[ad_1]

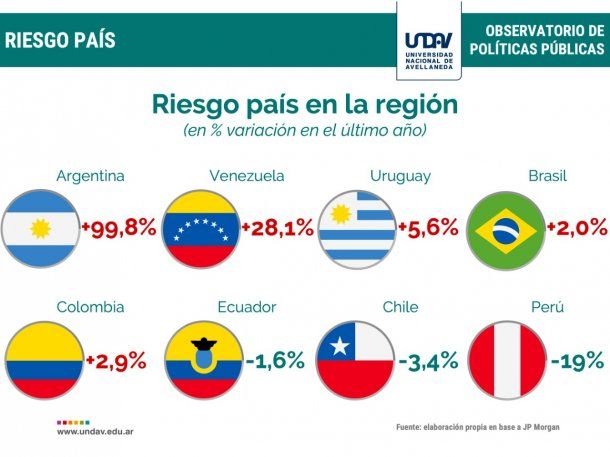

– Argentina + 99.8%

– Venezuela + 28.1%

– Uruguay + 5.6%

– Colombia + 2.9%

– Brazil + 2.0%

– Ecuador -1.6%

– Chile: 3.4%

– Peru-19%

On a global scale, Argentina has overtaken Turkey with 43.7%, Ukraine with 25.4% and South Africa with 25.2%.

COUNTRY RISK

Country risk 2018. Source: National University of Avellaneda

Why country risk increases

The macro-financial conditions of the Argentine economy show a clear deterioration while there are still several months for the presidential elections to be held in October.

Added to this is the growing fragility of the monetary, monetary and financial context that has allowed Argentina to finish the third year of the ranking of the countries with the highest inflation in the world, According to a report prepared by the IMF with 189 countries in total, only Venezuela and South Sudan have exceeded their targets.

In addition, the country risk exceeds 800 basis points, but Argentine bonds maturing in 2020 report a rate of interest close to 15% per annum in dollars.

According to the report, the situation of high interest rates close to 15% in dollars for the Argentine bonds extends to the deadlines which will even have to face the government, after which this one will be elected in October, c & rsquo; Ie in 2024.

But it is notorious that for the longer term, the yield declines, as for those maturing in 2033 or even for the 100-year bond, by reversing the yield curve which says that a bond in the longer term should pay a higher rate.

In those years (the next government), the maturity of the debt contracted with the IMF fell. The fund itself stated that it would be able to postpone payment deadlines in exchange for promoting "structural reforms" such as pension reform and labor

To this must be added inconsistencies in the agreement with the IMF. The BCRA barely has the interest rate needed to control the price of the dollar. But if it were to exceed the upper band, it could hardly sell just $ 60 million a day to contain the rising dollar.

This growing deterioration does not seem to be linked to political risk, as IMF officials say, but rather to the short-term macro-financial fundamentals of the Argentine economy, which has no certainty as to how it will refinance its money. liabilities in the coming years. .

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos