[ad_1]

:quality(85)/arc-anglerfish-arc2-prod-infobae.s3.amazonaws.com/public/34V4CGSNSFCBJE3BDBOWFT43ZE 420w)

Hector Colella, known as Alfredo Yabrán’s successor and a key player in logistics, armed nail mamushka offshore companies in different tax havens to protect $ 145.7 million which would come – as they explained to their entourage – from the sale of the company OCA, owner of OCASA, to the Exxel Group in 1997 with the aim of pay less taxes.

The Argentine businessman, whose name became public after Yabrán’s suicide, ordered the creation of a complex program abroad. He opened a trust in the UK run by executives at Swiss bank Julius Baer, then opened companies – in a sort of Russian doll set inside each other – in New Zealand, the Virgin Islands. British and Uruguay..

The information is derived from Pandora Papers, the flight of the International Consortium of Investigative Journalists (ICIJ) in which he participated Infobae near The nation, elDiarioAR and the Uruguay Weekly Research. Colella assured that the structure off the coast It was created in 2005, and its advisers have shown the Argentinian ICIJ team the documentation that shows that the companies have been duly declared to the tax authorities.

Established for almost two decades in Uruguay, Colella is one of the most important entrepreneurs in the logistics sector in Argentina, close to Pope Francis.

His life changed when, in his suicide note, Yabrán had his business bequeathed to “HC”, the acronym of his friend, with whom he had spoken on the phone shortly before committing suicide. After Yabrán’s death on May 20, 1998, Colella sold the OCA-OCASA package to the Exxel group, made up of “American investors”. The group ended up being denounced for suspected fraud and suspected of money laundering.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/NL3GFOSRIBHYVJ5BWKF726THTA.jpg 420w)

Colella has cultivated a rigorous low profile for decades, established her residence in Montevideo since 2002, and built her own empire: OCASA currently transports anthrax to investigational Covid-19 vaccines. The company has also become Contracting of the Federal Reserve (the Central Bank of the United States) for the export of dollars and currencies and handles the logistics of research kits and products for pharmaceutical companies on American soil.

OCASA was a Yabrán bank clearing house acquired by OCA, a postal company run by Colella who was suspected to also be from Yabrán. Colella, a friend and right-hand man of Yabrán, became the official owner of the company after accusations by then-Minister of the Economy, Domingo Cavallo, who publicly denounced Yabrán for leading an alleged “entrenched mafia in the to be able to”.

The origin of fortune

The bank accounts of Colella and his wife, Marta Ortiz Fissore, at Merrill Lynch and Morgan Stanley banks held the sum of $ 145.7 million, according to the documents in Pandora Papers, sum behind which was the Exxel Group, a holding that became strong in the 90s, whose shareholders remain a mystery. The Exxel group, led by businessman Juan Navarro, has started investing in dozens of Argentina’s leading companies and buying some of the major brands operating in the country. Supermarkets Norte (de Carrefour), Musimundo, Havanna, Freddo, Fargo, Lacoste and even the Quilmes Athletic Club. Many of its businesses ended up in the hands of its creditors, the banks. Later, allegations of scams, tax crimes and suspicion of money laundering were reported.

Through the Exxel Group, Colella forged a close relationship with the U.S. Embassy, which helped land her in that country years later.

The Mamushka off

But connecting Collela to that $ 145 million requires several downtime. Its accountants have set up a chain run by a trust in the United Kingdom, the documentation of which has been cataloged by the Trident Trust study, which specializes in operations. off the coast, as “very confidential”.

The program involves companies in New Zealand, Uruguay and the British Virgin Islands that are not listed in the businessman’s or his wife’s name in public registers., according to the request made by the Argentine team of the ICIJ.

The UK trust is managed by Julius Baer Family Office and Trust Limited. This company of the Swiss bank Julius Baer which owns the firm Fedmer Holdings Limited. This company was registered in New Zealand from September 23, 2013 to July 1, 2019, according to that country’s official register of companies. 100% of the company’s shares are held in the name of Julius Baer Family Office and Trust, but the final beneficiaries are Colella, his wife and children, as shown by the forms completed by the employer and the exchanges of emails and documents that appear in the Pandora Papers and to which the Argentinian ICIJ team had access.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/W375J7XJMJBGXEXYVUBOP3S24Q.jpg 420w)

“The entire structure, from trust to bank accounts in the United States, is duly declared and complies with FATCA (Foreign Account Tax Compliance Act) standards,” Colella told the Consortium’s Argentinian team. This regulation requires all financial entities to report accounts from customers with tax obligations in the United States. The destination of these funds is the future inheritance of his six children, explained the businessman. “This was done on the basis of the different agreements between the jurisdictions,” he added, referring to agreements that allow you to pay less taxes or avoid double taxation, for example.

At the request of the Argentine ICIJ team, Colella gave access to the statements before the Uruguayan authorities where the statement of your relationship to the trust, the Uruguayan company and the company is indicated off the coast who controls it.

It should be noted that all uses of off the coast They are illegal, but there are structures protected by law that keep the payment of taxes to a minimum. Combining businesses from different jurisdictions with little or no taxation is a legal tool for this purpose.

Real estate company

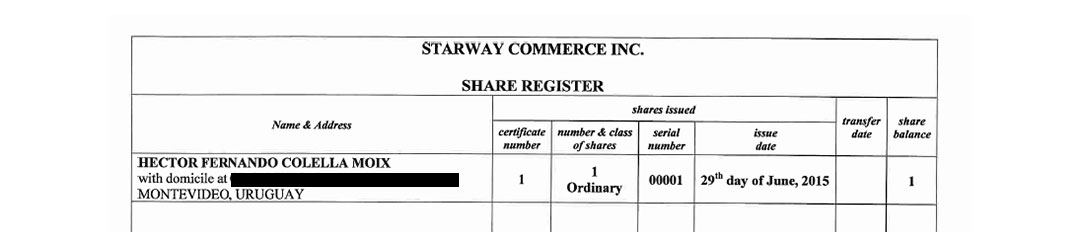

In addition to this complex mamushka, Colella is also listed in Pandora Papers documents as a shareholder of three companies based in Belize. in April 2015: Mestal Trader Limited; Starway Commerce Inc and Silverbuck Company.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/3U6TTMHZQNGRDL6BS3J26DOHKY.jpg 420w)

These companies, the businessman registered three departments in the Forum Puerto del Buceo complex in Montevideo, that he received in payment for the sale of land in that town, where a real estate project has been set up. The properties were then sold, as confirmed by the businessman’s environment.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/F2FX4M7FVVHCHHDXKZ57CKTGVA.jpg 420w)

Documents that appear in Pandora Papers allow to understand the mamushka created to protect these funds. Uruguayan society Fedmer Holdings Limited is, in turn, the owner of Mindrey SA, also Uruguayan. According to public balance sheets, Mindrey SA has equity in excess of US $ 185 million, as of fiscal year 2020. Last year, Mindrey SA recorded revenues of over US $ 13 million and only US $ 7,918 annual expenses.

Mindrey SA is, in turn, the owner of Fedmer LP, another offshore company. Fedmer LP owns the bank accounts the couple deposited the funds from the sale of OCASA into, according to documents viewed by the Consortium’s Argentine and Uruguayan team.

Accountant Ariel Eyman explained to the team Pandora Papers that such enterprises are used in Uruguay to make investments abroad without doing business in that country, and with little or no taxation. Often, they are also used as relay companies, to participate in investments in other companies.

In 2017, Uruguay established the obligation to inform the final beneficiaries of this type of companies and in September 2019 added the trustees of trusts as a new subject obliged to inform their holders before the Central Bank of Uruguay (BCU). But the information is confidential and only the authorities of a few agencies in the neighboring country have access to it. Before the consultation, Colella said there was no way he had not declared himself the final beneficiary of this structure before the Uruguayan authorities.

Between late 2018 and early 2019, Julius Baer requested by email the transfer of Fedmer Holdings Limited to the British Virgin Islands, for which he contacted the study at Trident Trust, specializing in the registration of companies and trusts in this Caribbean territory known to be a tax haven. When exchanging emails and when faced with repeated requests from Trident Trust’s compliance department, Julius Baer’s executives had to expand information on the off the coast and reveal who were the real owners of the structure and the origin of the funds.

The Trident study was consulted for this research by the ICIJ. His response was: “Each of Trident’s trust and business services business is regulated in the jurisdiction in which it operates and is fully committed to complying with all applicable regulations. Trident regularly cooperates with any competent authority requesting information. Trident does not discuss its customers with the media. “

With the collaboration of Guillermo Draper, of the Uruguay Weekly Research.

KEEP READING:

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos