[ad_1]

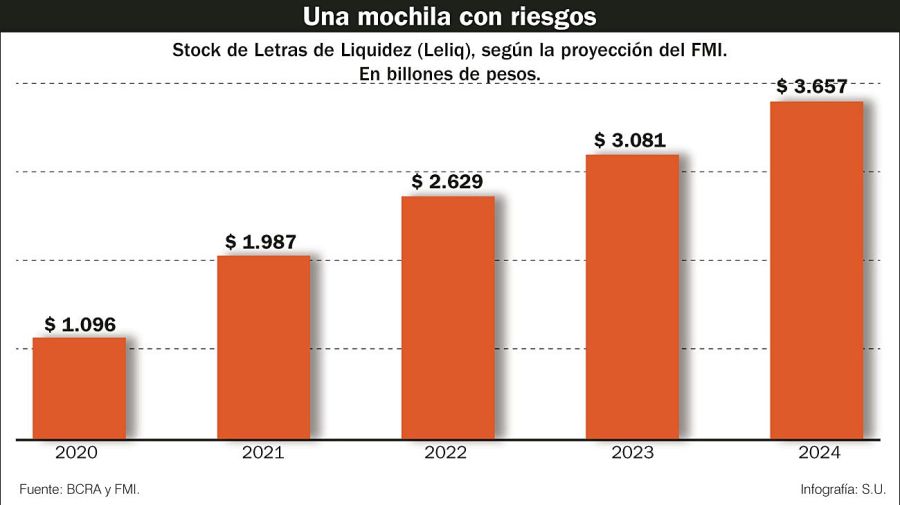

The IMF has projected that the stock of liquidity letters (Leliq) – that the issues and the banks of the Central Bank take with money in the future – It will almost double in 2020. In the report of the fourth revision of the agreement, it is expected that by the end of the year, it will reach 1.096 billion dollars and by the end of 2020, it will reach 1,987 billion, Ie a growth of 81.29%. On the way laid down until 2024, the amount increases, but at a lower rate. In 2021, it calculates a stock of 2,629 billion (+ 32.31%), in 2022 of 3 081 billion (+ 17.19%), 2023 of 3 657 billion (+ 18.69%) and in 2024 of 4.064 billion (+11, 1%) Between the end of 2019 and 2024, growth reached 270.8%. The IMF says that "the stock has risen by 1 billion pesos, but remains well below the peak of the 1st quarter of 2018 as a percentage of GDP", and "In the medium term, we expect overall growth in nominal GDP, while interest rates will remain at high levels for an extended period." Today, the Leliq account for about 6% of GDP, while their predecessors, the Lebacs, amounted to 11%.

These 7-day securities issued by the BCRA in two daily auctions generate an interest rate that averaged 61% on Friday. Since the beginning of the new monetary plan in October 2018, this rate has recorded a record of 74.069% on May 2nd.. As the financier has calculated Christian Buteler, From October to the end of July, Leliq generated interest for $ 439 billion. Friday's Leliq stock was $ 1.294 billion, close to the money base, which averaged $ 1.38 billion as of July 31.

Faced with the financial management of the next government, it will be an issue that wins who wins should attack. The Leliq have gained importance over the past week as a result of the words of the Todos Front candidate, Alberto Fernández. He opened the controversy by proposing that Leliq's interests fall sharply and that this money be used to increase pensions by 20% or to fund the creation of the Ministry of Science and Technology.

For some badysts, the amount of Leliq is manageable because they are studying the reserve ratio of the BCRA, and others warn that it could become a bomb the result of which is a sharp devaluation that ends up liquefying this liability. Others, like Diego Giacomini, They alerted via Twitter that they could lead to a Bonex plan.

Economists consulted by PROFILE agreed that the Leliq are "More controllable" Lebac spread among banks, local and foreign investors and savers, and it was easier to switch to the dollar. "On the other hand, the Leliq is only available for banks whose dollar status is regulated."he explained Matthias Rajnermanfrom Ecolatina.

Analysts said the virtuous scenario for disarming the stock would be as follows: once the electoral uncertainty lifted, the demand for money increases, which gradually lowers the rate without generating a rate of tension. exchange.

On the other hand, they would be problematic if, out of mistrust, there was general disarmament of the fixed conditions, because the banks could not renew all the Leliq and the BCRA to face the debt that had to be issued.

Fernando Baer, of Quantum Finance, has badessed that "The situation is more controllable, but the dynamics are relatively worrying, everything will depend on the reaction of the demand for money. Disabling it depends on the trust people have in the peso, but if there is no credibility and people withdraw fixed deadlines, this can lead to a spiral in the exchange rate and inflation ".

For Guido Lorenzo, from LCG, "There are more Leliq, but also more reserves, and this is the essential; the stock could become a problem as long as the reserves do not accompany it, if people start buying money and the BCRA has to go out to sell. " Martin Vauthier, from Eco Go, he said: "The positive scenario would be that the country's risk decreases because the electoral uncertainty is lifted and the rate can be lowered without generating a dollar bond, so that banks can disarm Leliq, and not because of fixed deadlines, but because the credit begins to betray. In a negative scenario where the demand for money is destabilized and Leliq is disarmed to return fixed terms, this would generate a problem in the financial system, increased exchange rate pressure and inflation. "

"It is very difficult to disarm almost a monetary base," he explained. The best would be the growth of the economy and the demand for money, but to double that base, it would take a spectacular and sustained boom in time, I think if follow this government, what can happen is like in 2018 , liquefy it with a strong devaluation, I do not see it apply a Bonex plan.

.

[ad_2]

Source link

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos

Naaju Breaking News, Live Updates, Latest Headlines, Viral News, Top Stories, Trending Topics, Videos