[ad_1]

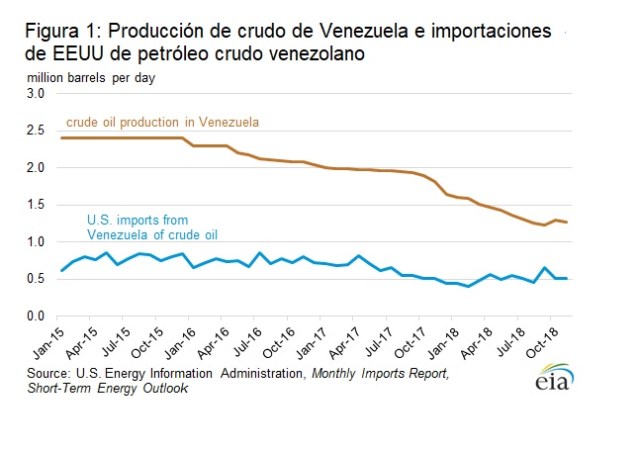

US imports of Venezuelan crude oil have declined in recent years, along with the decline in production in Venezuela (Figure 1), said the US Energy Information Administration in a report released Wednesday, quoted by La Patilla.

US imports of Venezuelan crude oil have declined in recent years, along with the decline in production in Venezuela (Figure 1), said the US Energy Information Administration in a report released Wednesday, quoted by La Patilla.

The recently announced sanctions in the United States. UU The state oil company, Petróleos de Venezuela, SA (PDVSA), will essentially eliminate US imports of Venezuelan crude oil as soon as the sanctions are applied. However, the US Energy Information Administration. UU (EIA) does not expect a significant decrease in the US refinery load. UU as a result of these sanctions.

US imports of Venezuelan crude oil have been declining for several years and refineries have replaced Venezuelan crude with other heavy crude. In the future, refineries may also choose to operate lighter crude oils, as transportation restrictions may limit the availability of heavy crudes. Refineries with significant capacity of asphalt processing units and road oils, for which Venezuelan crude oil is sufficient, may have more difficulty finding suitable substitutes ; However, these refineries have also recently limited Venezuelan imports.

On January 23, 2019, the United States officially recognized the president of the National Assembly of Venezuela, Juan Guaidó, as interim president of Venezuela. On January 25, 2019, the White House issued Executive Order 13857, take additional measures to address the national emergency vis-à-vis Venezuela., which extended US sanctions by including PDVSA in sanctions against the Maduro regime.

Although there is a settlement period to buy oil and petroleum products, payments must be placed in a guarantee account (in trust) to which PDVSA can not access. EIA expects this action to have an immediate impact, essentially eliminating US imports from Venezuela once the effects of the sanctions have been fully felt. The sanctions do not apply only to the United States. United States, but also to any transaction related to the US financial system. UU The Foreign Assets Control Office at the US Treasury Department UU It says that sanctions can be lifted after the transfer of control of PDVSA to interim president, Juan Guaidó or to a subsequently elected government.

The sanctions also prohibit US companies from exporting petroleum products to Venezuela. This ban includes dilution naphtha, which PDVSA uses to mix with its much heavier crudes. If PDVSA can not find another source of diluent in a relatively short time, it is likely that crude oil production in Venezuela will decrease.

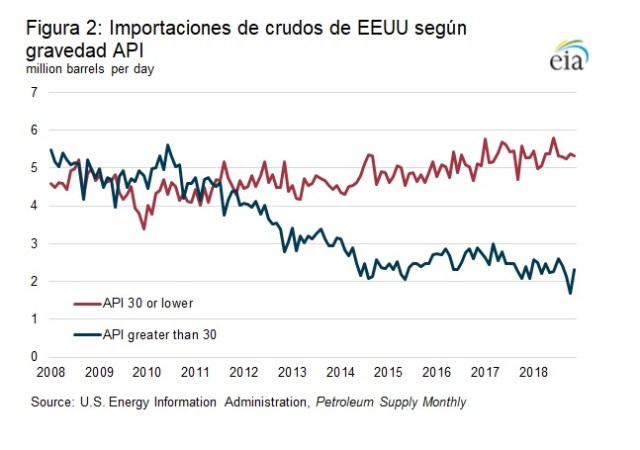

In the first 11 months of 2018, refineries on the US Gulf Coast UU worked with crude oil with an average sulfur content of 1.4% and an average severity of 32.6 degrees API. The average API gravity was 30.0 degrees in 2013 and this change reflects the trend of refineries on the Gulf Coast operating lighter crude oil shipments. The reduction in gross cargo is likely a result of increased refining capacity and the availability of lighter crude oil and does not indicate a decrease in heavy oil demand, as refineries on Gulf optimized to work.

US crude oil imports with an API gravity of 30.0 degrees or less (medium to high) increased, while US crude oil imports with API gravities greater than 30.0 degrees (lighter) decreased (Figure 2). In the first eleven months of 2018, imports from the Gulf Coast had an average severity of 23.2 degrees API, compared to a gravity of 25.5 degrees API in 2013, indicating that imports were increases. This trend is likely to reflect refiners' efforts to continue heavy oil production, while light crude oil production in the United States is increasing.

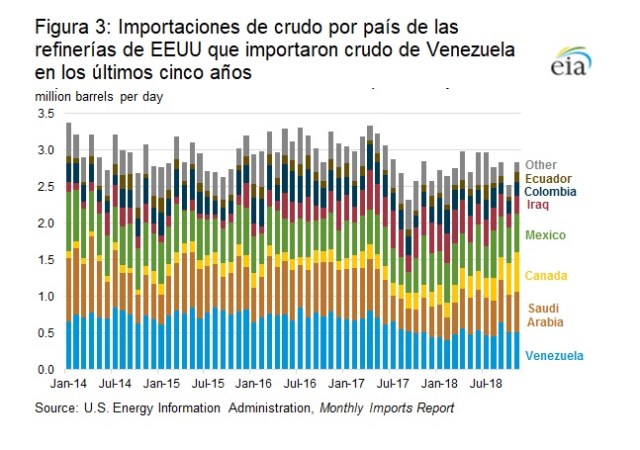

Imports from Canada, Mexico, Saudi Arabia and Venezuela accounted for more than 70% of crude oil imports from the Gulf Coast in the first 11 months of 2018 (the last few months for which data are available). Venezuelan imports had a weighted average API gravity of 17.1 degrees, while imports from Canada and Mexico were slightly higher (indicating that crudes were lighter) at 21.6 and 20.3, respectively. Saudi imports averaged an average of 32.0, but this average probably reflects heavy and light crude oil imports.

Although still an important part of Gulf Coast imports, Venezuela's imports have declined in recent years, in the midst of political turmoil and a decline in Venezuelan production. Venezuelan crude oil imports on the Gulf Coast rose from an average of 618,000 barrels per day (b / d) in the first 11 months of 2017 to 498,000 barrels per day during the same period in 2018 .

Of the 14 UU US refineries that Venezuelan crude oil imported in 2018 (including 12 on the Gulf Coast), imports until November decreased by 129,000 b / d compared to the same period in 2017 (Figure 3). Although Venezuelan imports declined, imports from Canada and Mexico into these refineries increased by 113,000 b / d and 48,000 b / d from 2017 levels.

Of the 14 American refineries that imported Venezuelan crude oil in the first 11 months of 2018, 5 are subsidiaries of PDVSA or previous joint venture badociations. PDVSA, owned by Citgo Petroleum Corp., currently owns three refineries in the United States: Lake Charles, Louisiana; Corpus Christi, Texas; and Lemont, Illinois. Citgo Lake Charles and Citgo Corpus Christi are responsible for a significant portion of US crude oil imports. Venezuela's UU, while Citgo Lemont receives its imports of heavy crude mainly from Canada instead of Venezuela.

The physical properties of Venezuelan crude oil make it particularly suitable for processing asphalt and road oils, and penalties are more likely to affect refineries with significant capacity in this area. Five of the US refineries that imported Venezuelan crude oil in the first eleven months of 2018 have a significant capacity of asphalt and road oil processing units. Two of these refineries are located in the five largest refineries in the United States, with asphalt processing units and road-processing oils – Valero Corpus Christi and Marathon Garyville – and each continued to operate. to import Venezuelan crude in 2018, although low volumes. As imports from each Venezuelan refinery declined, imports from Iraq, Canada and Mexico increased.

You will find economic recommendations, badyzes, interviews and an overview in our Telegram https://t.me/Descifrado channel.

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos