[ad_1]

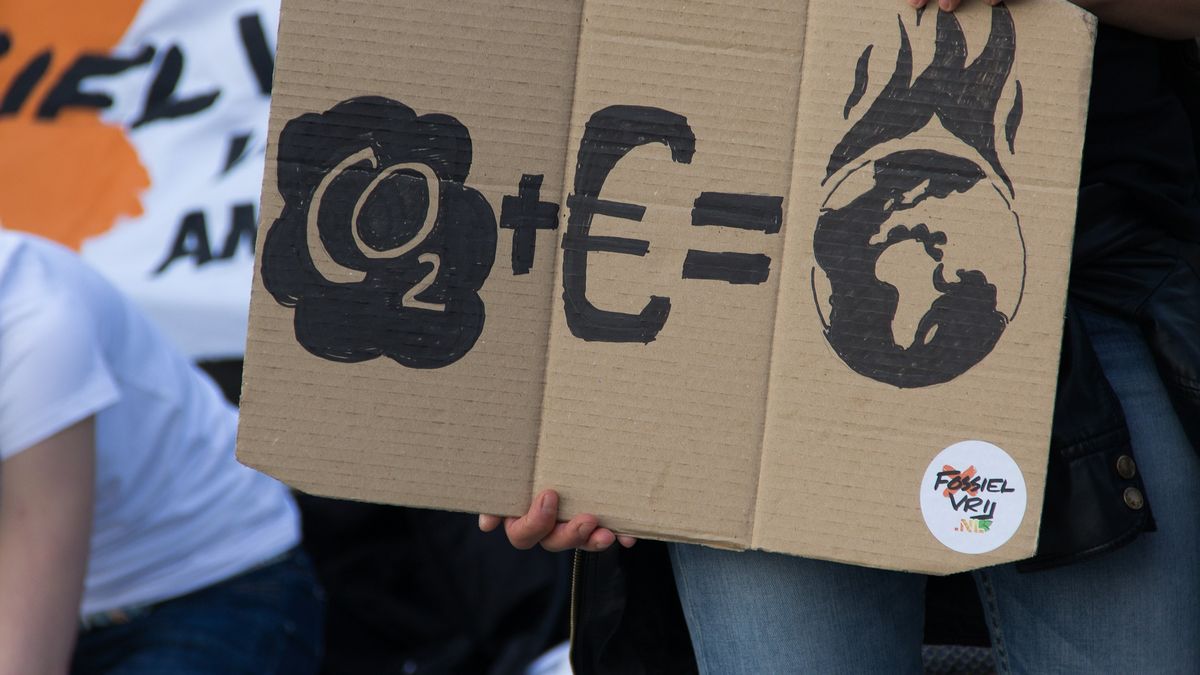

The environmental problem is increasingly worrying. In an article published this week, the weekly The Economist wonder if Could climate change trigger a financial crisis?

Economic models of climate change may have significantly underestimated the costs of continued warming, according to the article published in Environmental Research Letters. The article titled “The Social Cost of Carbon Dioxide Under Feedback from Climate Economics and Temperature Variability” and its authors are Jarmo Kikstra, Paul Waidelich, James Rising, Dimitry Yumashev, Chris Hope and Chris Brierley.

Researchers warn that the economic damage from ongoing climate change can be 6 times greater by the end of this century than previously estimated.

Projections of the economic damage from continued climate change are important in helping governments calculate the relative costs and benefits of reducing greenhouse gas emissions, but the analysis suggests that the economic models behind them may ignore significant risks and therefore underestimate the potential costs of warming.

The works indicate that most models they focus only on short-term damage and assume that climate change has no lasting effect on economic growth, despite growing evidence that extremes like droughts, fires, heat waves and storms, and their effects on health, savings and labor productivity, cause long-term damage.

Based on these considerations, it is argued that if the effects of climate change on economic growth are taken into account, global GDP could be 37% lower by 2100 than it would be without the impacts of warming. .

It should be noted that there is still a considerable uncertainty to what extent climate damage continues to affect long-term growth and to what extent societies can adapt to reduce this damage; depending on the importance of growth, the economic costs of this century’s warming could reach 51% of global GDP.

“We don’t yet know exactly what effect climate change will have on long-term economic growth – but it’s unlikely to be zero, as most economic models have assumed. Climate change causes damaging events such as the recent heat wave in North America and flooding in Europe are much more likely. If we stop assuming that economies recover from such events in a matter of months, the costs of warming appear to be much higher than We don’t often claim it. We still need to better understand how climate disrupts economic growth, but even with small, long-term effects, reducing emissions becomes much more urgent. ” Chris Brierley, University College London

The authors recalculated the effect of these changes on the “social cost of carbon,” a measure of the economic damage caused by the release of greenhouse gases. The analysis suggests that the economic damage due to the release of a single tonne of carbon dioxide can exceed $ 3,000.

Although the results show large uncertainties, this value is much higher than what policy makers assume. For example, the United States government currently uses a social cost of carbon of around $ 51 per tonne to judge the costs and benefits of projects related to greenhouse gas emissions, and the Emissions Trading System. emission from the European Union, which covers energy, manufacturing and aeronautics, amounts to 61 euros.

“The more we know about the risks of climate change, the more urgent the action. Each year they have seen more natural disasters linked to climate change, and the situation will continue to worsen until we can reach zero. One of the big steps forward in this work is to start capturing the risks of natural disasters, or climate variability, in cost estimates and not just in average temperature change, ”he explains. -he. James rising, of University of Delaware and London School of Economics and Political Science.

Crisis

For its part, The Economist warns against possible destabilization of financial markets as a consequence of climate change.

Climate change is thought to affect the financial system in three ways. One is through what the regulators qualify as “transition risks”, that is to say the displacement of polluting sectors towards cleaner sectors, with the risk of “dirty” companies defaulting on loans or bonds causing their stock prices to collapse.

The second effect it is the exposure of financial companies to the dangers of rising temperatures. The Financial Stability Board, a group of regulators, believes that global economic losses from climate-related disasters fell from $ 214 billion in the 1980s (at 2019 prices) to $ 1.62 trillion in the 2010sThese losses are often borne by insurers (although over time the costs should be passed on to customers through premium increases).

Finally, it should be noted that the financial system could also be exposed to wider economic damage caused by climate change, if they trigger changes in asset prices.

Based on a warming estimate of 3 ° C (compared to pre-industrial temperatures) financial losses vary between 2% and 25% of global GDP, according to Network for greening the financial system. Worse yet, the bleakest estimate could turn out to be overly optimistic if climate change triggers conflict or massive migration.

According to Carbon tracker, a group of climatologists, around $ 18 trillion in global stocks, $ 8 trillion in bonds, and maybe $ 30 trillion in unlisted debt are tied to high-issue economic sectors.

These are huge numbers given the trillions of dollars in secured debt securities that in 2007 were at the center of the global financial crisis, and which warn of how deep a general decline in the value of these assets.

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos