, from 21.2% in 2017 to 18.8% in 2018.

- ASML's market share increased 2.7% from 15.1% in 2017 to 17.6% in 2018

- LRCX's market share remained the same at 16.3%

- Tokyo Electron's market share increased 1.6% from 15.1% to 16.7% in 2018

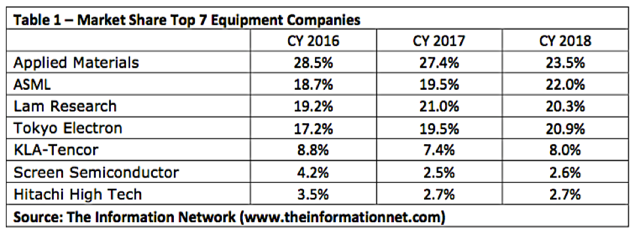

I mention 2 graphics in my title, but I want to add a chart to show more perspective. Table 1 shows the market shares of the seven largest companies between 2016 and 2018, as "other" companies combining shares of just 1.5% are not significant to this argument. In many articles by Seeking Alpha, I explained how AMAT was losing market share, particularly in an article called Seeking Alpha titled "Applied materials are closer to the loss of dominance in semiconductor equipment" .

We can see that AMAT's share continued to erode between 2016 and 2018. This refutes the Dickerson CEO's statement that:

"We'll see that over the next six years in 2017, we've been the only major supplier to stay up or down for six consecutive years."

Why are market shares important? Semiconductor manufacturers purchase equipment according to the "Best of Breed" strategy. Losses of market share indicate that the equipment is not the best of the breed. When a customer decides to purchase additional equipment to increase capacity, he will buy more from his current supplier. This means new market share gains.

AMAT sells equipment for almost every process used to manufacture a semiconductor chip. The two main segments are the deposition and the engraving. In 2015-17, deposits accounted for 46% of AMAT's revenue, while the state accounted for 18-20% of revenue. These two sectors account for two thirds of AMAT's revenues.

In 2018, the deposition, the deposit market increased by 3.9% and the engraving rose by 4.4%. As AMAT's total revenues grew by only 1.1%, it is clear that the company has lost shares in both sectors to competitors in these sectors, namely Lam Research, Tokyo Electron and Hitachi High Technologies. .

One thing I share partially with Dickerson is his comment:

"In 18 and 19, logic customers buy EUV systems. And these systems have very long delays. They buy the EUV tools for years before launching into mass production. We view this as a positive indicator in the adoption of future nodes. But right now, in the 18's and 19's, it's definitely a headwind. "

In several articles of Seeking Alpha, I explained that EUV will replace several deposition-etching steps commonly used in multi-exposure DUV lithography processes. Readers can obtain detailed data from my article Seeking Alpha entitled "The move to EUV lithography ASML will have an impact on the entire supply chain of semiconductors".

It is clear that the incorporation of the VU will be an obstacle for AMAT (as well as for its competitors in the deposition space), especially since it represents 66% of AMAT's revenues. But not only for the years 18-19.

Investor to take away

In its recent call for results, AMAT's management has concluded that its semiconductor is a short-term phenomenon. Dickerson's comment that EUV is an opposite wind of 18 and 19 can not be further from the truth.

ASML shipped 18 EUV systems in 2018 and is expected to ship 30 in 2019 and 33 in 2020, 45 in 2021 and 50 in 2022. ASML customers who purchase these systems are also customers of AMAT. TSMC (TSM) and Samsung Electronics (OTC: SSNLF) each delivered 10 systems until 2018, while Intel (INTC) has seven. In 2019, I expect TSMC to buy another 17, Samsung 5 and Intel 4 .

These companies are not going to spend more than $ 100 million on each EUV tool if they do not think they will reduce the need to buy drop and burn equipment.

Yes, these are just three companies. However, in 2018, INTC, TSM and SSNLF generated combined revenues of $ 187,621 million, or 49.2% of total semiconductor revenues. The move to EUV will have a significant impact on AMAT's future revenues, as will the loss of revenue for competitors.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link