[ad_1]

The government of Mauricio Macri has owed the order of 100 billion dollars to the Argentine state for a three-year term. On average, the debt ratio has quadrupled over the 2007-2015 period and, in aggregate form, the debt incurred over the last three years is greater than that of the previous eight years. In addition, the weight of dollar-denominated and international debt has increased, while the percentage of short-term liabilities has increased. This is to say that in addition to the strong quantitative growth in debt, it has clearly deteriorated qualitatively. The data was collected by the University of Avellaneda (Undav). Parallel to this process, the economy has been reduced, unemployment and poverty have increased and the power to purchase wages has declined.

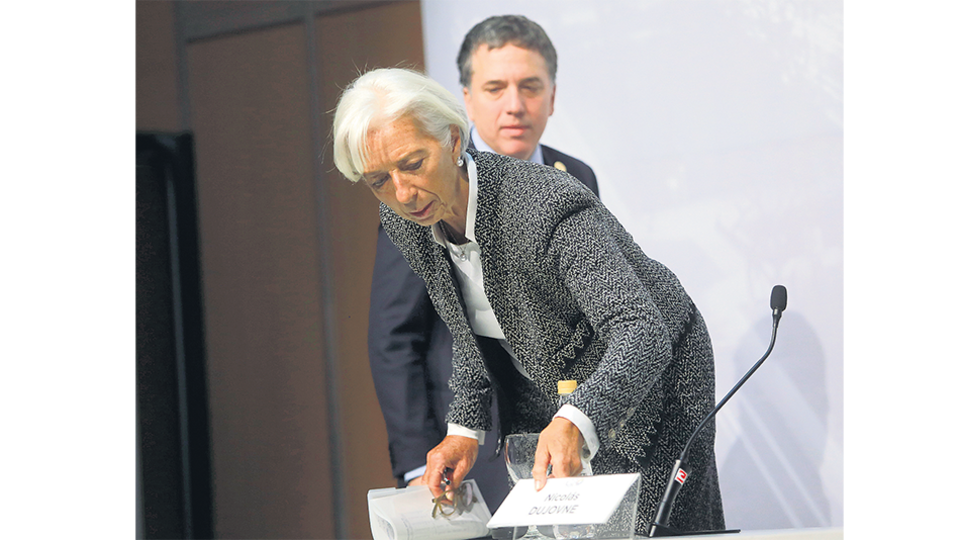

In terms of foreign trade, Cristina Fernández recorded in the last three years a volume of exports and imports of 401,532 million dollars, well above the 366,374 million exposures accounted for in 2016, 2017 and 2018. Moreover, the comparison of foreign direct investments indicates a favorable result for Cambiemos: 7628 million dollars according to the Central Bank, against 5681 million for the period 2013-2015 (increase of 34%). The external debt was central to Macri's motto of "reintegrating the world".

According to Undav, the pace of public debt has gone from over the equivalent of $ 9 billion a year over the 2007-2015 period to $ 35 billion in 2016-2018. In this context, the debt denominated in foreign currency, which implies a greater exposure of the economy to commitments in a currency that does not produce – to pay in foreign trade dollars or with new debts – has increased from 160,333 million in 2015 to $ 253.696 billion, an increase of $ 93.363 million (58% in just three years).

The report warns that of the total new debt, $ 66 billion was issued under foreign laws. This involved an increase from 28.2% to 39.3% of the debt settled by foreign courts in relation to total debt. On the other hand, "the debt has evolved towards a more short-term structure", warns the Undav. Between 2015 and 2018, the percentage of outstanding debt maturing in the short term (less than one year) rose from 8.4 to 11.8%.

The combination of rising debt and the shrinking economy is leading to a deterioration of debt sustainability conditions. The Undav stresses that the ratio of gross public debt to gross domestic product has fallen from 53.5% (including punitive interest paid to Vulture funds) to 86.2%. External debt with non-residents increased from 14.1% to 41.8%. In terms of exports, foreign currency debt increased from 212.6% to 331.2% between 2015 and 2018.

Gross external debt grew by 56% in three years, the largest increase in the region. In second place, the increase of Ecuador (54%) and far behind that of Bolivia (31%), Paraguay (30%), the Dominican Republic (28%) and Panama ( 25%).

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos