[ad_1]

Since China has become the world’s largest importer of beef, international prices started to rise and created tensions in the domestic markets of exporters.

These days the Argentine government has decided suspend meat exports for 30 days with the aim of “controlling” the marketing chain and “decoupling” domestic prices from those paid internationally.

Meat: they assure that the prices will not go down “and there is no reason for them to go down.

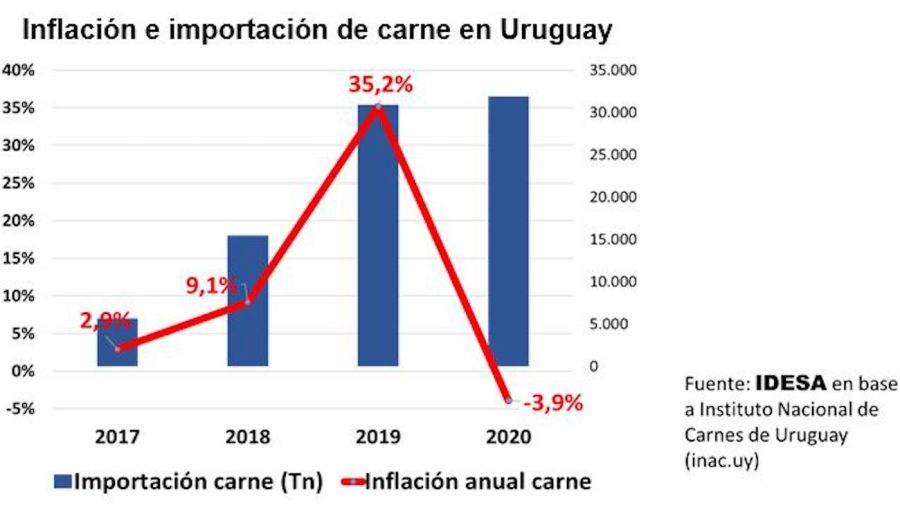

On the other side of the Río de la Plata, the Uruguayans have opted for a different strategy. According to the Institute for Argentine Development (IDESA), In 2017, domestic meat inflation in Uruguay was 3% per year and climbed to 35% per year in 2019. That year it increased its meat imports 6 times higher than in 2017 and last year there was a -4% meat deflation.

“These data show that Uruguay, even though he was a big exporter, when he had high inflation on meat, he did not shut down his exports. He also did not have a passive attitude, but rather called for opening up meat imports to increase supply in the domestic market and, in this way, lower the price. In 2020, 13% of domestic meat consumption was fueled by imports. In other words, Uruguay, unlike Argentina, he moderated the price of meat by stimulating foreign trade “the report holds.

Which countries benefit from stocks for Argentine meat exports.

Jorge Colina, president of IDESA, told Super Campo that “Uruguay has annual inflation of 8-9%. In 2019, inflation for meat was 35% on average, and for asado it reached 46%. When there is stability we can quickly detect what is happening in a particular case and that is why it was decided to import meat ”.

“They export top quality meat to Asia and the United States and it makes no sense to reduce high priced meat exports to improve domestic consumption. They therefore continue to export and, in order to have more meat on the domestic market, they import popular cuts from Brazil and Paraguay ”.

There are structural differences in the meat sector between Argentina and Uruguay. In our country, 70% of animals for slaughter are intended for the domestic market and 30% for export, which is divided into 7% high quality heavy steers and 23% low quality cows which go to China. “These animals are old, with little meat, which can be eaten boiled or mixed with vegetables,” said Miguel Schiaritti, director of Ciccra.

Export output

“Uruguay has no choice but to be a big exporter,” said Rafael Tardáguila, director of Tardáguila Agromercados in the neighboring country. And I add: “It is the country with the highest cow / inhabitant ratio in the world and the domestic market represents 30% of production. The country has a logic closer to that of Oceania, which exports up to 80% of its meat production. In the other Mercosur countries, the relationship is the reverse. For Uruguay, its main market is abroad and it must take care of it, he has no other choice. There have been governments of different political signs that have maintained a state policy that deals with foreign trade, because that’s what we live on. The export is completely free of meat and live cattle ”.

Tardáguila indicated that “Last year, Uruguay became an importer, Because it had much more expensive prices than the rest of the region, it continued to export as much as possible and compensated with boneless Brazilian meat, cheap cuts to make milanesas, like buttock and something. thing with bones from Argentina. Imports represented 30% of domestic consumption ”.

Sell high and buy low

The strategy of exporting at a high price and buying at a low price is not an “Uruguayan invention”. According to Miguel Gorelik, director of Valor Carne, “Many countries are doing the same, such as Mexico and the United States, which is the third largest exporter and the largest importer of beef in the world. Only the Argentinian leader cannot understand that a product can be exported and imported ”.

Regarding Argentina, Gorelik noted that most of the work is done in establishments that do not have the authorization to export, “therefore, this meat will never leave Argentina either the tenderloin, the ossobuco and the roast. 70% of our work is not exportable and remains in the country. There are long term variations and cycles here and experience shows that this cannot be controlled for a long time, because in the previous experience after four or five years the stock fell and prices started to rise again. increase ”.

LM

You may also like

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos