[ad_1]

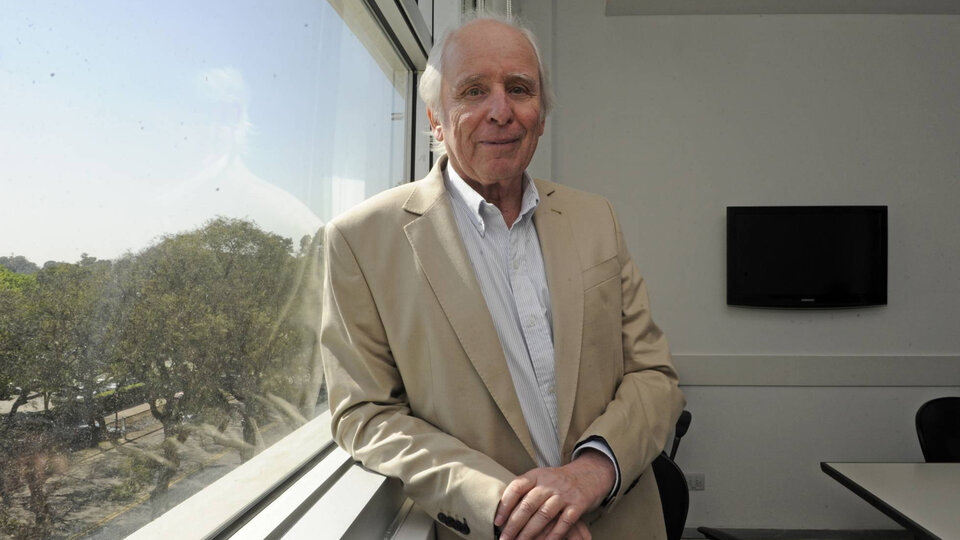

Pablo Gerchunoff is an economics historian, professor emeritus of Torcuato Di Tella University and an honorary member of the UBA. The list of his intellectual output would make this note tedious.

Although he has the full profile of a respected academic, he knows it perfectly within the state's work: he was an important advisor to the economic teams of the governments of Raúl Alfonsín and Fernando De the Rúa.

These data clearly show his radical belonging and his affinity with the government of Cambiemos, although he has always kept a suspicious look at the treatment that PRO has reserved for economic development, his specialty.

One such program explains the ice bath that traveled the city when his tweet was known, commenting on the "euphoria" of the bag on the last working day before STEP. The coverage of all the official media of the time celebrated the progress of nearly 10% of the Argentine shares on Wall Street and 8% in the Merval.

"What's happening on the stock market, it's a clown." Optimistic polls do not exist, I'm aware of some of them. </ P> <p> Some companies are buying back their own shares. something that says it's fear. Stop, "wrote the economist.

As it was difficult to accuse him of "counter", the somewhat desperate criticism was about his supposed "ignorance" of the functioning of the financial markets. Something that motivated a second tweet from the economist.

He was not alone in the answer. Another teacher in Di Tella, Gerry della Paolera, supported his colleague.

Della Polera does not miss a program. He holds a Ph.D. in Economics from the University of Chicago, the largest temple of the Liberals, as well as the founder of Di Tella, where many gurus National Financial He did not need to argue too much, he was referring only to similar pre-election cases in France.

If there was something missing to end the bitterness of the party, it was the appearance of Carlos Rodríguez, the ultra-liberal economist who was deputy minister of Roque Fernández during menemism.

He did not need too many words: "Very suspicious rally last minute, I would really like to know who bought and with whom is the money."

Much of the city shared their doubts, and some operators, without conclusive evidence, dared to name Rodriguez's suspicions. According to these versions, the official banks, Province and City, and ANSES, would have put at stake not less than 150 million pesos. In a market as small as that of Argentine equities, this figure could have a strong but temporary impact.

Due to doubts, the Central Bank has not taken the "optimistic" expectations as seriously and has continued to prepare the trench against a possible sudden dollarization of what remains of the peso investments after the leakage of all the money. ;year. Leliq's interest rate reached 63.70% on Friday.

Another reason for Alberto Fernández to continue to campaign with the official financial roulette. Starting with the Leliq.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos