[ad_1]

The decision of the People's Bank of China to apply a devaluation of the yuan higher than 1% was known very early in these latitudes. Fears of an escalation of the greenback have returned but eventually Intervention of the central bank in the futures marketin the average bank, the dollar has finally increased by 80 cents to $ 46.59.

Nail strong depreciation of the peso in elections, and its inflationary impact, have alerted the main swords of the ruling party. On August 15, Indec will publish the July CPI and Balcarce 50 are excited about a new victim and that the index is just below 2.5%. The price increase remains high – last year it would remain above 50% – but with hindsight, according to the official point of view.

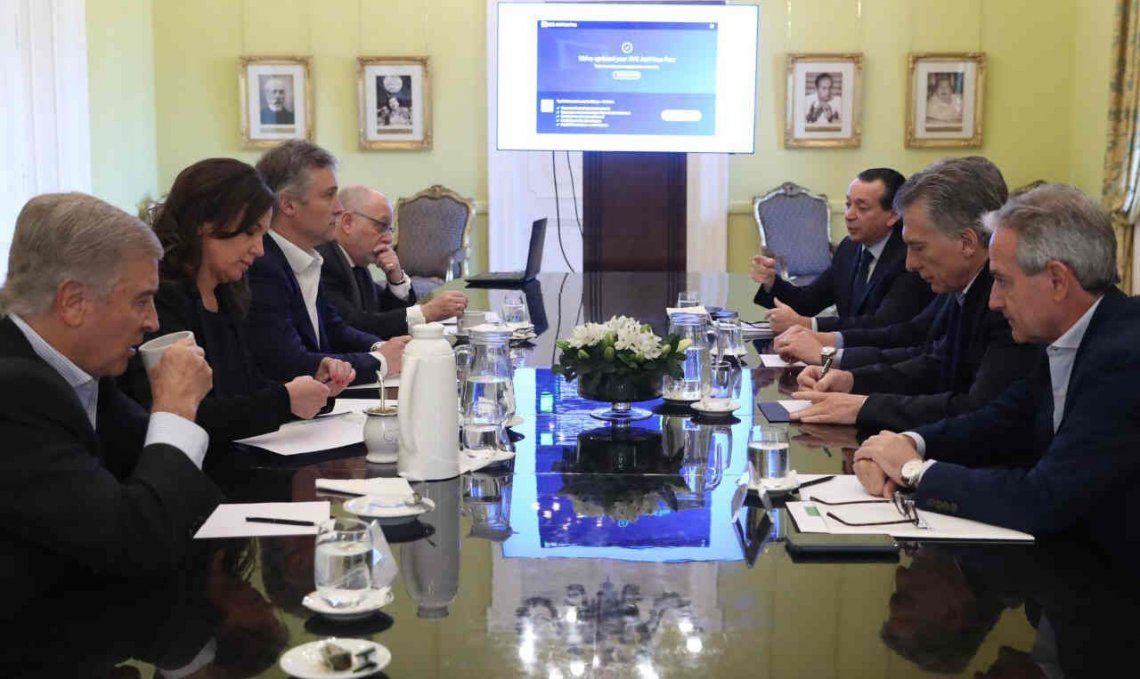

The truth is that at the cabinet meeting held at Casa Rosada at noon in the morning financial tremor caused by the Asian giant It was one of the topics of the discussion. Thus, the photos of the official communication showed that Finance Minister Nicolás Dujovne was giving explanations to Mauricio Macri, his peers and three other officials present: Vice President Gabriela Michetti, Secretary General Fernando de Andreis and Secretary of Energy, Gustavo Lopetegui.

IN ADDITION:

The dollar closed at $ 46.68 and the country risk was at a pace of 900 points

Macri in Rosario: "What we have done must give us strength for the second stage"

At the press conference that followed, the Deputy Chief of Staff, Andrés Ibarra, raised the issue by pointing out that "there is a permanent badysis at the Treasury and related to this. trade war between China and the United States.The currencies and the peso are Following the same trend and the advantage of Argentina is that in this very strict financial and fiscal program we are able to resist this kind of situation. But these are exogenous situations and affect other countries of the world. As the president said, the important thing is to diversify foreign trade, opening more than 170 new markets and thus allowing to trade with other countries. So we generated a trade surplus, something as important as real currency generation. "

In the afternoon, the sources of the Palacio de Hacienda consulted downplayed what happened. "Cuatwhere you are integrated in the world this can happenthat you are affected by the devaluation of a power. But we are busy minimizing the consequences. And, in fact, the dollar has evolved as in the countries of the region: Uruguay, Brazil, Chile or Ecuador. "

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos