[ad_1]

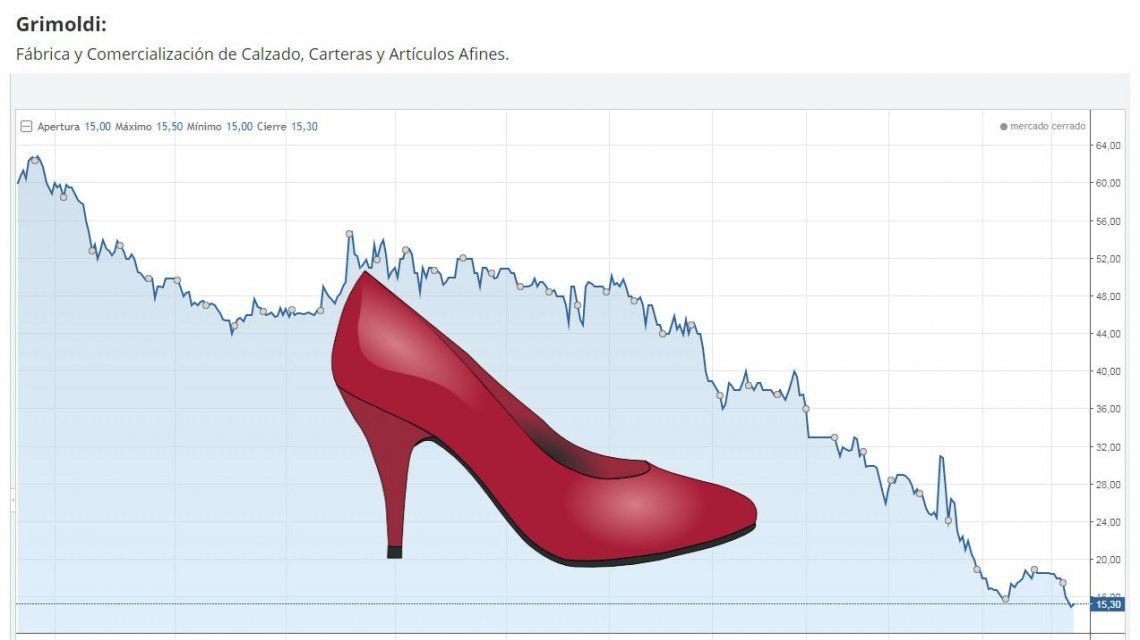

The most striking example of these last hours is that of Grimoldi. Perhaps the shoe brand more rooted by the Argentine consumer. With more than 120 years of history, he has gone through all the whims of the Argentine economy, but he has always led the sector.

Shares of the country's shoe brand par excellence collapsed in 2018 and collapsed in 2019. In September 2016, they had come in over 70 pesos and at the close of Friday, they were at $ 15.

Grimoldi is the most representative case of listed consumer companies. "They blame the lack of sales in the premises", Explains Santiago Llull of Future stock market.

In a dialogue with minutouno.com, the market badyst explains that the "investor" sees that consumption does not increase "and that is why stocks are collapsing. "The market tells you that this badet is worth today the 14 dollars which came to play the role of floor. In 2014, it was $ 5, but with another dollar. Today, it is trading at $ 15, which equals less than 50 cents. "

"Investors are essentially migrating to the problem of banks", Explains Llull, adding that"Most market shares are in banks. The Merval is run by Banco Galicia which represents 17% of the local population."

Sales of clothing, footwear and home textiles rose 18.4% in November 2018 compared with 2017, according to the survey conducted in Indec shopping centers. Of course, inflation was 47.6%, which represents a 30% drop from the inflation rate

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos