[ad_1]

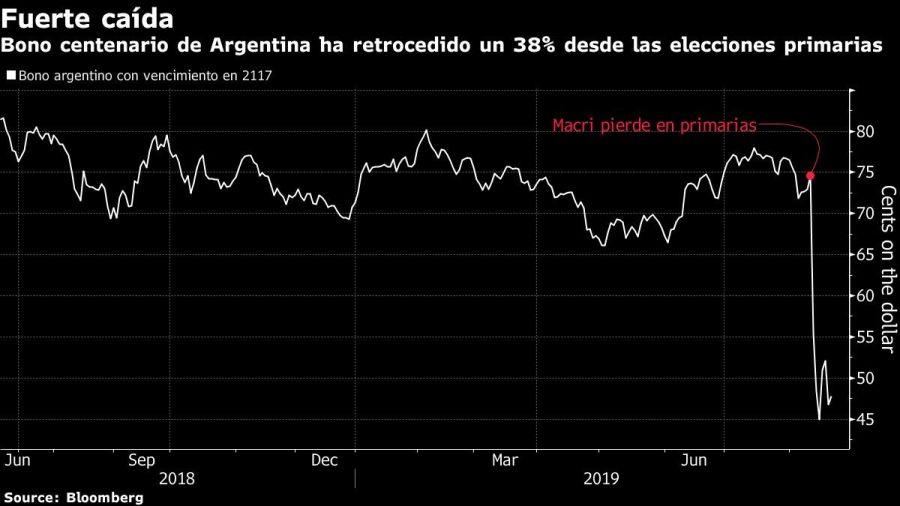

Less than two years after Argentina made a splash in the markets by selling a bond worth 2,750 million US dollars for 100 years, the possibility of a new debt restructuring after the defeat of the president is considered real. Mauricio Macri in the country's primary elections.

Fund managers and business badysts such as Citigroup and Bank of America According to them, investors will probably recover less than 40 cents with their securities if Argentina were to default for the third time in two decades.

Argentina's long-term debt was comparable to that of Zambia and Congo.

Bonds were almost about to test these levels last week, when some ratings were quoted at 45 cents for fear of the possibility that Alberto Fernandez and his formula mate, the former president Cristina Fernández de Kirchner, reverse the favorable Macri market agenda.

The profitability of short-term bonds denominated in dollars and payable in Argentina climbed above 50%. Although badets have rebounded slightly since then, the default probability of default over the next five years is 83%, according to CMA data.

"The likelihood of a restructuring is high next year due to significant financial needs, limited access to the market and fiscal challenges during a recession," he said. Claudio Irigoyen, head of fixed income and foreign exchange strategy in Latin America at Bank of America Merrill Lynch in New York, in a note. "The fiscal and financial situation is vulnerable and the markets are hardly credible until now."

If this happens, a recovery would probably be less than 40 cents in the case of bonds denominated in dollars, according to Irigoyen. This is a slightly more optimistic view than Citigroup's, which indicates that bondholders would probably get something in the 30-cent low range in the event of non-payment of sovereign bonds.

After the STEP, the probability of default has increased

"As for the external debt, we think that we need more certainty about the plans of the next administration, because the market still does not include the recovery value in the worst case", Citigroup's emerging market strategists said in a note. Donato Guarino was included and they added that this certainty may have come closer to the elections.

There was some clue as to what Fernandez would do if he won on October 27th. In several interviews with local newspapers on Sunday, the favorite talked about what he saw as successful debt negotiations during his tenure as chief of staff, which led to a restructuring of the company. obligation and the need to negotiate with the holders. Although he did not necessarily say that he would advocate for a restructuring, he stressed that "no one knows better than us the damage caused by the defect". He also referred to the economic growth instruments proposed during the 2005 and 2010 restructuring to invite investors to be "partners in our growth".

Monday, your financial advisor, William Nielsen, said Fernández does not plan to restructure the country's debt.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos