[ad_1]

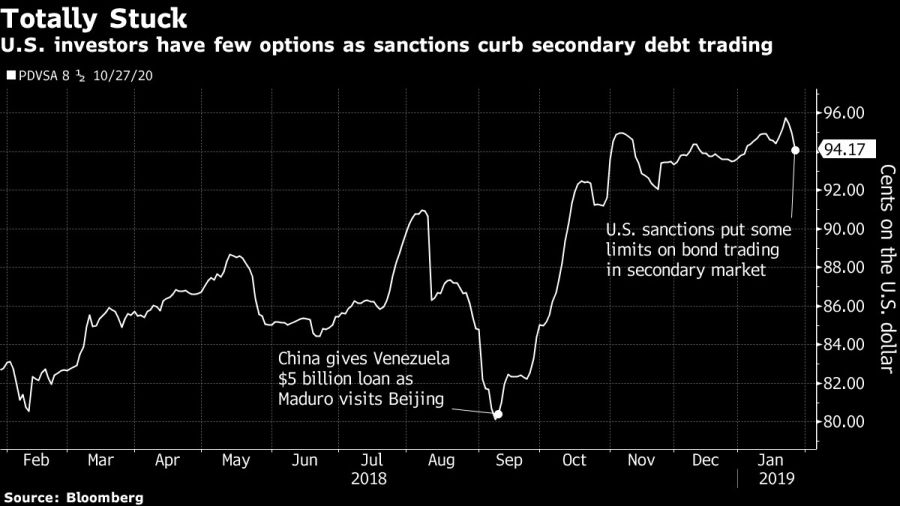

Investors received a bad surprise Monday when the government of Trump limit the commercial debt of the Venezuelan national oil company, as part of the measures to Nicolás Maduro.

Punishments ban Americans from buying bonds issued by Petróleos de Venezuela in the secondary market, leaving them with two options: sell them to a non-US person or keep them. However, the Treasury Department's ambiguity has implications for some US-based external debt traders, who have also refrained from trading, said Cecely Hugh, emerging markets investment advisor at Aberdeen Standard Investments in New York. London. In her opinion, a strict interpretation could imply that companies with US employees would also be subject to restrictions.

Operators in several of the main backgrounds of blanket of EE.UU. They said their lawyers had advised them not to move the bonds at the moment because the Treasury Department's Foreign Assets Control Office had not given him any other instructions. According to Trace, FINRA's bond price information system, the volume of transactions on PDVSA's debt lost 99.7% Tuesday against its five-week average.

"There is no exit"Ray Zucaro, Investment Director at RVX Asset Management in Miami, holder of PDVSA bonds, said:" Who will buy them? The inhabitants are bankrupt or in the street and Europeans expect similar trade bans. "

Meanwhile US sanctions According to Francisco Rodríguez, chief economist at Torino Capital in New York, they generate a default on PDVSA bills maturing in 2020, the only obligation that Venezuela has maintained by executing more than 9,000,000 USD payments. The consequences of the default are much more serious for these bonds as they are covered by a senior lien with a 50.1% interest in Citgo Holding Inc., the refinery arm of PDVSA in the United States. But the Maduro government has little reason to pay after Washington ceded control of Venezuela's bank accounts in the United States. the President of the National Assembly, Juan Guaidó, whom the Trump administration recognizes as interim leader.

"PDVSA has no incentive to pay since the loss of Citgo, it does not even have the capacity to do it," Rodriguez said.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos