[ad_1]

His proposal was not superfluous. Boeing shares do not stop falling from 737 Max accidents in Indonesia and Ethiopia. And this also causes that of other companies related to the production of the aircraft that is now in the eye of the cyclone. The delays in solving the software problems that would have caused the falls and the decision to slow down the production of the 737 Max are upsetting with the figures of the American company, the largest aircraft manufacturer in the world.

The interlocutors who listened to Boeing's CEO that day were almost speechless when their leader answered his own question: he announced that they would conduct test flights of aircraft for repair (placing MCAS software) as proof of trust. in their work teams.

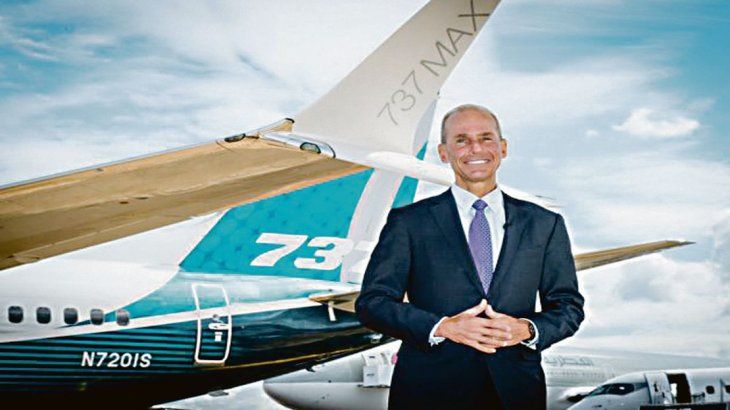

Senior management has decided to "put the body" to the crisis to strengthen the weight of the statements of the company. "Boeing is working to restore confidence in its industry, reaffirm its commitment to safety and restore pbadenger confidence," Boeing said in a statement, saying it "does not help." had not achieved the goal of appeasing customers and investors.

Boeing has been under the microscope since March 10, the year of the fall of 737 MAX Ethiopian Airlines and the death of 157 people. This was the second fatal accident with this type of device in five months.

During this period, the two accidents totaled 189 deaths and were a fatal blow to the company. Air authorities around the world have ordered the removal of 737 Max models, which represent a fleet of 400 aircraft that remained on the ground until further notice.

Boeing announced this week a 19% drop in commercial aircraft deliveries in the first quarter. The aerospace giant delivered 149 commercial aircraft in total in the first three months of the year, including 89,737 Max aircraft. This is a low compared to the 184 deliveries, including 132 of the 737 Max, over the same period of the previous year. The news touched on Boeing shares, which fell 3% in a single day. But they also affected the actions of the aerospace groups involved: Meggitt, Melrose and Safran dropped between 1 and 2.5%.

On the other hand, the shares of European Airbus, Boeing's main rival, progressed in the global aviation sector.

Another consequence of the accidents is that the airlines have already studied to make claims to the manufacturer for injuries sustained. One case is that of Norwegian, the most affected airline in Europe. He was already planning to seek compensation from Boeing for the immobilization of his 18 aircraft and to ask the US manufacturer for financial compensation for the additional losses and costs caused by this situation, which would further aggravate his precarious financial situation. "We hope that Boeing will pay the bill and we can not be economically penalized because a totally new plane can not fly," said spokesman Lbade Sandaker-Nielsen.

The Boeing 737 Max is a model chosen for its low cost because it consumes 20% less fuel than other aircraft. The Belgian Tui, with 15 units of the 737 Max, estimated at 200 million euros the losses caused up to mid-July by the immobilization of this model. With three more planes than Tui, Norwegian has his own accounts to claim Boeing.

As if that were not enough, there were also problems with the 787 models, better known as the Dreamliner. Australian airline Jetstar has detected problems in a Japanese jet engine. And All Nippon Airways has experienced the same thing in Osaka.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos