[ad_1]

The government also plans eliminate a special tax regime for chemical manufacturers like Braskem SA, whose shares fell by almost 4%.

These tax increases partially offset Bolsonaro’s decrees zero federal PIS / Cofins tax on diesel for two months and gas cooking indefinitely. Last month, Bolsonaro vowed to cut fuel costs when truckers threatened to strike over rising prices.

In this context, the dollar rose 1.2% against the real, sending the Brazilian currency to a three-month low despite the central bank auctioning more than $ 2 billion in the spot market. In this way, the currency of the neighboring country has accumulated a loss against the dollar of almost 5% in 4 days and around 9% in 2021.

On the other hand, the Bovespa equity index managed to offset the losses, which reached 2.7% in the morning, to finish up by 1.2%.

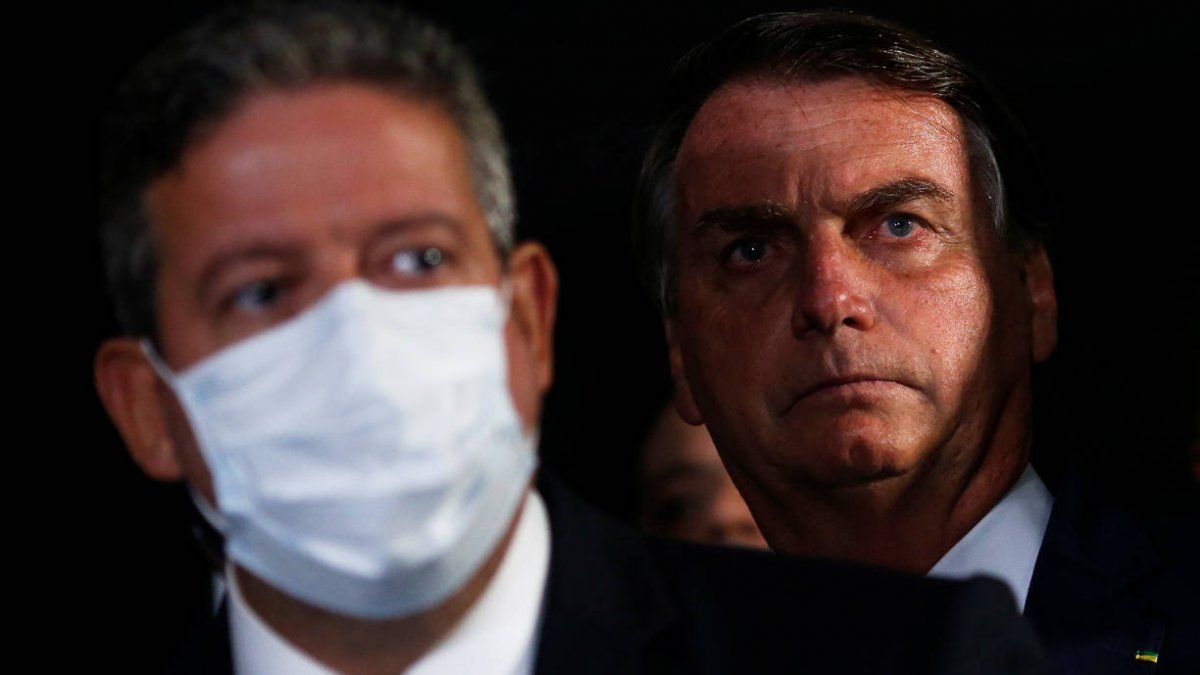

Many investors have interpreted the sudden change in tax policy as a sign that Bolsonaro has turned his back on the free market promises of his 2018 campaign, as his poll numbers tumble ahead of next year’s reelection race.

“For the first time, I am starting to lose confidence and feel uncomfortable,” Dan Kawa, analyst at TAG Investimentos, said in a note to clients. “I hope they stop here, but the signs are that economic liberalism has been sidelined and populism is gaining ground on the (political) agenda.”

Brazilian financial markets began to show more volatility last month, when Bolsonaro ousted the chief executive of state-owned oil company Petrobras for raising fuel prices.

Roberto Castello Branco, el presidente ejecutivo saliente de Petrobras, became accustomed to seguir las tendencias de los mercados mundiales del petróleo, y su despido asustó a los inversores que temen un regreso de la interferencia del gobierno en la empresa más important de Brasil y en the economy.

Economy Minister Paulo Guedes, an ally of Castello Branco and a staunch supporter of liberal orthodoxy, was visibly silent during the episode, suggesting his influence has waned.

“This decision creates institutional uncertainty,” said Paloma Brum, economist at Toro Investimentos, of the sudden change in the tax system. “In the context of an economic crisis, this creates uncertainty as to whether the government will really follow a liberal agenda”.

Among the main losers on Tuesday were Petrobras and state-owned energy company Eletrobras, which fell almost 5%.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos