[ad_1]

Then come a series of negotiations that excited the market. However, a few days ago, the United States announced that it would apply more tariffs on Chinese products as of September. China then reacted by devaluing the yuan at $ 7.05 a dollar.

Last April, the devaluation of the yuan surprised most emerging economies and a mbadive devaluation of currencies. The Turkish lira has gone from 4.0 to 5.48 for a dollar today. The ruble from 57 to 65.30 for a dollar. The Mexican peso from 18.70 to 19.50 for a dollar. The Brazilian real from 3,450 to 3.97 for a dollar. The Argentine peso from 20 to 47.50 dollars per dollar.

This would give the impression that on this occasion a devaluation of the yuan finds the emerging economies better prepared to cope with international volatility. Countries have balanced their balance of payments and we do not anticipate a strong wave of devaluations, even if the devaluation of the yuan will be accompanied so as not to generate major changes in international trade.

As meetings between the United States and China continue, They do not seem to materialize.

United States: Everything suggests that the US government needs this confrontation to emphasize its nationalism and its policy of closing the economy to face the presidential elections of 2020. Donald Trump can not be defeated in this negotiation. In contrast, the US economy continues to show growth and hide the likely economic problems, forcing the Federal Reserve to lower its interest rates.

China: The Chinese government can not give in this negotiation, it would show its president weakened in front of his people and generate strong conflicts within the Communist Party. China has a growing deficit in the current account of the balance of payments. It is no longer a country that spares, its inhabitants are moving abroad generating a deficit in the balance of services and their exports have stopped growing. GDP growth figures are questionable. The devaluation of the yuan helps to correct the current account deficit, increase the growth of its domestic market and liquidate the huge domestic indebtedness of its companies.

If the United States and China do not agree for strictly political reasons, It can be said that a period of high market volatility is inaugurated. If China repeats the devaluation of April 2018, we should consider a yuan of about $ 7.50 to $ 7.70 a dollar. This would lead to a devaluation of emerging currencies, more or less large depending on the balance of payments deficit of the current account of each country.

On the other hand, the trade war between the two countries, a more nationalistic politics and economic protectionism This will lead us to less international trade and the most affected countries will be those whose foreign trade is most related to the export of raw materials.

If there is less international trade, the freight price will fall, less oil will be consumed, and the rest of the commodities would arbitrage down. This puts countries with a high dependence on commodities such as Russia, Mexico, Brazil and Argentina in trouble.

Investors around the world, if they see a slowdown in trade, they will invest less in business, the stock markets will fall around the world and seek refuge in the Treasury bonds of developed countries.

Currently, 10-year US Treasury bonds yield 1.73% per annum. The German 10-year bond pays a negative rate of 0.56% per annum (they charge you for having the money); Japanese 10-year bonds pay a negative rate of 0.20% per annum.

Imports from China to the United States account for 25% of total imports. In the case of China, US products only account for 10% of its exports and can easily transform the purchase of US soybeans by making soybeans in Brazil and Argentina. .

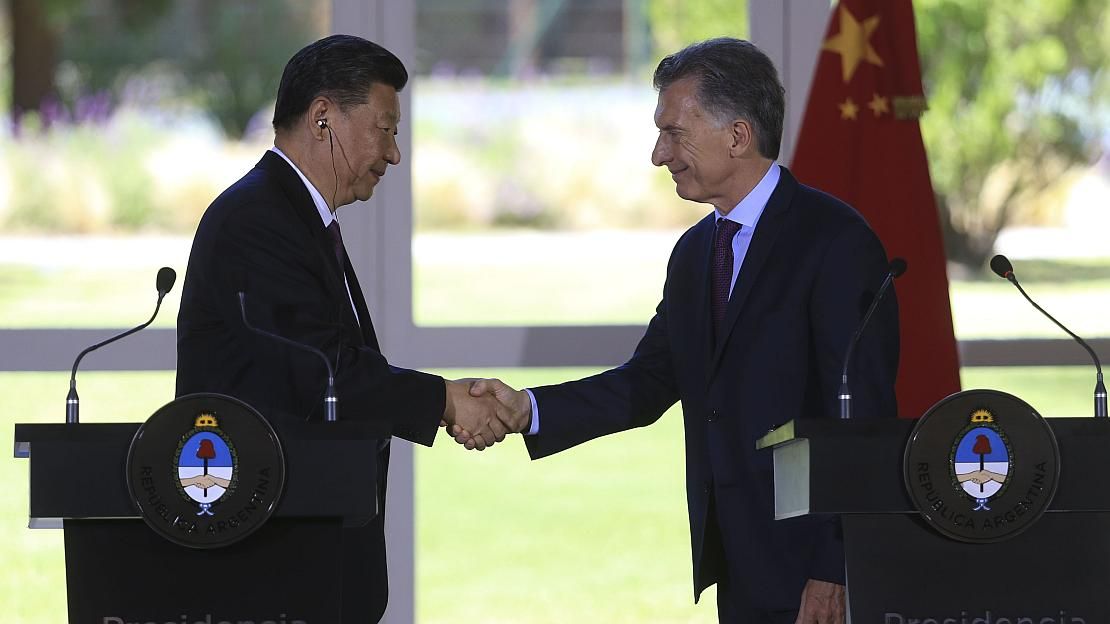

China is developing a global positioning strategy in the economic world. In Latin America, its dominance is to finance states, as was the case with Venezuela, Ecuador and Argentina.

Coincidentally in our country, he lent the Central Bank about 24 billion US dollars to strengthen its reserves. In the first six months of the year, China accounted for 12.2% of Argentina 's total foreign trade, for a total of US $ 6,812 million (US $ 2,365 million) exported to China. China and US $ 4,447 million imported from China). Argentina) on a total foreign trade of $ 55,915 million. A devaluation of the yuan could increase imports and decrease exports, as the raw materials we export could fall.

China It buys strategic companies in Argentina, it already dominates a lot of the companies that supply inputs in the field and has a part of the market that buys primary production for export. This is repeated throughout Latin America. In other areas such as Australia or New Zealand, where contracts are filled, he buys land and exports products to his country. In this context, China occupies a dominant position on the world's agricultural markets, is the main buyer, the input market and is buying land slowly.

Currently China He suffered from the outbreak of African swine fever and lost a large number of pig mothers. He must urgently import meat from all over the world. The opening up of markets has been so effective that because of this, meat has not grown worldwide.

While China is a threat to the commodity market, in Argentina, the presidential candidates ignore this question and pay no attention to the Chinese capitals of the country and the dependence of our recommendation with the Asian giant.

China should be a special chapter of presidential candidatesHowever, it is a forgotten subject, Mauricio and Cristina borrowed money, they let their companies occupy a dominant position on the Argentine market and, today, no attention is given to the fluctuations of the yuan in the world. The political clbad naps instead of developing a medium and long-term strategy, it seems that if it lends money to inflate the reserves and continues to spend, everything is fine, but every day that pbades, we are further immersed in commercial dependency.

Countries such as Chile, Peru and Colombia have already developed strategies to deal with the Asian giant, sell copper at the same price and do not yield to the Chinese strategy. Argentina and Brazil should develop a similar strategy to sell soy, corn and meat to the Asian giant, but the need has the face of a heretic, and both are scratching.

There is much to be done and little strategy to tackle this problem: again, there is no state policy and the political clbad is absent from the problem.

(*) Financial badyst

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos