[ad_1]

In a landmark decision of global impact, 130 countries. including Argentina, has accepted an international tax reform to tax multinationals with a tax of “at least 15%”. which will avoid tax competition between nations and the establishment of companies in tax havens to avoid paying taxes.

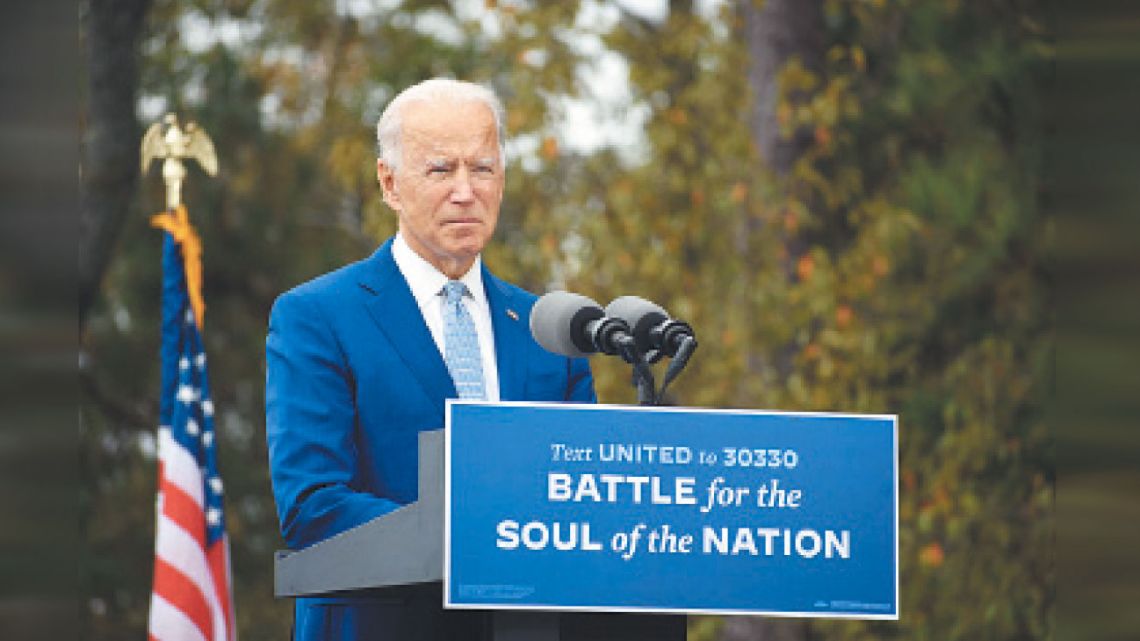

The tax initiative was spurred on by the government of Joe Biden and the the approval of the Argentinian government, which had nevertheless decided in favor of a higher rate through its Minister of the Economy Martín Guzmán.

“After years of hard work and negotiations, this historic package of measures will ensure that large multinational corporations pay their fair share of taxes around the world,” said the secretary-general of the Organization for Economic Co-operation and Development ( OECD), cited in a press release. declaration.

Alberto Fernández and Martín Guzmán analyzed the measures to counter the possible exchange rate pressure

International Agreement on a Global Tax on Multinational Enterprises

The pact was concluded less than a month after the G7 summit, in which the richest economies have accepted a minimum tax for large multinationals. A small group of countries, including Ireland and Hungary, very reluctant to sign the draft agreement under negotiation, did not sign the declaration, according to the list provided by the organization.

China, whose position was eagerly awaited, and countries generally considered to be tax havens have joined the pact.

“Multinationals will no longer be able to pit one country against another in an attempt to reduce taxes. and protect their profits to the detriment of public revenues ”, US President Joe Biden reacted it is a statement. “They will no longer be able to avoid paying their fair share by hiding the profits generated in the United States, or any other country, in less tax jurisdictions,” he added.

For his part, the Secretary of the Treasury of the United States, Janet Yellen, celebrated a “historic day of economic diplomacy”.

For the French Minister of the Economy, Bruno Le Maire, this is “the most important international tax agreement concluded in the last century”, while his German counterpart Olaf Scholz hailed “a colossal step towards greater tax justice.

The joint declaration, which builds on the agreement reached at the G7 in early June, also provides for a “fairer” distribution of profits between the countries where the companies are based and those where they actually operate, including without a physical presence. This part is aimed in particular at digital giants like Facebook and Google.

“This two-pillar plan will be of great help to countries that need to raise the tax revenues necessary to restore their public finances and budgets, while investing in essential public services, infrastructure and the measures necessary for a recovery. strong and durable after the crisis. , said the OECD in its press release.

“This package of measures does not put an end to tax competition, nor does it intend to, but rather seeks to limit it according to the rules agreed at the multilateral level”, insisted Cormann.

Argentina’s position on the global tax

The government has repeatedly expressed support for the initiative, although it has demanded a higher tax. “The 15% global corporate minimum rate is too low. There is a significant risk that it will end up being the highest rate. From Argentina, we consider that a rate of 21% would be better, a rate of 25% even better, ”Guzmán said this week. in a panel organized by the G24 and G24 and the Independent Commission for the Reform of International Business Taxation (ICRICT).

“There is a substantial risk that developing countries will earn very low incomes,” the official added.

Government to propose 25% global minimum tax for multinational companies

Tax demand in 2023

Participants in the negotiations had until October to “finalize the technical work” and prepare “a plan for its effective implementation in 2023”.

The health crisis, which has forced states to spend heavily to face the pandemic and support their economies, has strengthened the political will to reach this agreement, which would increase tax revenues.

According to the OECD, at a rate of at least 15%, the global minimum tax would generate around $ 150 billion in additional tax revenue per year worldwide.

You may also like

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos