[ad_1]

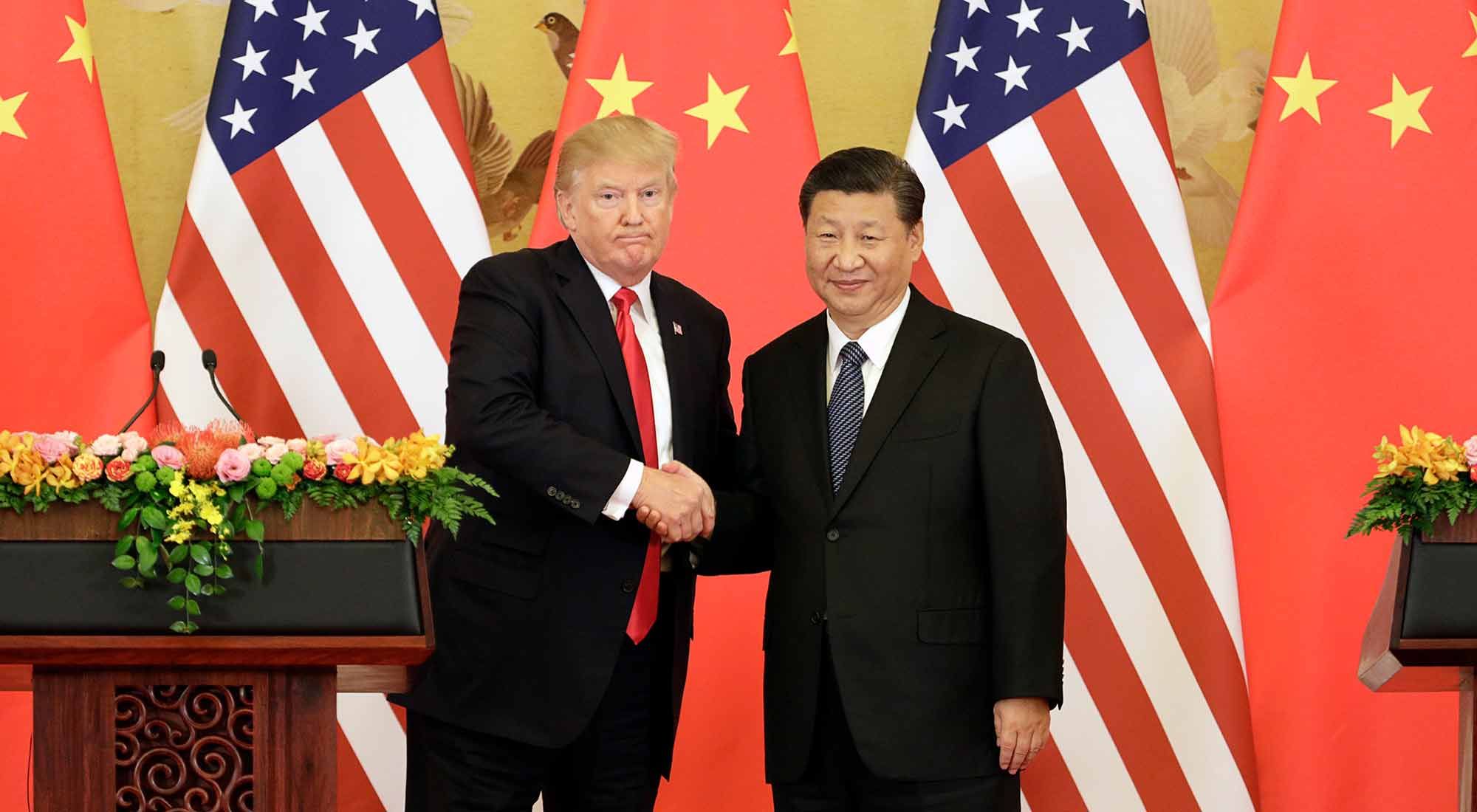

China has a powerful arsenal in the financial markets for its commercial struggle with the United States, which includes Treasury bonds and its currency. But using these weapons has a cost. Beijing promised revenge if US President Donald Trump threatened to raise tariffs on $ 200 billion Chinese imports Friday, from 10 to 25%. But responding with its own tariffs is not the most likely solution in China, said Brad Setser, a former treasury official who is now a prominent member of the international economy at the Council on Foreign Relations.

"Matching the US dollar to the US dollar would imply a 25% increase in all US imports, including those destined for Chinese exports," said Setser. "China could certainly do it, but in many cases it would be directly harmed." Trump pays attention to the financial markets. He often tweeted about the actions taken as they approached historic highs. After Trump announced the tariff increase on Sunday, the S & P 500 has fallen every day.

China, the second largest economy in the world, has some market levers to intensify the battle. Here are a few:

1. devalue the yuan

Chinese policymakers could devalue the yuan to offset the impact of US tariffs on the Chinese economy. The Yuan abroad weakened by 5.5% against the US dollar in 2018, provoking Trump's anger and fueling speculation that the country was deliberately weakening its currency. It has lost 1.5% since Trump's threat last weekend, its highest in four days since July.

However, China's painful experience with the devaluation of the yuan in 2015, which caused the capital flight from the country, could probably discourage a similar move, according to Tao Wang, chief economist at UBS Group AG in China. responsible for economic research in Asia. . "In addition, the depreciation of the yuan last year has angered the Trump government and led to a rise in US tariffs."

The cost of Trump tariffs is very high, but it is not China who pays

Currency was a central element of trade negotiations. USA is seeking a stability pact in yuan as part of a possible deal, according to people familiar with the subject.

2. Get rid of Treasury bonds

The US government has a debt of 1.1 billion US dollars, more than any other foreign country. If you reduce your holdings on this badet clbad by $ 15.9 trillion, this could be a powerful weapon. Last year, bond markets were shaken by reports that the Chinese authorities have recommended cutting or halting purchases of Treasury securities.

However, China does not really have any other interesting options to put its $ 3.1 billion foreign exchange reserves – the largest in the world – making it an unlikely trajectory, according to Ed Al- Hussainy of Columbia Threadneedle Investments. In addition, if China gets rid of its treasury bonds, prices could collapse, yields rise and US debt be devalued. who still maintain. Until now, bonds have rebounded, not fallen.

"Any sudden change in US rates has a negative impact on the valuation of their existing positions in Treasury bonds and could generate a rise in the dollar," says the strategist. "The risks of this policy in terms of finances and monetary stability could outweigh the benefits."

Trump raises tariffs in China: its impact on the markets and Argentina

3. Reject soy

China, the largest buyer of soybeans in the United States, has already imposed a 25% tariff on cereals. Much of the harvest is made in the Midwestern states that constitute Trump's electoral base, making his fate even more important for the president.

Before trade negotiations get more complicated, China has made the US Secretary of Agriculture, Sonny Perdue, described in February as a purchase of "good faith", and future purchases could well be made feel. Devaluing the yuan or getting rid of the treasures would be harder, preventing soy from being done relatively easily, said Setser.

"China can do some easy things," including soybean rejection, he said. Harvest futures fell 11% from April 10th.

Lagarde: "tensions" between the US and China pose a "threat" to the global economy

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos