[ad_1]

The Central Bank of the Argentine Republic intends to keep the LELIQS interest rate at 60%, annually or more, during the electoral process. This measure was aimed at keeping the cheap dollar at 43-47 pesos, believing that this stable and cheap dollar would allow the government to try its luck in the general elections of 27 October and the vote of 24 November.

LELIQS are simple promissory notes of the Central Bank for banks. Its term is one week and its interest rates are the minimum reference money market rates. Instead of using the deposits of public banks to lend the same money to private production companies, banks use people's money to lend it to the Central Bank by subscribing to the LELIQS, leaving the companies private production without credit. The LELIQS generate the ridicule that instead of being the central bank that lends money to banks, it is the banks that lend money to the plant.

6 keys to understand the Leliq

Given the shortage of bank credit, when an SME is forced to deduct a check at the bank from which it operates, it must pay interest rates of the order of 100% per annum. year to bring the bank to sacrifice guaranteed income interest. the LELIQS of 58-60% per annum, to lend to this SME with great risks. The risks come precisely from the recession caused by LELIQS interest rates. At these rates, all businesses risk going bankrupt unless they have access to international credit. But only the very large and transnational have this access. That's why we are seeing business and small business closures every day in our country, leading to a significant increase in unemployment. For these reasons, the dollar at 43-47 did not win the Together for Change elections. High rates were the main factor in the victory of Frente de Todos. Again, this sentence of 1992 is imposed, in very bad taste, but accurate, from Bill Clinton to George Bush Sr.: "It's the economy, stupid"

The mechanism by which high interest rates in pesos manage to smooth the exchange rate and artificially maintain it at 43-47 pesos per dollar is known as a financial cycle: speculators bring dollars into Argentina, thus lowering their price, get 43-47 pesos for every dollar sold. Then, with the pesos, they buy LELIQS at the plant and earn between 58 and 60% per year. For example, as soon as the FF formula appears clear winner in October, as soon as the risk of dollar leakage appears, for example, speculative banks will be the first to try to buy dollars and escape them, by obtaining a minimum income of 4% per month, but in dollars, the highest rate in the world.

How to disbademble the "bomb" of Leliqs

LELIQS are poison pills for the Argentinean economy. LELIQS not only cause a strong recession and a high unemployment rate, but also high inflation. Its stock already exceeds one billion pesos and slightly exceeds the monetary base. This means that to pay the interest of the LELIQS, the currency should grow at a rate above 60% per year. And if the central bank decided to buy back the total of the LELIQS with cash issue, we would immediately have an annual inflation of 130%.

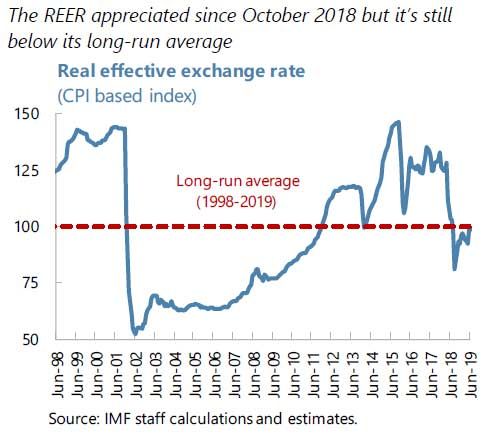

Do youWhat must I do now, now the Macri government, for to transform PASO's electoral disaster and usher in an anti-timba development economy? First, place the exchange rate at its long-term equilibrium level indexed to the consumer price index. This exchange rate must be compatible with annual GDP and employment growth of around 8% per year in our country. What is this exchange rate currently? All indications are that it was the one in effect in 2003-2007. According to the IMF, this exchange rate, at the beginning of August, at current prices, would be around 60 pesos per dollar. With a real exchange rate at this level, the real active interest rate of the Argentine economy should be reduced to 5% in real terms per year. In support of my thesis on the real initial exchange rate of development, at 60 pesos per dollar, it should be noted that this real exchange rate was in effect from 2003 to 2007, while Dr. Alberto Fernández was head of cabinet of the national government and the government. The national economy grew by 8% a year. For him, Alberto President I would change this policy. If you do not believe it, check the chart below for the real exchange rate. It is a faithful copy of what is inserted on page 28 of the IMF's July 15, 2019 report. To interpret this chart, remember that IMF economists see the exchange rate as the overvalued peso means for them a high dollar and undervalued peso, weak dollar.

On the other hand, in order to guarantee low interest rates and eliminate financial constraints, LELIQS should be saved by transforming them into medium-term index-linked pesos of the national government, with a rate of annual rate of 2%. It would also be necessary to index term deposits with the same consumer price index in the national banking system to encourage Argentine savers not to buy dollars and also to offer them a real interest of 2% per annum. . Rescue and indexing can be carried out immediately by necessity and emergency decrees. It should be recalled that the same short – term debt problems of the Central Bank, the LELIQS, have a very weak legal basis in an urgent and urgent presidential decree of 2002, a decree which without other treatment by Congress, The reality is legally null.

Why the dollar goes up uncontrollably and what is the ceiling possible until October

In addition, to put the finishing touches to the lasting consolidation of the interest rate cuts in our country, the executive branch should send Congress a bill inviting the repatriation of fugitives from Argentine capitals abroad. $ 300 billion, provided that they are used for term deposits in indexed pesos in the national banking system, or for the purchase of shares of companies listed on the stock exchanges of the country , in pesos, all this subject to the payment of a 1% tax. The capital of drug trafficking and corruption should be excluded. Which deputy or senator, fernandista or macrista could oppose that the rate of internal interest and the country risk decrease in such a way that the economy and the employment are reactivated as if by magic ?

With these and other measures that I have proposed in my book Overcoming Economic Development Proposals, Prose Editors, 2018, exports could increase by 15% per year and GDP by 8% for several years. In less than three years, full employment would be achieved. Thus, the government that implements and follows them unceasingly would be covered with glory, easily winning all the electoral machinery until 2040.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos