[ad_1]

The Foreign direct investment in the local economy in 2020 was only 4019 million dollars, which implies a decrease of 39.7% year-on-year. He was half of the flow that attracted smaller economies like Chile and Colombia and less than a tenth of the resources that went to Brazil. This disparity compared to Argentina is explained by the economic crisis since 2018 and the lack of international credit. The data comes from a report prepared by ECLAC.

Foreign direct investment (FDI) is considered to be that which operates on physical assets, either from the installation of a new productive enterprise, or from the purchase of enterprises. These are much more stable operations than financial investments and have the potential for job creation, infrastructure and exports.

Anyway, Alicia Bárcena, Executive Secretary of ECLAC, warned that “over the past decade FDI has not made relevant contributions to change the productive structure of the region. We must channel FDI into activities that generate more productivity, innovation and technology ”. In the country, investment flows are directed mainly to the primary sector.

Natural resources

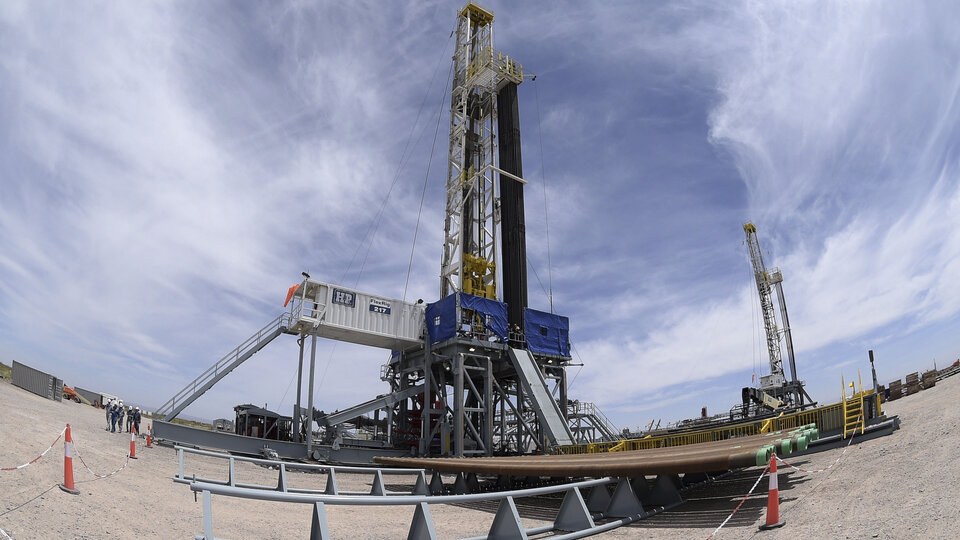

The feat of hydrocarbons and mines they were the protagonists of FDI in the country. The operation was highlighted in the Vaca Muerta deposit for which the Anglo-Dutch Royal Dutch Shell and the Norwegian Equinor have acquired for 355 million dollars 49% of the Bandurria Sur block, which belonged to the American Schlumberger.

In mining, the canadian Gold closed acquired the entire Don Nicolás mine for $ 45 million to operate a gold mine in Santa Cruz. In the lithium sector, the Chinese company Jiangxi Ganfeng Lithium acquired an additional 1% of Minera Exar for 16 million dollars, thus holding 51% of the shares. With this acquisition, the Chinese company is now the conglomerate with the largest stake in the Caucharí-Olaroz lithium project, in Jujuy. The Chinese company’s counterpart is the Canadian Lithium Americas.

The most important project was a high-quality diesel refinery plant, inaugurated by Pan American Energy Group, which required a $ 1.5 billion investment under the AXION Energy brand. In transport and logistics, the German DHL has inaugurated a new distribution center which required an investment of 350 million dollars.

In the manufacturing industry, Japan’s Nissan has announced an additional investment of $ 130 million in its Cordoba plant. In the field of communication, projects of the Spanish company Movistar and the American companies Lumen and Globalstar have been registered. Finally, transnational companies have extended their production capacity to renewable energies, where it has been emphasized commissioning of 9 of the 20 wind turbines that make up the Vientos Neuquinos wind farm, whose construction required an investment of 140 million dollars from the American AES.

In the region

Latin America and the Caribbean received $ 105.48 billion in FDI in 2020, implying a 34.7% year-on-year decline. The number is also 51% lower than the all-time high reached in 2012 and is the lowest amount since 2010. The the natural resources and manufacturing sectors were hit the hardest, while renewable energies remained the sector in the region with the most interest for foreign investors.

The decline was not unique to the region. In fact, FDI recorded an overall decline of around 35%, the lowest value since 2005. “Global FDI flows will recover slowly. On the other hand, it is expected that a large part of these Europe, North America and some Asian countries, growing global asymmetries“, warns the ECLAC study, which forecasts an improvement of only 5% of FDI in the region in 2021.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos