[ad_1]

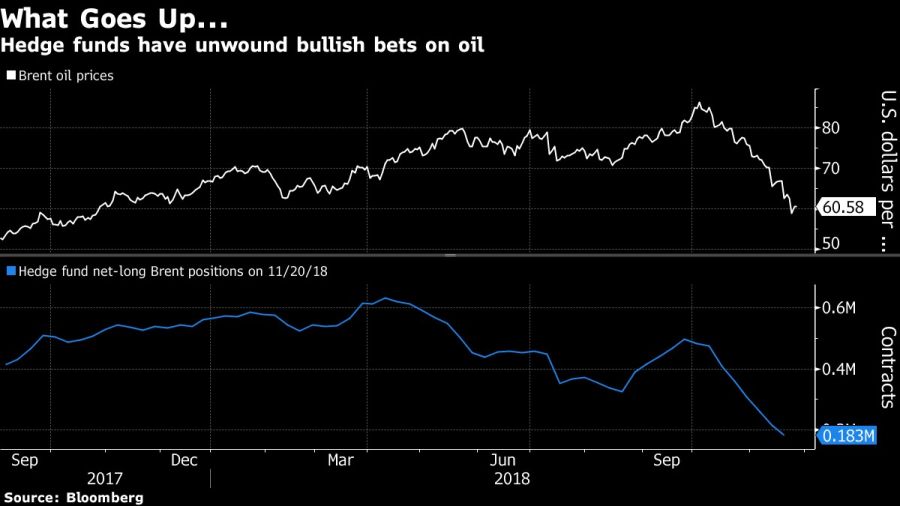

Just a few months ago, the big retailers of oil They predicted the reappearance of a gross of 100 USD. Now, with oil prices at half this level, here is a picture of what this fall means for the global economy.

Energy importers such as India and South Africa will benefit; Oil producers such as Russia and Saudi Arabia will be harmed. Central banks under pressure to raise interest rates will have a respite; Those seeking to reactivate prices, such as the Bank of Japan, face more headwinds.

Ultimately Much depends on how the world's demand for oil is presented to be punished by a strong dollar and global trade conflicts and the reaction of the biggest producers.

Saudi Arabia lies between Russia, its ally in the management of production to maintain prices, and the United States, where President Donald Trump sends Twitter messages to the producer to bring down prices. All eyes are on the G20 meeting It will be held this week to see if there is a consensus on production between the Saudis and the Russians and if it can be transferred to the OPEC meeting next week.

This is a photo of Bloomberg Economy which shows net oil imports (or exports) as a percentage of GDP: cheaper oil helps those at the top of the table and hurts those at the bottom of the list.

- What does this mean for global growth?

As winter approaches, falling oil prices will protect households and businesses in times of slower economic growth. Oil-importing and current-account deficit countries, such as South Africa, are also able to benefit from it. China is the world's largest oil importer and is already struggling for more general moderation of its economy in the context of a trade war with the United States. and internal challenges.

- What does this mean for inflation?

Falling oil prices mean less inflationary pressure and less pressure on central banks to raise interest rates. An example: Bloomberg Economics says the drop in energy is changing the rules of the game for India and could mean that the Reserve Bank of India will have a neutral vision.

- How will emerging markets manage lower prices?

Every $ 10 a barrel drop in oil prices raises revenues by about 0.5 to 0.7% of the gross domestic product of major emerging market oil importers, badysts say Capital Economics. The same reduction will lead to a 3% to 5% decline in GDP in most Gulf economies and a slowdown of 1.5% to 2% of GDP in the United Arab Emirates, Russia and Nigeria. annual basis, according to badysts.

- What does this mean for the world's largest economy?

Trump has defined falling oil prices as the equivalent of a tax break. However, less US dependence on imported oil due to the onset of shale production will weaken the positive economic consequences at the industry level.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos